Concept explainers

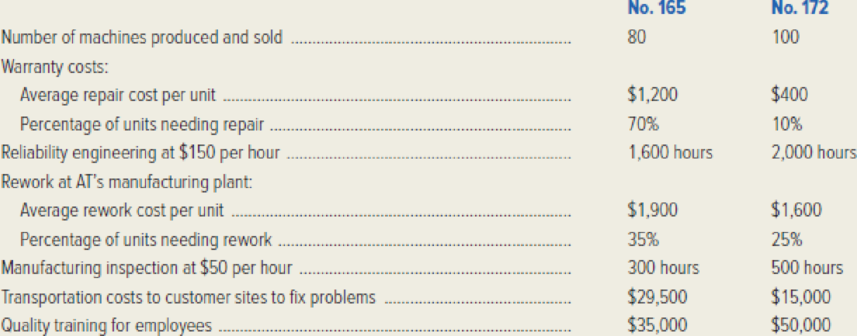

Advanced Technologies (AT) produces two compression machines that are popular with manufacturers of plastics: no. 165 and no. 172. Machine no. 165 has an average selling price of $60,000, whereas no. 172 typically sells for approximately $55,000. The company is very concerned about quality and has provided the following information:

Required:

- 1. Classify the preceding costs as prevention, appraisal, internal failure, or external failure.

- 2. Using the classifications in requirement (1), compute AT’s quality costs for machine no. 165 in dollars and as a percentage of sales revenues. Also calculate prevention, appraisal, internal failure, and external failure costs as a percentage of total quality costs.

- 3. Repeat requirement (2) for machine no. 172.

- 4. Comment on your findings, noting whether the company is “investing” its quality expenditures differently for the two machines.

- 5. Quality costs can be classified as observable or hidden. What are hidden quality costs, and how do these costs differ from observable costs?

1.

Classify the given costs of company A as prevention, appraisal, internal failure, or external failure.

Explanation of Solution

Absorption Costing: “Absorption costing is a method that allocates “direct labor, direct materials, fixed manufacturing overhead and variable manufacturing overhead” to products and it is required by GAAP for the purpose of external reporting”.

Variable Costing: Managers frequently use variable costing for internal purposes for taking decision making. The cost of goods manufactured includes direct materials, direct labor, and variable factory overhead. Fixed factory overhead treated as period (fixed) expense.

Classify the given costs of company A as prevention, appraisal, internal failure, or external failure as follows:

| Particular | Type of costs |

| Warranty costs | External failure |

| Reliability engineering | Prevention |

| Rework at AT’s manufacturing plant | Internal failure |

| Manufacturing inspection | Appraisal |

| Transportation costs to customer sites | External failure |

| Quality training for employees | Prevention |

Table (1)

Type of costs:

- A prevention cost is the cost that is used to prevent or minimize the defects. Example: Quality engineering, warranty costs.

- The appraisal cost is the costs that are used to determine whether any defects exist.

- The internal failure costs is the costs that helps to repair the defects (found any) prior to product delivery.

- The external failure cost is the costs that incurred after defective products have been delivered.

2.

Calculate the quality costs of company A for machine no. 165 in dollars and as a percentage of sales revenues, and also compute the percentage of total quality costs of prevention, internal failure, appraisal, and external failure costs.

Explanation of Solution

Calculate the quality costs of company A for machine no. 165 in dollars and as a percentage of sales revenues as follows:

| Company S | ||||

| Quality-Cost Report for Machine 165 | ||||

| For the Month of May | ||||

| Particulars | Units or hours (A) | Cost per unit (B) | Total cost | Percentage of Sales |

| Sales revenue: | 80 units | $60,000 | $4,800,000 | |

| Prevention: | ||||

| Reliability engineering | 1,600 hours | $150 | $ 240,000 | |

| Quality training | 35,000 | |||

| Total (a) | $ 275,000 | 5.73% | ||

| Appraisal (inspection): | 300 hours | $50 | $ 15,000 | 0.31% |

| Total (b) | $ 15,000 | 0.31% | ||

| Internal failure | 80 units | $665 (1) | $ 53,200 | 1.11% |

| Total (c) | $ 53,200 | 1.11% | ||

| External failure: | ||||

| Warranty costs: | 80 units | $840 (2) | $ 67,200 | |

| Transportation to customers | 29,500 | |||

| Total (d) | $ 96,700 | 2.01% | ||

| Total quality costs | $ 439,900 | 9.16% | ||

Table (2)

Compute the percentage of total quality costs of prevention, internal failure, appraisal, and external failure costs as follows:

| Company S | ||

| Quality-Cost Report for Machine 165 | ||

| For the Month of May | ||

| Particulars | Amounts in ($) (a) | Percentage of Total |

| Prevention | $275,000 | 62.51% |

| Appraisal | 15,000 | 3.41% |

| Internal failure | 53,200 | 12.09% |

| External failure | 96,700 | 21.98% |

| Total | $439,900 | |

Table (3)

Working note (1):

Compute the cost per unit of internal failure for machine 165 as follows:

Working note (2):

Compute the warranty cost per unit for machine 165 as follows:

3.

Calculate the quality costs of company A for machine no. 172 in dollars and as a percentage of sales revenues, and also compute the percentage of total quality costs of prevention, internal failure, appraisal, and external failure costs.

Explanation of Solution

Calculate the quality costs of company A for machine no. 172 in dollars and as a percentage of sales revenues as follows:

| Company S | ||||

| Quality-Cost Report for Machine 172 | ||||

| For the Month of May | ||||

| Particulars | Units or hours (A) | Cost per unit (B) | Total cost | Percentage of Sales |

| Sales revenue: | 100 units | $55,000 | $5,500,000 | |

| Prevention: | ||||

| Reliability engineering | 2,000 hours | $150 | $ 300,000 | |

| Quality training | 50,000 | |||

| Total (a) | $ 350,000 | 6.36% | ||

| Appraisal (inspection): | 500 hours | $50 | $ 25,000 | 0.45% |

| Total (b) | $ 25,000 | 0.45% | ||

| Internal failure | 100 units | $400 (3) | $ 40,000 | 0.73% |

| Total (c) | $ 40,000 | 0.73% | ||

| External failure: | ||||

| Warranty costs: | 100 units | $40(4) | $ 4,000 | |

| Transportation to customers | 15,000 | |||

| Total (d) | $ 19,000 | 0.35% | ||

| Total quality costs | $ 434,000 | 7.89% | ||

Table (2)

Compute the percentage of total quality costs of prevention, internal failure, appraisal, and external failure costs as follows:

| Company S | ||

| Quality-Cost Report for Machine 172 | ||

| For the Month of May | ||

| Particulars | Amounts in ($) (a) | Percentage of Total |

| Prevention | $350,000 | 80.65% |

| Appraisal | 25,000 | 5.76% |

| Internal failure | 40,000 | 9.22% |

| External failure | 19,000 | 4.38% |

| Total | $434,900 | |

Table (3)

Working note (3):

Compute the cost per unit of internal failure for machine 172 as follows:

Working note (4):

Compute the warranty cost per unit for machine 172 as follows:

4.

Describe whether the company is “investing” its quality expenditures differently for the two machines.

Explanation of Solution

Yes, the company is “investing” its quality expenditures differently for the two machines. With respect to prevention and appraisal the company spent almost over 86% of the total quality expenditures for machine 172. Whereas, the company spent only 66% (approximately) of the total quality expenditures for machine 165. Thus, the net result is lower internal and external failure costs and, perhaps more important, lower total quality costs as a percentage of sales (7.89% for no. 172 and 9.16% for no. 165). In this case, the company proves the essence of total quality management (TQM) systems when compared with conventional quality control procedures.

5.

Explain the meaning of hidden quality costs, and describe the manner in which the hidden quality costs differ from observable costs.

Explanation of Solution

Prevention, appraisal, internal failure, and external failure costs are the costs that are visible which could be measured and reported. If inferior products make it to the marketplace, it often creates customer dissatisfaction; as a result a loss would occur on the sales of the defective product and perhaps on other goods as well. Thus, the opportunity cost related with lost sales is a hidden quality cost to the company which is very difficult to measure.

Want to see more full solutions like this?

Chapter 8 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Market Value Ratios Gambit Golf's market-to-book ratio is currently 2.5 times and PE ratio is 6.75 times. If Gambit Golf's common stock is currently selling at $12.50 per share, what is the book value per share and earnings per share?arrow_forwardSolutionarrow_forwardabc general accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning