Concept explainers

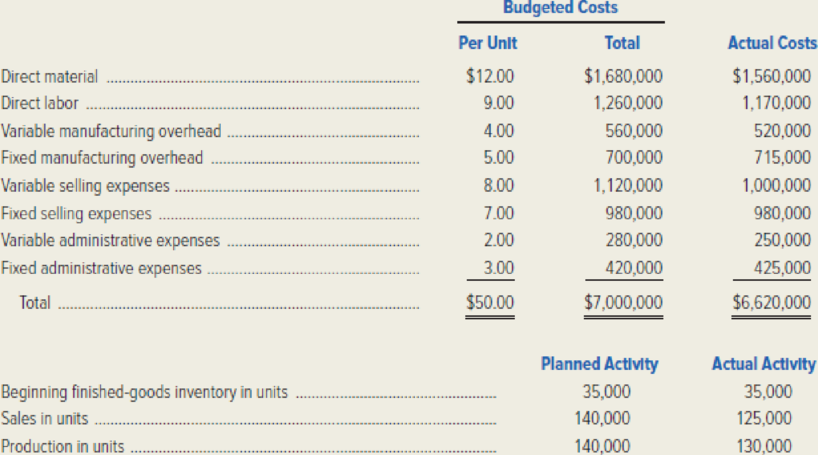

Outback Corporation manufactures tactical LED flashlights in Brisbane, Australia. The firm uses an absorption costing system for internal reporting purposes; however, the company is considering using variable costing. Data regarding Outback’s planned and actual operations for 20x1 follow:

The budgeted per-unit cost figures were based on Outback producing and selling 140,000 units in 20x1. Outback uses a predetermined

Required: Was Outback’s 20x1 operating income higher under absorption costing or variable costing? Why? Compute the following amounts.

- 1. The value of Outback Corporation’s 20x1 ending finished-goods inventory under absorption costing.

- 2. The value of Outback Corporation’s 20x1 ending finished-goods inventory under variable costing.

- 3. The difference between Outback Corporation’s 20x1 reported operating income calculated under absorption costing and calculated under variable costing.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Managerial Accounting

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning