Concept explainers

Refer to Cornerstone Exercise 8.1, through Requirement 1. FlashKick requires ending inventory of product to equal 20 percent of the next month’s unit sales. Beginning inventory in January was 3,100 practice soccer balls and 400 match soccer balls.

Required:

- 1. Construct a production budget for each of the two product lines for FlashKick Company for the first three months of the coming year.

- 2. What if FlashKick wanted a production budget for the two product lines for the month of April? What additional information would you need to prepare this budget?

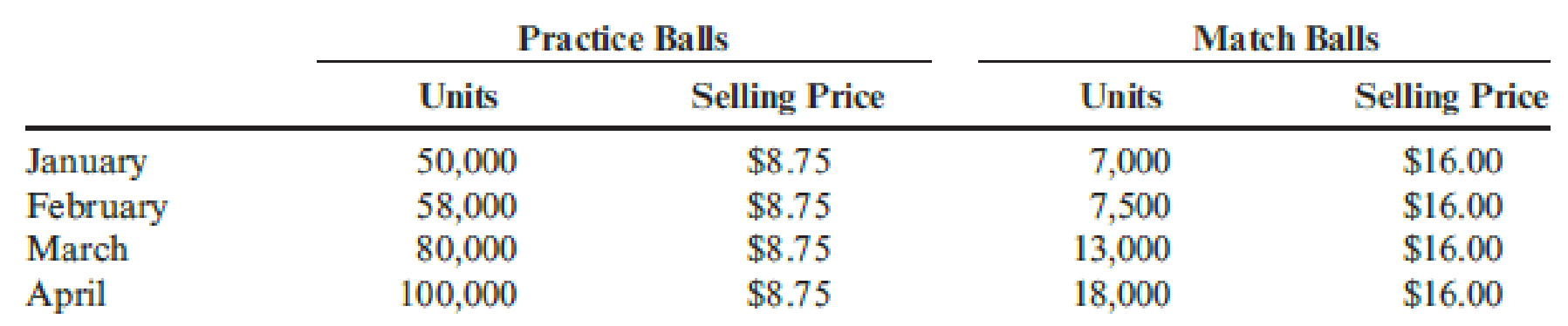

FlashKick Company manufactures and sells soccer balls for teams of children in elementary and high school. FlashKick’s best-selling lines are the practice ball line (durable soccer balls for training and practice) and the match ball line (high-performance soccer balls used in games). In the first four months of next year, FlashKick expects to sell the following:

Required:

- 1. Construct a sales budget for FlashKick for the first three months of the coming year. Show total sales for each product line by month and in total for the first quarter.

- 2. What if FlashKick added a third line—tournament quality soccer balls that were expected to take 40 percent of the units sold of the match balls and would have a selling price of $45 each in January and February, and $48 each in March? Prepare a sales budget for Flash- Kick for the first three months of the coming year. Show total sales for each product line by month and in total for the first quarter.

Trending nowThis is a popular solution!

Chapter 8 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

- Sandhill Company received the following selected information from its pension plan trustee concerning the operation of the company's defined benefit pension plan for the year ended December 31, 2025. January 1, 2025 December 31, 2025 Projected benefit obligation $1,517,000 $1,545,000 Market-related and fair value of plan assets 784,000 1,107,400 Accumulated benefit obligation 1,568,000 1,689,300 Accumulated OCI (G/L)-Net gain 0 (201,700) The service cost component of pension expense for employee services rendered in the current year amounted to $78,000 and the amortization of prior service cost was $121,300. The company's actual…arrow_forwardneed help this questionsarrow_forwardCrane Company sponsors a defined benefit pension plan. The corporation's actuary provides the following information about t January 1, 2025 December 31, 2025 Vested benefit obligation $1,560 $2,010 Accumulated benefit obligation 2,010 2,820 Projected benefit obligation 2,260 3,630 Plan assets (fair value) 1,540 2,560 Settlement rate and expect rate of return 10% Pension asset/liability 720 ? Service cost for the year 2025 $400 Contributions (funding in 2025) 730 Benefits paid in 2025 200 (a)Compute the actual return on the plan assets in…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning