Concept explainers

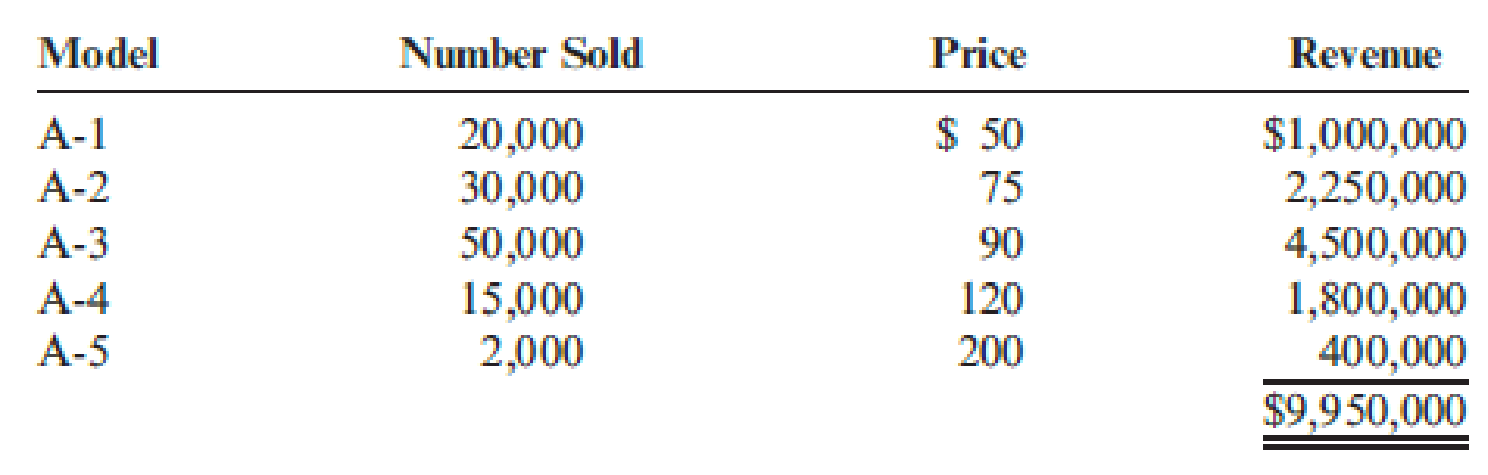

Audio-2-Go, Inc., manufactures MP3 players. Models A-1, A-2, and A-3 are small and light. They are attached to armbands and use flash memory. Models A-4 and A-5 are somewhat larger and use a built-in hard drive; they can be put into fanny packs for use while working out. It is now early January, and Audio-2-Go’s budgeting team is finalizing the sales budget for this year. Sales in units and dollars for last year were as follows:

In looking over last year’s sales figures, Audio-2-Go’s sales budgeting team recalled the following:

- a. Model A-1 costs were rising faster than the price could rise. Preparatory to phasing out this model, Audio-2-Go, Inc., planned to slash advertising for this model and raise its price by 30 percent. The number of units of Model A-1 to be sold was

forecast to be 50 percent of last year’s units. - b. Model A-5 was introduced on November 1 of last year. It contains a built-in 20 GB hard drive and can be synchronized with several popular music software programs. Audio-2-Go brought out this model to match competitors’ audio players, but the price is so much higher than other Audio-2-Go products, that sales have been disappointing. The company plans to discontinue this model on June 30 of this year, and thinks that monthly sales will remain at last year’s level if the sales price remains unchanged.

- c. Audio-2-Go plans to introduce Model A-6 on July 1 of this year. It will be a high-end player that will be lighter and more versatile than Model A-5 (which it will replace). The target price for this model is $180; unit sales are estimated to equal 2,500 per month.

- d. A competitor has announced plans to introduce an improved version of Model A-3. Audio-2-Go believes that theModelA-3 price must be cut 20 percent to maintain unit sales at last year’s level.

- e. It was assumed that unit sales of all other models would increase by 10 percent, prices remaining constant.

Required:

Prepare a sales forecast by product and in total for Audio-2-Go, Inc., for this year.

Trending nowThis is a popular solution!

Chapter 8 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

- QS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forwardQuestion 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forwardQuestion 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College