a)

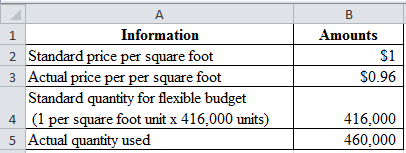

Compute the material variance information:

a)

Explanation of Solution

Compute the material variance information:

Table (1)

b)

Compute the materials price and usage variance and identify whether it is unfavorable or favorable.

b)

Explanation of Solution

Compute the total materials price variances:

Hence, the total materials price variances are $18,400 which is a favorable variance.

Compute the total materials usage variance:

Hence, the total materials usage variances are $44,000 which is an unfavorable variance.

c)

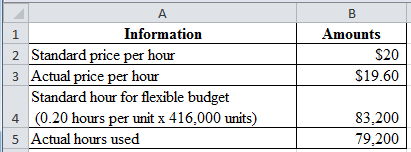

Compute the labor variance information:

c)

Explanation of Solution

Compute the labor variance information:

Table (2)

d)

Determine the labor price and usage variance and identify whether it is unfavorable or favorable.

Given information:

Refer part a) for the table information

d)

Explanation of Solution

Compute the labor price variance:

Hence, the labor price variance is $31,680 which is a favorable variance.

Compute the labor usage variance:

Hence, the labor usage variance is $80,000 which is a favorable variance.

e)

Determine the predetermined

e)

Explanation of Solution

Calculate the the predetermined overhead rate:

Hence, the predetermined overhead rate is $1 per unit.

f)

Compute the fixed cost spending and variance and specify whether it is unfavorable or favorable variance.

f)

Explanation of Solution

Compute the fixed cost spending variance:

Hence, the fixed cost spending variance is $8,000 which is the unfavorable variance

Compute the fixed cost volume variance:

Hence, the fixed cost spending variance is $16,000 which is the favorable variance as the company produced more units than actually planned which leads to decrease in fixed cost per unit

g)

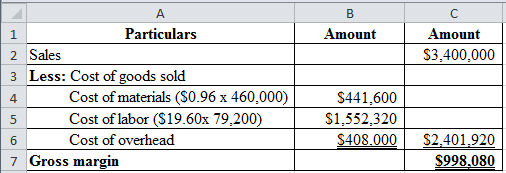

Determine the gross margin of Company S

g)

Explanation of Solution

Determine the gross margin of Company S:

Table (3)

Want to see more full solutions like this?

Chapter 8 Solutions

Fundamental Managerial Accounting Concepts

- Please show me how to solve this financial accounting problem using valid calculation techniques.arrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- how much overhead cost would be assigned to product G98X using the activity based costing system ?arrow_forwardThe closing price of a stock is $74.55, and the net earnings per share are $3.50. The stock's P/E ratio is .arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education