a)

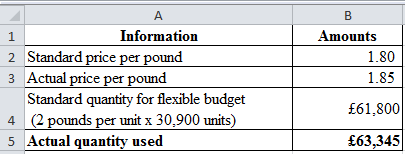

Compute the material variance information:

a)

Explanation of Solution

Compute the material variance information:

Table (1)

b)

Compute the materials price and usage variance and identify whether it is unfavorable or favorable.

b)

Explanation of Solution

Compute the total materials price variances:

Hence the total materials price variances are $3,167.25 which is a unfavorable variance.

Compute the total materials usage variance:

Hence, the total materials usage variances are $2,781 which is an unfavorable variance.

c)

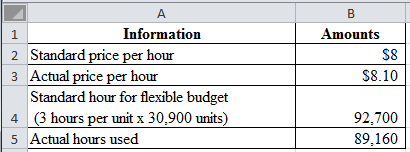

Compute the labor variance information:

c)

Explanation of Solution

Compute the labor variance information:

Table (2)

d)

Determine the labor price and usage variance and identify whether it is unfavorable or favorable.

Given information:

Refer part a) for the table information

d)

Explanation of Solution

Compute the labor price variance:

Hence, the labor price variance is $8,916 which is a unfavorable variance.

Compute the labor usage variance:

Hence, the labor usage variance is $28,320 which is a favorable variance.

e)

Determine the predetermined

e)

Explanation of Solution

Calculate the the predetermined overhead rate:

Hence, the predetermined overhead rate is $23.40 per unit.

f)

Compute the fixed cost spending and variance and specify whether it is unfavorable or favorable variance.

f)

Explanation of Solution

Compute the fixed cost spending variance:

Hence, the fixed cost spending variance is $36,000 which is the unfavorable variance

Compute the fixed cost volume variance:

Hence, the fixed cost spending variance is $21,060 which is the favorable variance as the company produced more units than actually planned which leads to decrease in fixed cost per unit

g)

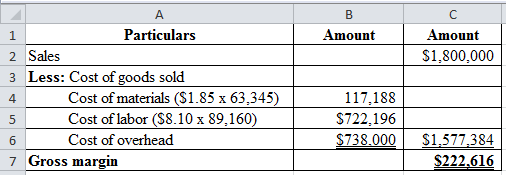

Determine the gross margin of Company S

g)

Explanation of Solution

Determine the gross margin of Company S:

Table (3)

Want to see more full solutions like this?

Chapter 8 Solutions

Fundamental Managerial Accounting Concepts

- Accurate answerarrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forwardCobalt Industries purchases a milling machine for $12,500. In addition, it incurs a sales tax of $600, shipping costs of $1,200, and $2,300 in labor costs to put the machine in place. The estimated residual value of the machine at the end of its useful life is $900. What is the depreciable base of the machine?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education