Concept explainers

Spreadsheet Exercise

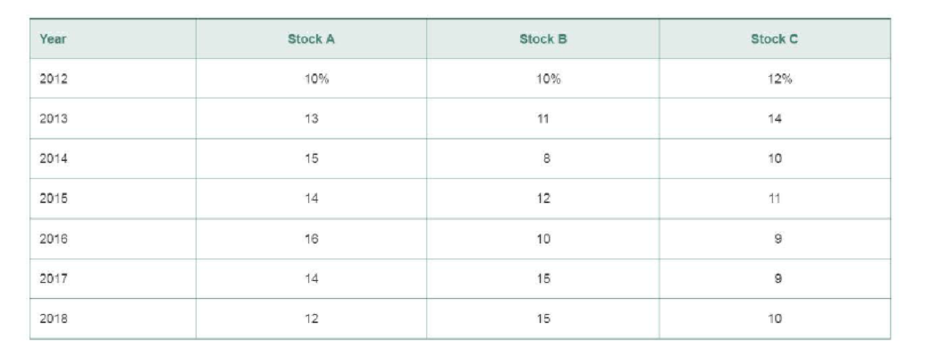

Jane is considering investing in three different stocks or creating three distinct two-stock portfolios. Jane views herself as a rather conservative investor. She is able to obtain historical returns for the three securities for the years 2012 through 2018. The data are given in the following table.

In any of the possible two-stock portfolios, the we1ght of each stock m the portfolio will be 50%. The three possible portfolio combinations are AB, AC, and BC.

To Do

Create a spreadsheet similar to Tables 8.6 and 8.7 to answer the following:

- a. Calculate the average return for each individual stock.

- b. Calculate the standard deviation for each individual stock.

- c. Calculate the average returns for portfolios AB, AC, and BC.

- d. Calculate the standard deviations for portfolios AB, AC, and BC.

- e. Would you recommend that Jane invest in the single stock A or the portfolio consisting of stocks A and B? Explain your answer from a risk-return viewpoint

- f. Would you recommend that Jane invest in the single stock B or the portfolio consisting of stocks B and C? Explain your answer from a risk-return viewpoint

My Lab Finance Visit www.pearson.com/mylab/finance for Chapter Case: Analyzing Risk and Return on Chargers Products’ Investments, Group Exercises, and numerous online resources.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Principles of Managerial Finance, Student Value Edition (15th Edition) (The Pearson Series in Finance)

- if image is blurr or data is not clear in image please comment i will write data or upload new image. Don't use chatgpt. confirm i will give unhelpful if answer with using incorrect data .arrow_forwardBright wood Seating sells reclining chairs for $55.00 per unit. The variable cost is 322 per unit. Each reclining chair requires 5 direct labor hours and 3 machine hours to produce. atribution margin pegmachine home* Wrightwood Manufacturing has a break-even point of 1,500 units. The sales price per unit is $18, and the variable cost per u 13. If the company sells 3,500 units, what will its net income be? Creatwood Industries provides the following budget data for its Processing Department for the year 2022: ⚫ Manufacturing Overhead Costs=$250,400 . Direct Labor Costs $1,234,500 Determine the manufacturing overhead application rate underthe base of Direct Labor Costs. Modesto Accessories manufactures two types of wallets leather and canvas. The company allocates manufacturing overhead using a single plant wide rate with direct labor cost as the allocation base. $48 Estimated Overhead Costs = 30,600 Direct Labor Cost per Leather Wallet Direct Labor Cost per Canvas Wallet = $52 Number of…arrow_forwardPlease don't use AI . Chatgpt giving wrong answer . confirm i will give unhelpharrow_forward

- Anti-Pandemic Pharma Co. Ltd. reports the following information inits income statement:Sales = $5,250,000;Costs = $2, 173,000;Other expenses = $187,400;Depreciation expense = $79,000;Interest expense= $53,555;Taxes = $76,000;Dividends = $69,000.$136,700 worth of new shares were also issued during the year andlong-term debt worth $65,300 was redeemed.a) Compute the cash flow from assetsb) Compute the net change in working capital Show all calculations. Please no spreadsheet so that I can clearly understandarrow_forwardAnswer this question Using the Google drive liink below it hhas the case study In the scenario, Sharp’s employer has been putting more emphasis on controlling costsfor the various businesses. With the slowing of overall spending in the construction sector,Travolta had ordered managers to closely monitor expenses. He had sold several companiesand has given vice presidents greater responsibility for statements of financial positions. Whatpositive and negative consequences might this pose to the company in future fraud prevention?Outline at least three of each type. Please use sources and insert intext citiations Apa 7 format in the answer and provide the links and references below. https://docs.google.com/document/d/1MpthrFl3eAnMKR-EprYRP9sMo8Ll0WtbhxhpGtLbdcw/edit?usp=sharingarrow_forwardfile:///C:/Users/rafan/Downloads/Assignment%201%20Paving%20Company%20Case%20S2%202024%20to%202025.pdf Using the link for the fraud case answer only this question below. b) As discussed in units 1 to 4, all frauds involve key elements. Identify and describe usingexamples, the elements of Sharp’s fraud.arrow_forward

- Option should be match experts are giving incorrect answer they are using AI /Chatgpt that is generating wrong answer. i will give unhelpful if answer will not match in option. dont use AI alsoarrow_forwardOption should be match. please don't use ai if option will not match means answer is incorrect . Ai giving incorrect answerarrow_forwardOption should be match. please don't use ai if option will not match means answer is incorrect . Ai giving incorrect answerarrow_forward

- all frauds involve key elements. Identify and describe usingexamples the elements of fraudarrow_forwardSolve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate of 9%. Use the ordinary interest method. (Use Days in a year table.) Note: Do not round intermediate calculations. Round your final answers to the nearest cent. face value(principal) $50000rate interest:11%length of note: 95 days maturity value: ?date of note: june 10date note discounted: July 18discount period:?bank discount:?proceeds:?arrow_forwardWhat are the different types of audits and different types of auditors? WHat is an example of each type of audit? What is the significance of each from the perspective of different stakeholders?arrow_forward

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning