Concept explainers

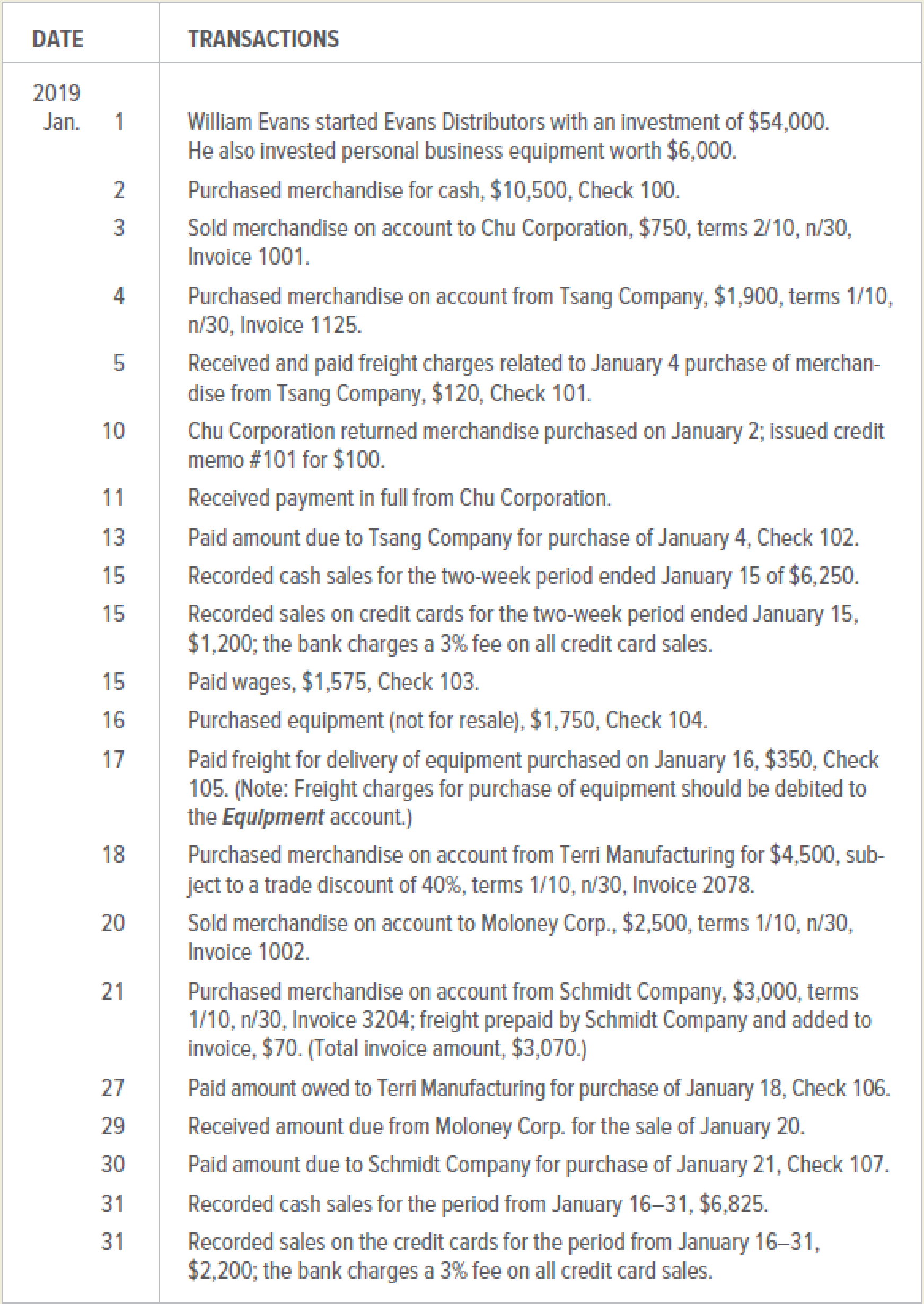

William Evans began Evans Distributors, a sporting goods distribution company, in January 2019 and engaged in the transactions below. Assume Evans Distributors and its customers take advantage of all cash discounts.

INSTRUCTIONS

Record the transactions in a general journal. Number the first journal as page 1. Provide brief explanations after each

Prepare general journal for the transactions of company ED.

Explanation of Solution

General Journal:

All the transactions of a business are prima facie recorded in general journal in chronological order. The general ledger is also known as the primary books of account.

Record the transactions in the general journal as follows:

Recording the capital invested:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 1, 2019 | Cash | 54,000 | ||

| Equipment | 6,000 | |||

| Capital | 60,000 | |||

| (to record the capital invested and equipment provided) | ||||

Table (1)

- • The cash account is an asset account and the account balance is increasing. Therefore, it is debited.

- • The equipment account is asset account and the balance of account is increasing. Therefore, it is debited.

- • The capital account is owners’ equity account. The balance is increased by introducing capital. Hence, it is credited.

Recording the merchandise purchased on cash:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 2, 2019 | Purchases | 10,500 | ||

| Cash | 10,500 | |||

| (to record the merchandise purchased for cash) | ||||

Table (2)

- • The purchases account is expense account and has a normal debit balance which is increasing. Hence, it is debited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the merchandise sold on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 3, 2019 | Accounts receivables/Company C | 750 | ||

| Sales | 750 | |||

| (to record the merchandise sold on account with terms 2/10, n/30) | ||||

Table (3)

- • The accounts receivable is an asset and the account balance is increasing. Hence, it is debited.

- • The sales account is a revenue account. The revenue is generated on selling the merchandise. Hence, it is credited.

Recording the merchandise purchased on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 4, 2019 | Purchases | 1,900 | ||

| Accounts payable/Company TS | 1,900 | |||

| (to record the merchandise purchased on account with terms 1/10, n/30) | ||||

Table (4)

- • The purchases account is expense account and has a normal debit balance which is increasing. Hence, it is debited.

- • Accounts payable is a liability and the account balance is increasing. Therefore, it is credited.

Recording the freight charges paid:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 5, 2019 | Freight In | 120 | ||

| Cash | 120 | |||

| (to record the freight charges paid) | ||||

Table (5)

- • Freight-in charges are the expenses and the expenses are increasing. Hence, the account is debited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the sold goods returned:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 10, 2019 | Sales returns and allowances | 100 | ||

| Accounts receivables/Company C | 100 | |||

| (to record goods returned and credit memo issued) | ||||

Table (6)

- • The sales returns and allowances account is identified as contra revenue account with normal debit balance and increasing. Therefore, it is debited.

- • The account receivable account is an asset account and the account balance is decreasing. Therefore, the accounts payable account is credited.

Recording the payment received from the buyer:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 11, 2019 | Sales Discount | 13 | ||

| Cash | 637 | |||

| Accounts receivable/Company C | 650 | |||

| (to record the payment received and discount provided) | ||||

Table (7)

- • The sales discount account is identified as contra revenue account and it has normal debit balance which is increasing. Therefore, it is debited.

- • The cash account is an asset account and the account balance is increasing. Therefore, it is debited.

- • The accounts receivable account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 13, 2019 | Accounts payable/Company TS | 1,900 | ||

| Purchases discounts | 19 | |||

| Cash | 1,881 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (8)

- • The accounts payable account is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on cash:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 15, 2019 | Purchases | 6,250 | ||

| Cash | 6,250 | |||

| (to record the inventory purchased on cash) | ||||

Table (9)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The cash account is an asset account and account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold using credit card:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 15, 2019 | Credit card expense | 36 | ||

| Cash | 1,164 | |||

| Sales | 1,200 | |||

| (to record the merchandise sold on) | ||||

Table (10)

- • The credit card expense is the expense account which has normal debit balance. The balance is increasing. Therefore, it is debited.

- • The cash account is an asset account and the account balance is increasing. Therefore, the cash account is debited.

- • The sales account is identified as the revenue account and the revenue is generated from selling merchandise. Therefore, sales account is credited.

Recording the wages paid:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 15, 2019 | Wages | 1,575 | ||

| Cash | 1,575 | |||

| (to record the wages paid) | ||||

Table (11)

- • Wages are the expenses and the expenses are increasing. Hence, it is debited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchase of equipment:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 16, 2019 | Equipment | 1,750 | ||

| Cash | 1,750 | |||

| (to record the equipment purchased) | ||||

Table (12)

- • Equipment is an asset and the account balance of asset is increasing. Hence, the account is debited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the charges paid for transporting equipment:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 17, 2019 | Equipment | 350 | ||

| Cash | 350 | |||

| (to record the freight charges paid on equipment) | ||||

Table (13)

- • Freight-in charges are the expenses and the expenses are increasing. Hence, the account is debited. The freight-in charges related to transport of equipment are debited to the equipment account only.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 18 , 2019 | Purchases | 1,700 | ||

| Accounts payable/Company TE | 1,700 | |||

| (to record the inventory purchased on account with terms1/10, n/30) | ||||

Table (14)

- • The purchases account is debited. This is because the purchase account is an expense account and has normal debit balance which is increasing.

- • Accounts payable is liability and account balance is increasing. Therefore, it is credited.

Recording the merchandise sold on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 20, 2019 | Accounts receivables/Company M | 2,500 | ||

| Sales | 2,500 | |||

| (to record the merchandise sold on account with terms 1/10, n/30) | ||||

Table (15)

- • The accounts receivable is an asset and the account balance is increasing. Hence, it is debited.

- • The sales account is a revenue account. The revenue is generated on selling the merchandise. Hence, it is credited.

Record the purchases on the credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 21, 2019 | Purchases | 3,000 | ||

| Freight In | 70 | |||

| Accounts payable/Company S | 3,070 | |||

| (to record the inventory purchased on account with terms 1/30, n/30) | ||||

Table (16)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • Freight-in charges are the expenses and the expenses are increasing. Hence, the account is debited.

- • The accounts payable is a liability and the account balance is increasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 27, 2019 | Accounts payable/Company TE | 2,700 | ||

| Purchases discounts | 27 | |||

| Cash | 2,673 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (17)

- • The accounts payable account is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the payment received from the buyer:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 29, 2019 | Sales Discount | 25 | ||

| Cash | 2,475 | |||

| Accounts receivable/Company M | 2,500 | |||

| (to record the payment received and discount provided) | ||||

Table (18)

- • The sales discount account is identified as contra revenue account and it has normal debit balance which is increasing. Therefore, it is debited.

- • The cash account is asset account and the account balance is increasing. Hence, cash account is debited. The amount in cash account would be calculated by subtracting the merchandise returned by the buyer and the sales discount provided.

- • The accounts receivable account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 30, 2019 | Accounts payable/Company S | 3,070 | ||

| Purchases discounts | 30 | |||

| Cash | 3,040 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (19)

- • The accounts payable account is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on cash:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 30, 2019 | Purchases | 6,825 | ||

| Cash | 6,825 | |||

| (to record the inventory purchased on cash) | ||||

Table (20)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The cash account is an asset account and account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold using credit card:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 30, 2019 | Credit card expense | 66 | ||

| Cash | 2,134 | |||

| Sales | 2,200 | |||

| (to record the merchandise sold on) | ||||

Table (21)

- • The credit card expense is the expense account which has normal debit balance. The balance is increasing. Therefore, it is debited.

- • The cash account is an asset account and the account balance is increasing. Therefore, the cash account is debited.

- • The sales account is identified as the revenue account and the revenue is generated from selling merchandise. Therefore, sales account is credited.

Working Note:

Calculation for sales discount:

The sales discount is provided to the customer by the seller fulfilling the terms of making the timely payments as per 2/10, n/30 terms. The customer is entitled to receive the two percent of sales discount on the merchandise sold if the payment is made with ten days of invoice provided.

The amount calculated as per given information would be $13.

Calculation of purchases discount:

The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company TS was agreed as 1/10, n/30. The terms 1/10, n/30 means the buyer is entitled to receive one percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $19.

Calculations for the credit card expense:

The fee is charged for availing the services of credit card. The bank fee to be charged as credit card is given as three percent for all credit card sales.

The expense would amount to be $36.

Calculations for the purchases amount:

The seller provides the trade discount of forty percent on the list price to the buyer. The purchases amount to be recorded by the buyer would be at the invoice price.

The purchases amount that would be calculated is $2,700.

Calculation of purchases discount:

The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company TE was agreed as 1/10, n/30. The terms 1/10, n/30 means the buyer is entitled to receive one percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $27.

Calculation for sales discount:

The sales discount is provided to the customer by the seller fulfilling the terms of making the timely payments as per 1/10, n/30 terms. The customer is entitled to receive the one percent of sales discount on the merchandise sold if the payment is made with ten days of invoice provided.

The amount calculated as per given information would be $25.

Calculation of purchases discount:

The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company S was agreed as 1/10, n/30. The terms 1/10, n/30 means the buyer is entitled to receive one percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $30.

Calculations for the credit card expense:

The fee is charged for availing the services of credit card. The bank fee to be charged as credit card is given as three percent for all credit card sales.

The expense would amount to be $66.

Want to see more full solutions like this?

Chapter 8 Solutions

GEN COMBO COLLEGE ACCOUNTING; CONNECT ACCESS CARD

- hello teacher please answerarrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What journal entry would Abercrombie & Fitch have made to write down its merchandise inventory during the year ended…arrow_forwardHow much did riverton spend to acquire new fixed assets during 2022 ?arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,