GEN COMBO COLLEGE ACCOUNTING; CONNECT ACCESS CARD

4th Edition

ISBN: 9781260087376

Author: M. David Haddock Jr. Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 16E

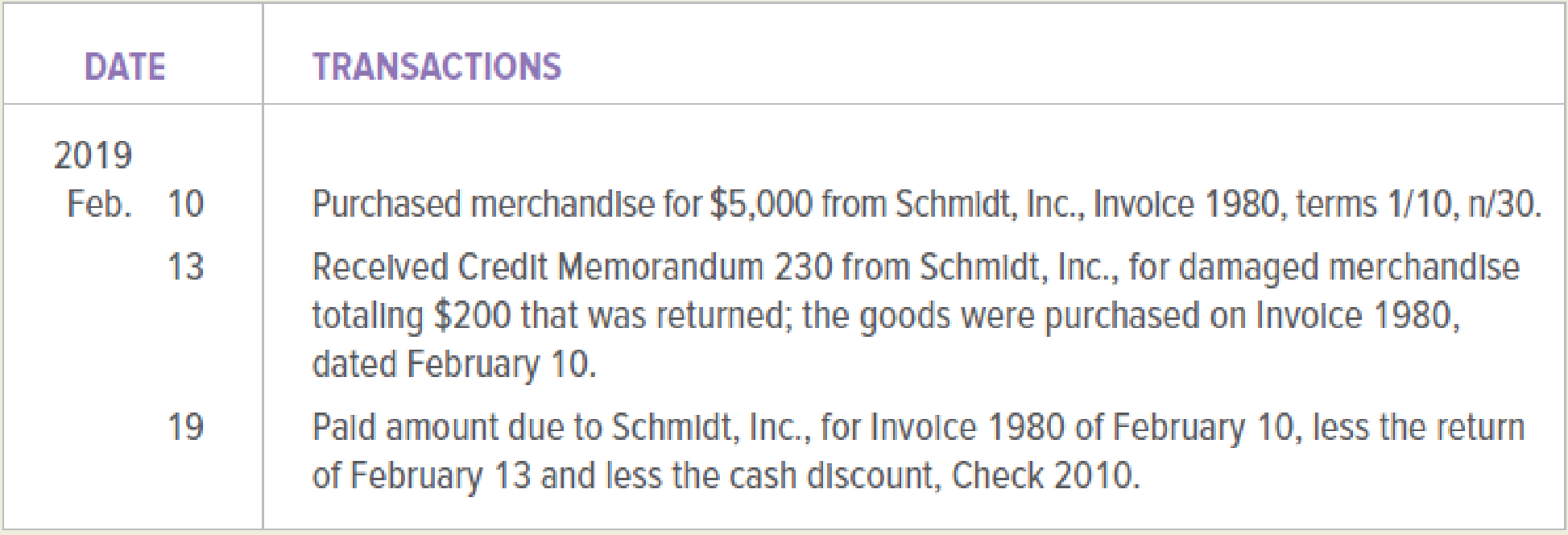

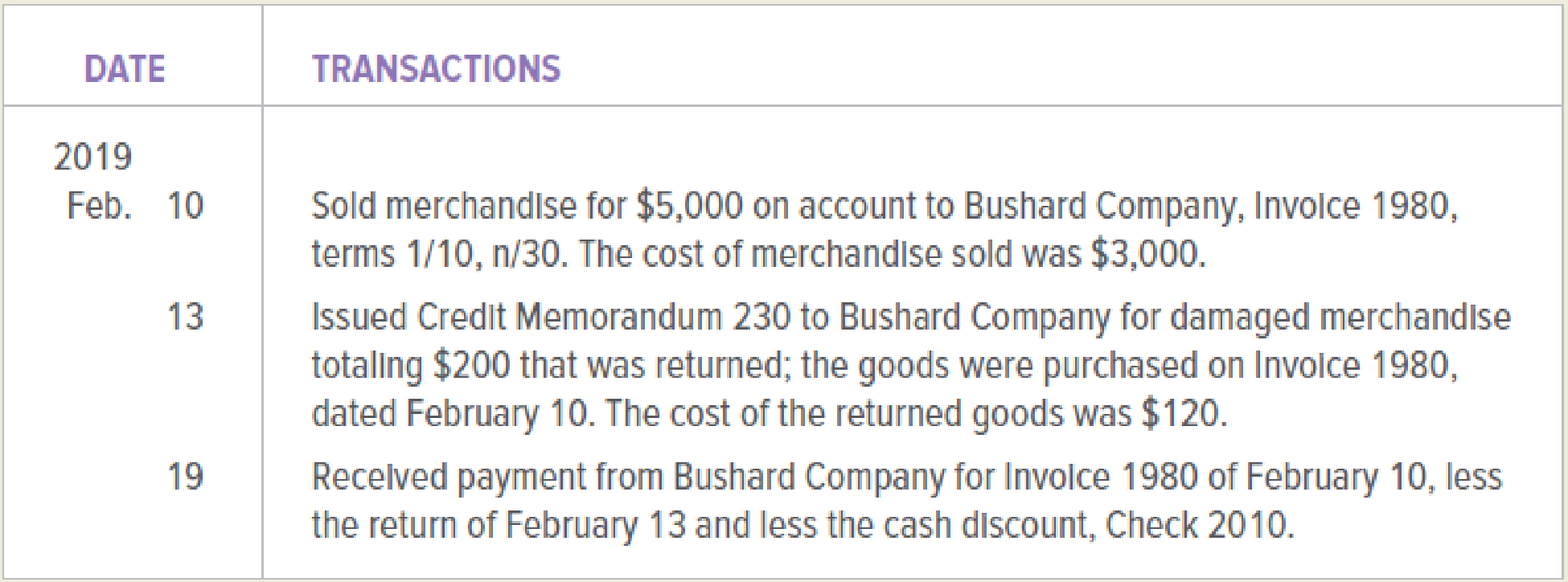

Bushard Company (buyer) and Schmidt, Inc. (seller) engaged in the following transactions during February 2019:

Bushard Company

Schmidt, Inc.

Both companies use the perpetual inventory system. Journalize the transactions above in a general journal for both Bushard Company and Schmidt, Inc. Use 20 as the journal page for both companies.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Financial accounting 2

What is the value of the ending inventory of this financial accounting question?

What is the materials price variance for the month ?

Chapter 8 Solutions

GEN COMBO COLLEGE ACCOUNTING; CONNECT ACCESS CARD

Ch. 8 - What is the name of the account used to record...Ch. 8 - What does FOB shipping point mean?Ch. 8 - Prob. 1.3SRQCh. 8 - Prob. 1.4SRECh. 8 - Prob. 1.5SRECh. 8 - Prob. 1.6SRACh. 8 - Prob. 2.1SRQCh. 8 - Prob. 2.2SRQCh. 8 - The total of the schedule of accounts payable...Ch. 8 - In the accounts payable ledger, a suppliers...

Ch. 8 - Prob. 2.5SRECh. 8 - Prob. 2.6SRACh. 8 - What is the name of the account used to record...Ch. 8 - What type of account is Purchases Returns and...Ch. 8 - Prob. 3CSRCh. 8 - Prob. 4CSRCh. 8 - Prob. 5CSRCh. 8 - Prob. 1DQCh. 8 - Prob. 2DQCh. 8 - Prob. 3DQCh. 8 - Prob. 4DQCh. 8 - Prob. 5DQCh. 8 - Prob. 6DQCh. 8 - What type of accounts are kept in the accounts...Ch. 8 - Prob. 8DQCh. 8 - Prob. 9DQCh. 8 - Prob. 10DQCh. 8 - Prob. 11DQCh. 8 - Prob. 12DQCh. 8 - Prob. 13DQCh. 8 - Why is using the Purchases Returns and Allowances...Ch. 8 - Prob. 15DQCh. 8 - Prob. 16DQCh. 8 - Prob. 17DQCh. 8 - Prob. 18DQCh. 8 - Identify the normal balance of the following...Ch. 8 - Prob. 2ECh. 8 - Prob. 3ECh. 8 - Record the following transactions of J. Min...Ch. 8 - Record the following transactions of Allen Inc.:Ch. 8 - Bushard Company (buyer) and Schmidt, Inc. (seller)...Ch. 8 - Prob. 7ECh. 8 - Prob. 8ECh. 8 - Prob. 9ECh. 8 - Prob. 10ECh. 8 - Prob. 11ECh. 8 - Prob. 12ECh. 8 - Prob. 13ECh. 8 - Record the following transactions of Fashion Park...Ch. 8 - On April 1, Moloney Meat Distributors sold...Ch. 8 - Bushard Company (buyer) and Schmidt, Inc. (seller)...Ch. 8 - Annettes Photo Shop is a retail store that sells...Ch. 8 - Prob. 2PACh. 8 - Prob. 3PACh. 8 - NewTech Medical Devices is a medical devices...Ch. 8 - Prob. 5PACh. 8 - Bowden Company (buyer) and Song, Inc. (seller),...Ch. 8 - The following transactions took place at Fine...Ch. 8 - Prob. 1PBCh. 8 - Taras Card and Novelty Shop is a retail card,...Ch. 8 - Prob. 3PBCh. 8 - Prob. 4PBCh. 8 - Prob. 5PBCh. 8 - Belladonna Company (buyer) and Sachi, Inc....Ch. 8 - The following transactions took place at The...Ch. 8 - William Evans began Evans Distributors, a sporting...Ch. 8 - Prob. 2CTPCh. 8 - Prob. 1MFCh. 8 - Prob. 2MFCh. 8 - Prob. 3MFCh. 8 - Prob. 4MFCh. 8 - Prob. 5MFCh. 8 - Prob. 6MFCh. 8 - Prob. 1ED

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License