Accounting for Governmental & Nonprofit Entities

17th Edition

ISBN: 9780078025822

Author: Jacqueline L. Reck James E. Rooks Distinguished Professor, Suzanne Lowensohn, Earl R Wilson

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 17.8EP

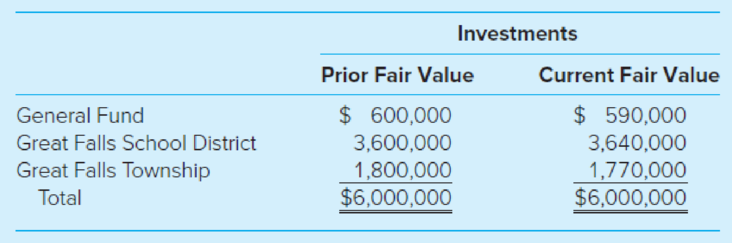

The city council of the City of Great Falls decided to pool the investments of its General Fund with those of Great Falls School District and Great Falls Township, each of which carried its investments at fair value as of the prior

One month after creation of the pool, earnings on pooled investments totaled $59,900. It was decided to distribute the earnings to the participants, rounding the distribution to the nearest dollar. The Great Falls School District should receive

- a. $36,000.

- b. $35,940.

- c. $36,339.

- d. $37,000.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I want to correct answer general accounting

Can you help me with accounting questions

Acorn Construction (calendar-year-end C corporation) has had rapid expansion during the last half of the current year due to the housing market's recovery. The company has record income and would like to maximize its cost recovery deduction for the current year. (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.)

Note: Round your answer to the nearest whole dollar amount.

Acorn provided you with the following information:

Asset

Placed in Service

Basis

New equipment and tools

August 20

$ 3,800,000

Used light-duty trucks

October 17

2,000,000

Used machinery

November 6

1,525,000

Total

$ 7,325,000

The used assets had been contributed to the business by its owner in a tax-deferred transaction two years ago.

a. What is Acorn's maximum cost recovery deduction in the current year?

Chapter 8 Solutions

Accounting for Governmental & Nonprofit Entities

Ch. 8 - Prob. 1QCh. 8 - Identify the different types of trust funds and...Ch. 8 - Prob. 3QCh. 8 - Explain how the financial reporting of fiduciary...Ch. 8 - Prob. 5QCh. 8 - Prob. 6QCh. 8 - Prob. 7QCh. 8 - Prob. 8QCh. 8 - Prob. 9QCh. 8 - Prob. 10Q

Ch. 8 - Prob. 11CCh. 8 - Prob. 12CCh. 8 - Prob. 13CCh. 8 - Prob. 14CCh. 8 - Prob. 16.1EPCh. 8 - Prob. 16.2EPCh. 8 - Prob. 16.3EPCh. 8 - Prob. 16.4EPCh. 8 - Prob. 16.5EPCh. 8 - Prob. 16.6EPCh. 8 - Prob. 16.7EPCh. 8 - Prob. 16.8EPCh. 8 - Prob. 16.9EPCh. 8 - Prob. 16.10EPCh. 8 - Prob. 17.1EPCh. 8 - Prob. 17.2EPCh. 8 - Prob. 17.3EPCh. 8 - Prob. 17.4EPCh. 8 - Prob. 17.5EPCh. 8 - At the date of the creation of the investment...Ch. 8 - The city council of the City of Great Falls...Ch. 8 - The city council of the City of Great Falls...Ch. 8 - Prob. 17.9EPCh. 8 - Prob. 17.10EPCh. 8 - Prob. 18EPCh. 8 - Special Assessment Debt. Residents of Green Acres,...Ch. 8 - Identification of Fiduciary Funds. Following is a...Ch. 8 - Prob. 21EPCh. 8 - Pass-through Agency Funds. Evergreen County acts...Ch. 8 - Fiduciary Financial Statements. Ray County...Ch. 8 - Prob. 24EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Don't use ai given answer accounting questionsarrow_forwardMultiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forwardMultiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License