Accounting for Governmental & Nonprofit Entities

17th Edition

ISBN: 9780078025822

Author: Jacqueline L. Reck James E. Rooks Distinguished Professor, Suzanne Lowensohn, Earl R Wilson

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 17.7EP

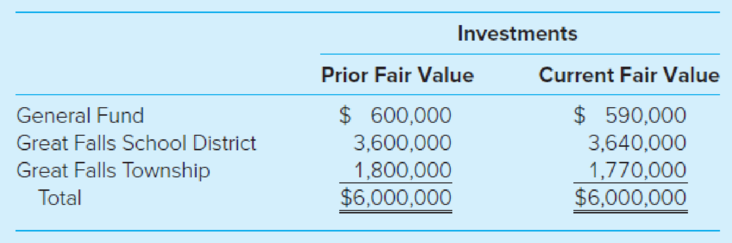

The city council of the City of Great Falls decided to pool the investments of its General Fund with those of Great Falls School District and Great Falls Township, each of which carried its investments at fair value as of the prior

One day after creation of the pool, the investments that had belonged to Great Falls Township were sold by the pool for $1,760,000.

- a. The loss of $40,000 is borne by each participant in proportion to its equity in the pool.

- b. The loss of $10,000 is borne by each participant in proportion to its equity in the pool.

- c. The loss of $40,000 is considered to be a loss borne by Great Falls Township.

- d. The loss of $10,000 is considered to be a loss borne by Great Falls Township.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Solve this following requirements

Need help

Horizon Electronics Ltd. has the following data: please correct answer this general accounting question

Chapter 8 Solutions

Accounting for Governmental & Nonprofit Entities

Ch. 8 - Prob. 1QCh. 8 - Identify the different types of trust funds and...Ch. 8 - Prob. 3QCh. 8 - Explain how the financial reporting of fiduciary...Ch. 8 - Prob. 5QCh. 8 - Prob. 6QCh. 8 - Prob. 7QCh. 8 - Prob. 8QCh. 8 - Prob. 9QCh. 8 - Prob. 10Q

Ch. 8 - Prob. 11CCh. 8 - Prob. 12CCh. 8 - Prob. 13CCh. 8 - Prob. 14CCh. 8 - Prob. 16.1EPCh. 8 - Prob. 16.2EPCh. 8 - Prob. 16.3EPCh. 8 - Prob. 16.4EPCh. 8 - Prob. 16.5EPCh. 8 - Prob. 16.6EPCh. 8 - Prob. 16.7EPCh. 8 - Prob. 16.8EPCh. 8 - Prob. 16.9EPCh. 8 - Prob. 16.10EPCh. 8 - Prob. 17.1EPCh. 8 - Prob. 17.2EPCh. 8 - Prob. 17.3EPCh. 8 - Prob. 17.4EPCh. 8 - Prob. 17.5EPCh. 8 - At the date of the creation of the investment...Ch. 8 - The city council of the City of Great Falls...Ch. 8 - The city council of the City of Great Falls...Ch. 8 - Prob. 17.9EPCh. 8 - Prob. 17.10EPCh. 8 - Prob. 18EPCh. 8 - Special Assessment Debt. Residents of Green Acres,...Ch. 8 - Identification of Fiduciary Funds. Following is a...Ch. 8 - Prob. 21EPCh. 8 - Pass-through Agency Funds. Evergreen County acts...Ch. 8 - Fiduciary Financial Statements. Ray County...Ch. 8 - Prob. 24EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Give true answer the financial accounting questionarrow_forwardNeed help with this financial accounting questionarrow_forwardGary Watson, a graduating business student at a small college, is currently interviewing for a job. Gary was invited by both Tilly Manufacturing Company and Watson Supply Company to travel to a nearby city for an interview. Both companies have offered to pay Gary's expenses. His total expenses for the trip were $96 for mileage on his car and $45 for meals. As he prepares the letters requesting reimbursement, he is considering asking for the total amount of the expenses from both employers. His rationale is that if he had taken separate trips, each employer would have had to pay that amount. Who are the parties that are directly affected by this ethical dilemma? multiple choice 1 Tilly Manufacturing Company Watson Supply Company Both the employers Are the other students at the college potentially affected by Gary's decision? multiple choice 2 Yes No Are the professors at the college potentially affected by Gary's decision? multiple choice 3 Yes No…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License