>Practice Set

P7-31 Using all journals

This problem continues the Crystal Clear Cleaning problem. Crystal Clear Cleaning has decided that, in addition to providing cleaning services, it will sell cleaning products. Crystal Clear uses the perpetual inventory system. During December 2017, Crystal Clear completed the following transactions:

Dec. 2 Purchased 475 units of inventory for $2,850 on account from Sparkle, Co. on terms 3/10, n/20.

5 Purchased 600 units of inventory from Borax on account with terms 2/10, n/30. The total invoice was for $4,500, which included a $150 freight charge.

7 Returned 75 units of inventory to Sparkle from the December 2 purchase (cost, $450).

9 Paid Borax.

11 Sold 285 units of goods to Happy Maids for $3,990 on account on terms 3/10, n/30. Crystal dear's cost of the goods was $1,710.

12 Paid Sparkle.

15 Received 22 units with a retail price of $308 of goods back from customer Happy Maids. The goods cost Crystal Clear $132.

21 Received payment from Happy Maids, settling the amount due in full.

28 Sold 265 units of goods to Bridget, Inc. for cash of $3,975 (cost, $1,691).

29 Received bill and paid cash for utilities of $415.

30 Paid cash for Sales Commission Expense of $550.

31 Recorded the following

a. Physical count of inventory on December 31 showed 428 units of goods on hand, $3,148

b.

c. Accrued salaries expense of $725

d. Prepared all other adjustments necessary for December. (Hint: You will need to review the adjustment information in Chapter 3 to determine the remaining adjustments.) Assume cleaning supplies at December 31 are $30.

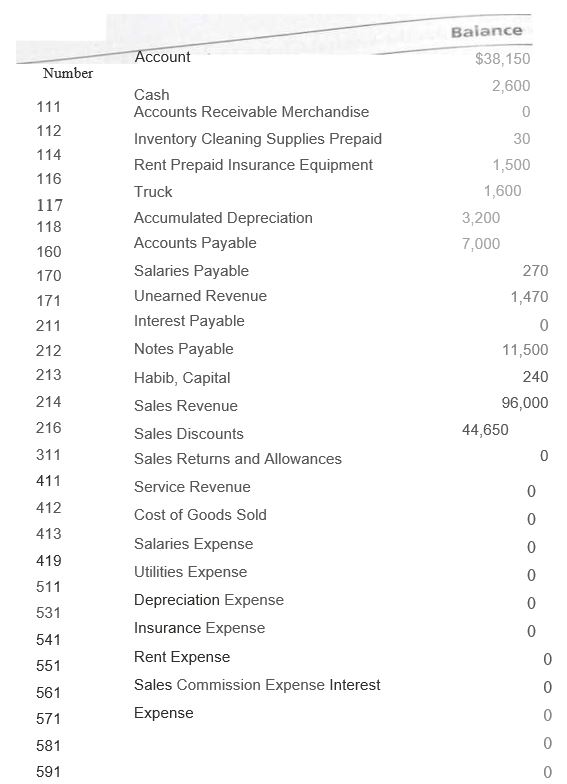

Crystal Clear Cleaning had the following selected accounts with account numbers and normal balances:

Requirements

1. Use the appropriate journal to record the preceding transactions in a sales journal (omit the Invoice No. column), a cash receipts journal, a purchases journal, a cash payments journal (omit the Check No. column), and a general journal.

2. Total each column of the special journals. Show that total debits equal total credits in each special journal.

3. Show how postings would be made from the journals by writing the account Numbers and check marks in the appropriate places in the journals.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Horngren's Accounting (11th Edition)

- Provide answer general Accounting questionarrow_forwardDegregorio Corporation makes a product that uses a material with the following direct material standards: Standard quantity 2.7 kilos per unit Standard price $9 per kilo The company produced 5,700 units in November using 15,760 kilos of the material. During the month, the company purchased 17,830 kilos of direct material at a total cost of $156,904. The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for November is: a. $3,330 F b. $3,236 F c. $3,330 U d. $3,236 Uarrow_forwardNonearrow_forward

- The blending department had the following data for the month of March: Units in BWIP Units completed 7,200 Units in EWIP (40% complete) 750 $27,000 Total manufacturing costs Required: 1. What is the output in equivalent units for March? 2. What is the unit manufacturing cost for March?arrow_forwardGiven answer accounting questionarrow_forwardAccounting question answerarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning