Concept explainers

>Continuing Problem

P7-30 Using all journals

This problem continues the Daniels Consulting situation. Daniels Consulting performs systems consulting. Daniels has also begun selling accounting software and uses the perpetual inventory system to account for software inventory. During January 2017, Daniels completed the following transactions:

Jan. 2 Completed a consulting engagement and received cash of $5,700.

2 Prepaid three months office rent, $2,400.

7 Purchased 50 units software inventory on account from Miller Co., $1,050, plus freight in, $50.

18 Sold 40 software units on account to Jason Needle, $2,625 (cost, $880).

19 Consulted with a client, Louis Frank, for a fee of $2,500 on account. (Use general journal.)

20 Paid employee salaries, $1,885, which includes accrued salaries from December of $685. Paid Miller Co. on account, $1,100. There was no discount.

21 Purchased 185 units software inventory on account from Whitestone Co., $4,810. Received bill and paid utilities, $375.

22 Sold 135 units software for cash, $5,265 (cost, $3,470).

24 Recorded the following

- Accrued salaries expense, $775

Depreciation on Equipment, $60; Depreciation on Furniture, $50- Expiration of prepaid rent, $800

- Physical count of software inventory, 50 units, $1,300

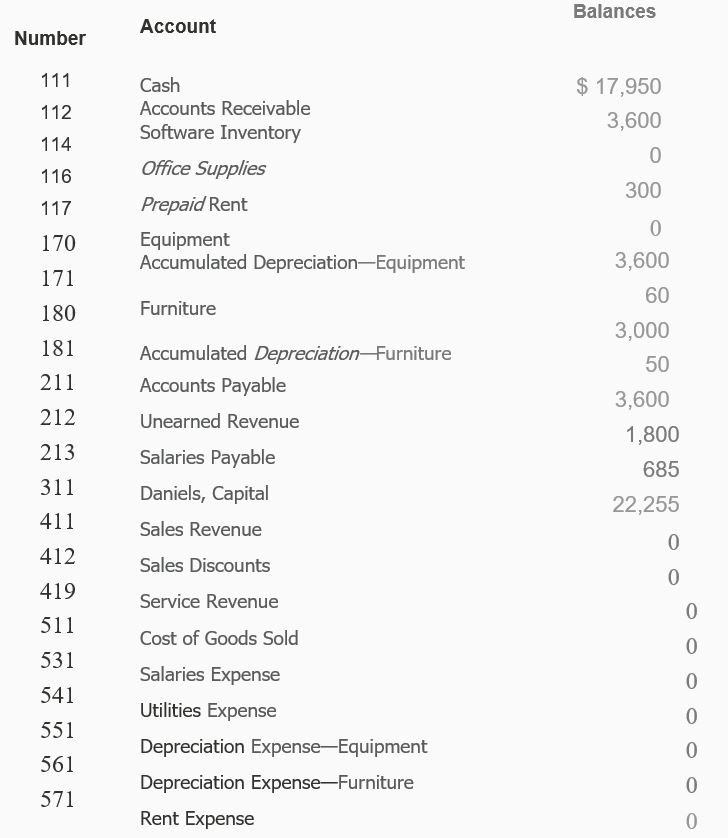

Daniels Consulting had the following

selected accounts with account numbers and normal balances:

Requirements

- Use the appropriate journal to record the preceding transactions in a sales journal (omit the Invoice No. column), a cash receipts journal, a purchases journal, a cash payments journal (omit the Check No. column), and a general journal.

- Total each column of the special journals. Show that total debits equal total credit in each special journal.

- Show how postings would be made from the journals by writing the account numbers and check marks in the appropriate places in the journals.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

ACCOUNTING PRINCIPLES 122 5/16 >C<

- Financial accounting questionarrow_forwardThe following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. Date Item Debit Credit BalanceDebit BalanceCredit August 1 Bal., 6,300 units, 4/5 completed 16,884 31 Direct materials, 113,400 units 226,800 243,684 31 Direct labor 64,390 308,074 31 Factory overhead 36,212 344,286 31 Goods finished, 114,900 units 332,958 11,328 31 Bal., ? units, 2/5 completed 11,328 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. Line Item Description Amount 1. Direct materials cost per equivalent unit $fill in the blank 1 2. Conversion cost per equivalent unit $fill in the blank 2 3. Cost of the beginning work in process completed during August $fill in the blank 3 4. Cost of units started and completed during August $fill in the blank 4 5. Cost of the ending work in…arrow_forwardWahwaht is the stock price? General accounting questionarrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College