Concept explainers

Flexible budget for factory

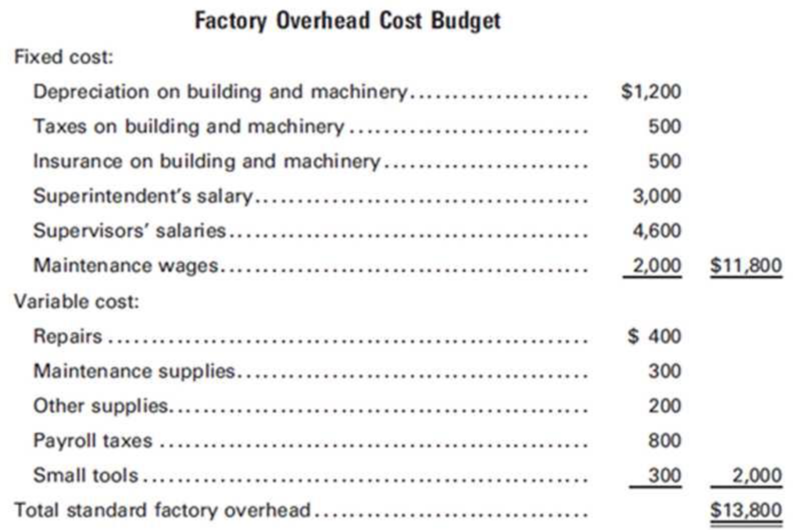

Presented below are the monthly

Required:

- 1. Assuming that variable costs will vary in direct proportion to the change in volume, prepare a flexible budget for production levels of 80%, 90%, and 110% of normal capacity. Also determine the predetermined factory overhead rate at each level of volume in both units and direct labor hours.

- 2. Prepare a flexible budget for production levels of 80%, 90%, and 110%, assuming that variable costs will vary in direct proportion to the change in volume, but with the following exceptions. (Hint: Set up a third category for semi-variable expenses.)

- a. At 110% of capacity, another supervisor will be needed at a salary of $24,000 annually.

- b. At 80% of capacity, the repairs expense will drop to one-half of the amount at 100% capacity.

- c. At 80% of capacity, one part-time maintenance worker, earning $10,000 a year, will be laid off.

- d. At 110% of capacity, a machine not normally in use and on which no

depreciation is normally recorded will be used in production. Its cost was $12,000, it has a 10-year life, and straight-line depreciation will be taken.

- 2. Prepare a flexible budget for production levels of 80%, 90%, and 110%, assuming that variable costs will vary in direct proportion to the change in volume, but with the following exceptions. (Hint: Set up a third category for semi-variable expenses.)

1.

Prepare the flexible budget for the production levels of 80%, 90% and 110% of normal capacity and calculate the predetermined factory overhead rate at each level of volume in both units and direct labor hours.

Explanation of Solution

Prepare the factory overhead cost budget.

| Factory overhead cost budget | |||

| Percent of normal capacity | 80% | 90% | 110% |

| Number of units | 4,000 | 4,500 | 5,500 |

| Number of standard direct labor hours | 16,000 | 18,000 | 22,000 |

| Budgeted factory overhead: | |||

| Fixed cost: | |||

| Depreciation on building and machinery | $ 1,200 | $ 1,200 | $ 1,200 |

| Taxes on building and machinery | $ 500 | $ 500 | $ 500 |

| Insurance on building and machinery | $ 500 | $ 500 | $ 500 |

| Superintendent's salary | $ 3,000 | $ 3,000 | $ 3,000 |

| Supervisors' salaries | $ 4,600 | $ 4,600 | $ 4,600 |

| Maintenance wages | $ 2,000 | $ 2,000 | $ 2,000 |

| Total fixed cost | $ 11,800 | $ 11,800 | $ 11,800 |

| Variable cost: | |||

| Repairs | $ 320 | $ 360 | $ 440 |

| Maintenance supplies | $ 240 | $ 270 | $ 330 |

| Other supplies | $ 160 | $ 180 | $ 220 |

| Payroll taxes | $ 640 | $ 720 | $ 880 |

| Small tools | $ 240 | $ 270 | $ 330 |

| Total variable cost | $ 1,600 | $ 1,800 | $ 2,200 |

| Total factory overhead cost | $ 13,400 | $ 13,600 | $ 14,000 |

Table (1)

Calculate the predetermined factory overhead rate.

2.

Prepare the flexible budget for the production levels of 80%, 90% and 110% by assuming that the variable costs will differ in the portion to the change in volume with certain exceptions.

Explanation of Solution

Prepare the factory overhead cost budget.

| Factory overhead cost budget | |||

| Percent of normal capacity | 80% | 90% | 110% |

| Number of units | 4,000 | 4,500 | 5,500 |

| Budgeted factory overhead: | |||

| Fixed cost: | |||

| Taxes on building and machinery | $ 500 | $ 500 | $ 500 |

| Insurance on building and machinery | $ 500 | $ 500 | $ 500 |

| Superintendent's salary | $ 3,000 | $ 3,000 | $ 3,000 |

| Total fixed cost | $ 4,000 | $ 4,000 | $ 4,000 |

| Semi variable cost: | |||

| Depreciation of building and machinery (1) | $ 1,200 | $ 1,200 | $ 1,300 |

| Supervisor’s salaries (2) | $ 4,600 | $ 4,600 | $ 6,600 |

| Maintenance wages (3) | $ 1,167 | $ 2,000 | $ 2,000 |

| Repairs (4) | $ 200 | $ 360 | $ 440 |

| Total semi variable cost | $7,167 | $8,160 | $10,340 |

| Variable cost: | |||

| Other supplies | $160 | $180 | $220 |

| Payroll taxes | $640 | $720 | $880 |

| Small tools | $240 | $270 | $330 |

| Maintenance supplies | $240 | $270 | $330 |

| Total variable cost | $1,280 | $1,440 | $1,760 |

| Total factory overhead cost | $12,447 | $13,600 | $16,100 |

Table (2)

Working note (1): Calculate the semivariable cost for depreciation of building and machinery for 110%.

Working note (2): Calculate the semivariable cost for supervisors’ salaries for 110%.

Working note (3): Calculate the semivariable cost for Maintenance wages for 80%.

Working note (4): Calculate the semivariable cost for repairs for 80%.

Want to see more full solutions like this?

Chapter 7 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Understanding Business

Horngren's Accounting (12th Edition)

Foundations Of Finance

Marketing: An Introduction (13th Edition)

Essentials of MIS (13th Edition)

- Answer? ? Financial accounting questionarrow_forwardNeither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Income: Joe's salary $ 144,100 Jessie's craft sales 18,400 Interest from certificate of deposit 1,650 Interest from Treasury bond funds 716 Interest from municipal bond funds 920 Expenditures: Federal income tax withheld from Joe's wages $ 13,700 State income tax withheld from Joe's wages 6,400 Social Security tax withheld from Joe's wages 7,482 Real estate taxes on residence 6,200 Automobile licenses (based on weight) 310 State sales tax paid 1,150 Home mortgage interest 26,000 Interest on Masterdebt credit card 2,300 Medical expenses (unreimbursed) 1,690 Joe's employee expenses (unreimbursed) 2,400 Cost of…arrow_forwardNeed General Accounting Question solutionarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College