Flexible budgeting, performance measurement, and ethics

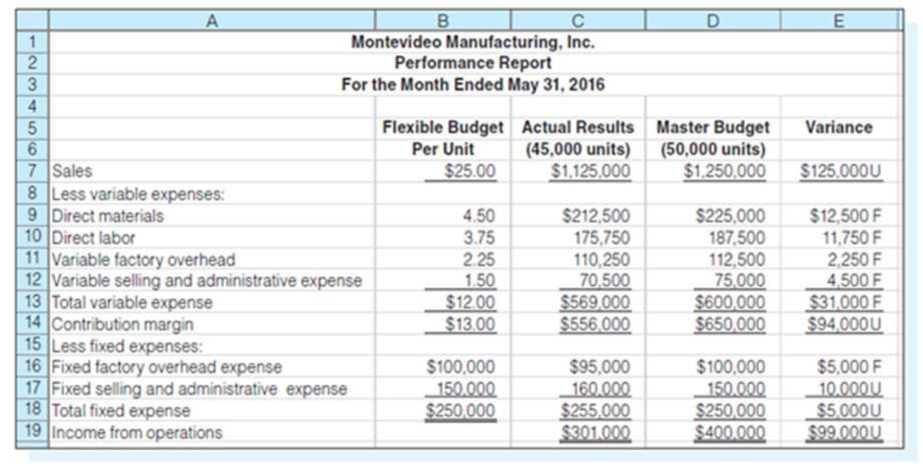

Montevideo Manufacturing, Inc. produces a single type of small motor. The bookkeeper who does not have an in-depth understanding of accounting principles prepared the following performance report with the help of the production manager.

In a conversation with the sales manager, the production manager was overheard saying, “You sales guys really messed up our May performance, and it is only because production did such a great

Required:

- 1. Do you agree with the production manager that the manufacturing area did a good job of controlling costs?

- 2. Prepare a flexible budget for Montevideo Manufacturing’s expenses at the following activity levels: 45,000 units, 50,000 units, and 55,000 units.

- 3. Prepare a revised performance report, using the most appropriate flexible budget from (2) above.

- 4. Now what is your response to the production manager’s claim?

- 5. Assume that you have just been hired as the new accountant. You observe that the production manager is about to receive a large bonus based on the favorable materials, labor, and factory

overhead variances indicated in the flexible budget prepared by the bookkeeper. Using the IMA Statement of Ethical Professional Practice as your guide, what standards, if any, apply to your responsibilities in this matter?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Marketing: An Introduction (13th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentneedarrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit RevenueCorrectarrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenuecorrectarrow_forward

- GAP Corp. is a calendar year S corporation with three shareholders. George and Anna each own 49 percent of the stock. Peter owns 2 percent of the stock. The corporation was formed on January 2, Year 1, and has been an S corporation since its inception. Using the exhibits, prepare a schedule of GAP's income, gain, loss, and deduction items for Year 2. In column B, enter the amount for federal income tax purposes. In column C, enter the amount included in GAP's Form 1120S ordinary business income (OBI) or loss. In column D, enter the amount included on GAP's Schedule K as a taxable or deductible separately stated item. Each item may have amounts entered in ordinary business income, separately stated items, or both. Enter income and gain amounts as positive numbers. Enter losses and deductions as negative numbers. If the amount is zero, enter a zero (0). A B C D 1 Income, Gain, Loss, and Deduction Items Amount for Federal Income Tax Purposes Ordinary Business Income…arrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenue need helparrow_forwardDennis Green and Peter Olinto are equal partners in Foxy Partnership. Peter is an active general partner. Dennis is a limited partner and is not involved in the operations of the business. Foxy Partnership's Year 2 financial statements are provided in the exhibits. Using the information provided, enter the appropriate amounts to be reported on page 1 of Foxy Partnership's income tax return in the table below. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). A B 1 Gross receipts or sales 2 Cost of goods sold 3 Salaries and wages 4 Guaranteed payments to partners 5 Repairs and maintenance 6 Bad debts 7 Rent 8 Depreciation 9 Other deductions 10 Ordinary business income (loss)arrow_forward

- Dennis Green and Peter Olinto are equal partners in Foxy PartneDennis Green and Peter Olinto are equal partners in Foxy Partnership. Peter is an active general partner. Dennis is a limited partner and is not involved in the operations of the business. Foxy Partnership's Year 2 financial statements are provided in the exhibits. Using the information provided, enter the appropriate amounts to be reported on page 1 of Foxy Partnership's income tax return in the table below. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). 2. Cost of goods sold 3. Salaries and wages 4. Guaranteed payments to partners 5. Repairs and maintenance 6. Bad debts 7. Rent 8. Depreciation 9. Other deductions 10. Ordinary business income (loss)arrow_forwardIf a business pays off a loan, which of the following will occur?A. Assets and liabilities increaseB. Assets and liabilities decreaseC. Only liabilities increaseD. Equity decreasesarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementneedarrow_forward

- No chatgpt! Which financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings StatementNo Aiarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,