Concept explainers

Variable and Absorption Costing Unit Product Costs and Income Statements L07—1, L07—2, L07—3

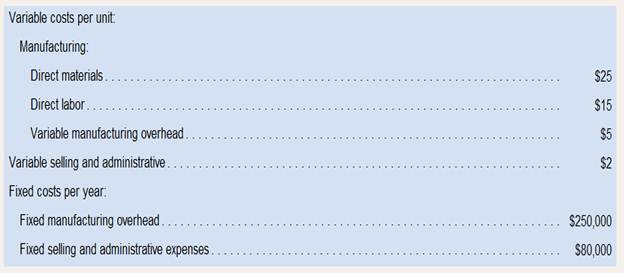

Walsh Company manufactures and sells one product. The following information pertains to each of the company’s first two ears ofoperations:

During its first year of operations, Walsh produced 50,000 units and sold 40,000 units. During its second year of operations, it produced40,000 units and sold 50,000 units. The selling price of the company’s product is $60 per unit.

Required:

1. Assume the company uses variable costing:

a. Compute the unit product cost for Year 1 and Year 2.

b. Prepare an income statement for Year 1 and Year 2.

2. Assume the company uses absorption costing:

a. Compute the unit product cost for Year 1 and Year 2.

b. Prepare an income statement for Year 1 and Year 2.

3. Explain the difference between variable costing and absorption costing net operating income in Year 1. Also, explain why the two netoperating incomes differ in Year 2.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Introduction To Managerial Accounting

- Please provide the correct answer to this financial accounting problem using valid calculations.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning