Companywide and Segment Break-Even Analysis; Decision Making L07—4, L07—5

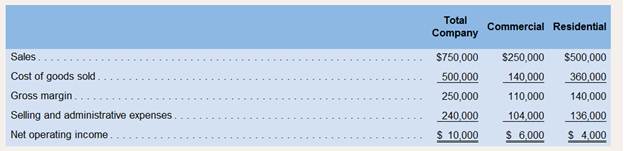

Toxaway Company is a merchandiser that segments its business into two divisions—Commercial and Residential. The company’s accountingintern was asked to prepare segmented income statements that the company’s divisional managers could use to calculate their break-evenpoints and make decisions. She took the prior month’s companywide income statement and prepared the absorption format segmented incomestatement shown below:

In preparing these statements, the intern determined that Toxaway’s only variable selling and administrative expense is a 10% salescommission on all sales. The company’s total fixed expenses include $72,000 of common fixed expenses that would continue to be incurredeven if the Commercial or Residential segments are discontinued, $55,000 of fixed expenses that would be avoided if the Commercial segment is dropped, and $38,000 of fixed expenses that would be avoided if the Residential segment is dropped.

In preparing these statements, the intern determined that Toxaway’s only variable selling and administrative expense is a 10% salescommission on all sales. The company’s total fixed expenses include $72,000 of common fixed expenses that would continue to be incurredeven if the Commercial or Residential segments are discontinued, $55,000 of fixed expenses that would be avoided if the Commercial segment is dropped, and $38,000 of fixed expenses that would be avoided if the Residential segment is dropped.

Required:

1. Do you agree with the intern’s decision to use an absorption format for her segmented income statement? Why?

2. Based on a review of the intern’s segmented income statement:

a. How much of the company’s common fixed expenses did she allocate to the Commercial and Residential segments?

b. Which of the following three allocation bases did she most likely use to allocate common fixed expenses to the Commercial and

Residential segments: (a) sales, (b) cost of goods sold, or (c) gross margin?

3. Do you agree with the intern’s decision to allocate the common fixed expenses to the Commercial and Residential segments? Why?

4. Redo the intern’s segmented income statement using the contribution format.

5. Compute the companywide break-even point in dollar sales.

6. Compute the break-even point in dollar sales for the Commercial Division and for the Residential Division.

7. Assume the company decided to pay its sales representatives in the Commercial and Residential Divisions a total monthly salary of$15000 and $30,000, respectively, and to lower its companywide sales commission percentage from 10% to 5%. Calculate the newbreak-even point in dollar sales for the Commercial Division and the Residential Division.

1:

Whether absorption costing method should be used for segmented income statement

Explanation of Solution

Under absorption costing the fixed expenses get deferred to next period due to absorption in closing stock even though they have actually been incurred. As such, profit/loss shown by Absorption costing is not real profit. Hence, variable costing should be used.

2 (a)

Allocation of Common Fixed Costs

Answer to Problem 24P

Solution:

| Particulars | Total Company | Commercial | Residential |

| Actual Selling expenses | $ 240,000 | $ 104,000 | $ 136,000 |

| Less: Variable Selling expenses | $ (75,000) | $ (25,000) | $ (50,000) |

| Less: Traceable fixed selling expenses | $ (93,000) | $ (55,000) | $ (38,000) |

| Balance fixed expenses | $ 72,000 | $ 24,000 | $ 48,000 |

| (common fixed expenses allocated) | |||

Explanation of Solution

- Total selling and administrative expenses are given. These are a sum total of variable selling expenses + traceable fixed selling expenses + common allocated fixed selling expenses;

- Variable selling expenses are given as % of sales and have been computed accordingly in above working note;

- Traceable fixed selling expenses are given in the question;

- Balance remaining after deducting variable selling and traceable fixed expenses will give common fixed expenses allocated.

- Given Variable Sales commission % as 10%

Sales traceable fixed selling expenses

- Formula

- Calculation

The common fixed cost has been allocated as $ 24,000 to Commercial and $ 48,000 to Residential

2 (b)

Allocation basis of common fixed cost out of given options:

Answer to Problem 24P

Solution:

In order to evaluate what basis has been used, we will compute the ratio under all the options and then assess as under:

| Company | Commercial | Residential | |

| Common Fixed Expenses allocated (as per answer 2(a)) | $ 72,000 | $ 24,000 | $ 48,000 |

| Ratio of Common Fixed Expenses allocated | 33% | 67% | |

| Sales | $ 750,000 | $ 250,000 | $ 500,000 |

| Ratio of Sales | 33% | 67% | |

| Cost of Goods Sold | $ 500,000 | $ 140,000 | $ 360,000 |

| Ratio of Cost of Goods Sold | 28% | 72% | |

| Gross Margin | $ 250,000 | $ 110,000 | $ 140,000 |

| Ratio of Gross Margin | 44% | 56% |

As clear from above, the intern used Sales Ratio to distribute common fixed expenses.

Explanation of Solution

- The ratio of individual common allocated fixed expenses to total common fixed expenses works out to 33% and 67% for Commercial and Residential respectively.

- The ratio of individual sales to total sales also works out to 33% and 67% for Commercial and Residential respectively.

- As such, sales ratio has been used for allocating common fixed expenses.

Sales ratio has been used to distribute common expenses

3:

Whether fixed common expenses should be allocated to segments

Answer to Problem 24P

Solution:

Fixed Common Expenses should not be allocated to segments

Explanation of Solution

- Given :

Intern has allocated common expenses on the basis of sales to both the segments

It is not advisable to allocate common fixed costs to segments for evaluating the segment's profitability. These costs would get incurred whether segment exists or not. As such, they make a segment look less profitable and hence should be excluded while evaluating segment wise profitability. However, while deciding whether to continue or drop a segment these costs need to be considered.

In view of reflecting true segment margin, fixed common expenses should not be allocated to segment.

4:

In contribution format, details are shown in the following sequence:

Sales, Total Variable cost, contribution margin, total fixed cost, Net operating Income

Segmented Income Statement in Contribution Format

Solution (a):

| Toxaway Company

Income statement (contribution format) | |||

| Total Company | Commercial | Residential | |

| Sales | $ 750,000 | $ 250,000 | $ 500,000 |

| Cost of Goods Sold | $ 500,000 | $ 140,000 | $ 360,000 |

| Variable selling and administrative expenses | $ 75,000 | $ 25,000 | $ 50,000 |

| Contribution Margin | $ 175,000 | $ 85,000 | $ 90,000 |

| Fixed Expenses | $ 165,000 | $ 79,000 | $ 86,000 |

| Net Operating Income | $ 10,000 | $ 6,000 | $ 4,000 |

Explanation of Solution

- Given:

Sales and Cost of Goods Sold are given in the question

Variable selling and administrative expenses and fixed expenses have been computed in above solutions

- Formula:

- Calculation:

Net Operating Income for Company is $ 10,000 and for Commercial and Residential segment is $ 6,000 and $ 4,000 respectively.

5:

Breakeven point is that level of sales at which the Company is at a No profit no loss situation. This means that the company is able to fully recover its variable cost and fixed cost but nothing above that.

Breakeven point in dollar Sales

Answer to Problem 24P

Solution:

- Break-even point in dollar Sales = $ 707,243

Explanation of Solution

- Break-even point is computed to calculate the minimum sales that must be achieved to arrive at a no profit no loss situation;

- Break-even point in unit salesis calculated by dividing the Fixed cost with contribution per unit Break-even point in dollar salesis calculated by dividing the Fixed cost with contribution Margin %

- Contribution Margin is the ratio of Contribution to Sale value.

- Given:

Fixed Cost has been computed as $ 165,000

Sales is given as $ 175,000

Contribution margin has been computed as $ 175,000

- Formula:

- Calculation:

Toxaway Company will have to make a minimum sale of $ 707,243 to be able to fully recover its variable as well as fixed cost.

6:

Breakeven point in dollar sales for Commercial and Residential division.

Answer to Problem 24P

Solution:

Break-even point in dollar Sales = Fixed Cost/ Contribution Margin %

| Commercial | Residential | |

| Fixed Cost (A) | $ 79,000 | $ 86,000 |

| Contribution Margin (B) | $ 85,000 | $ 90,000 |

| Sales (C) | $ 250,000 | $ 500,000 |

| Contribution Margin % (D = B / C) | 34% | 18% |

| Break even point (A / D) | $ 232,353 | $ 477,778 |

Explanation of Solution

- Given

Fixed cost has been computed in above solutions

Sales is given in the question

- Formula

- Calculation

Commercial will have to make a minimum sale of $ 232,353 to be able to fully recover its variable as well as fixed cost. Similarly, Residential will have to make a minimum sales of $ 477,778

7:

To determine: Break-even point in dollar sales:

Answer to Problem 24P

Solution:

| Commercial | Residential | |

| Sales (A) | 250,000 | 500,000 |

| Cost of Goods Sold (B) | 140,000 | 360,000 |

| Variable selling and administrative expenses (5% of sales) (C) | 12,500 | 25,000 |

| Contribution Margin (D = A-B-C) | 97,500 | 115,000 |

| Fixed Expenses (E) | 94,000 | 116,000 |

| Contribution Margin % (F = D / A) | 39% | 23% |

| Break even point (E / F) | 241,026 | 504,348 |

Explanation of Solution

- Given:

Additional fixed cost is given as $ 15,000 for Commercial and $ 30,000 for Residential.

Variable selling and administrative expenses have been given as 5% of Sales

Cost of Goods Sold is given as $ 140,000 and $ 360,000 for Commercial and Residential respectively

- Formula:

- Calculation:

New Break-even point of Commercial is $ 241,026; New Break-even point of Residential is $ 504,348

Want to see more full solutions like this?

Chapter 7 Solutions

Introduction To Managerial Accounting

- Dear tutor. I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardno aiWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forwardDon't use chatgpt Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understated i need help in this question quiarrow_forwardI need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forwardNo ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardDevelopment costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,