Concept explainers

Variable and Absorption Costing Unit Product Costs and Income Statements; Explanation of Difference in Net Operating Income L07—1, L07—2, L07—3

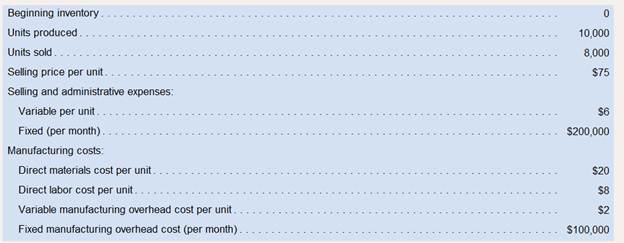

High Country, Inc., produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cotthat will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant’s operation:

Management is anxious to assess the profitability of the new camp cot during the month of May.

Management is anxious to assess the profitability of the new camp cot during the month of May.

Required:

Assume that the company uses absorption costing.

a. Determine the unit product cost.

b. Prepare an income statement for May.

Assume that the company uses variable costing.

a. Determine the unit product cost.

b. Prepare a contribution format income statement for May.

Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this differenceon reported net operating income.

Answer 1:

Absorption Costing: is also known as Full costing method. In this method, those costs which vary directly with production are considered in product cost. Also, fixed Manufacturing Expenses are treated as product cost only. Selling Expenses (since they do not vary with production), both variable and fixed, are charged off completely in the period in which the expenses get incurred.

Unit product Cost and Income statement for May.

Answer to Problem 20P

Solution:

| Computation of Unit Product Cost under Absorption Costing | |

| Particulars | Per unit cost |

| Direct Material | $ 20 |

| Direct Labour | $ 8 |

| Variable Manufacturing Overhead | $ 2 |

| Fixed Manufacturing Overhead | $ 27 |

| Total Product Cost | $ 57 |

| Income Statement under Absorption Costing | ||

| May | ||

| A | Sales(Sales Volume X Sales Price) | $ 600,000 |

| B | Less: Cost of Goods Sold | |

|

C | Beginning Inventory

Opening Inventory Quantity X Unit Product Cost of previous year | $ - |

| D | Add: Cost of Goods Manufactured

Production Quantity X Unit Product Cost | 570,000 |

| E | Less: Closing Inventory

Closing Inventory Quantity X Unit Product Cost of current year | $ 114,000 |

| B | Cost of Goods Sold (C+D-E) | $ 456,000 |

| F | Gross Margin (A - B) | $ 144,000 |

| G | Variable Selling & Admin Expenses

(Sales quantity X Variable selling cost per unit) | $ 48,000 |

| H | Fixed Selling Overhead | $ 130,000 |

| I | Net Operating Income (F - G - H) | $ (34,000) |

| Working Notes:

| ||

| May | Remarks | |

| Sales Volume | 8,000 | (as given in question) |

| Production Volume | 10,000 | (as given in question) |

| Opening Stock | - | (Closing Stock of previous period) |

| Closing Stock | 2,000 | (Opening Stock + Production - Sales) |

| Selling Price per unit | $ 75 | (as given in question) |

| Fixed Manufacturing Cost | $ 270,000 | |

| Fixed Manufacturing Cost per unit | $ 27 | (Fixed manufacturing cost / Production Qty) |

| Variable Selling Cost | $ 6 |

Explanation of Solution

- In absorption costing, direct material, direct labour, variable manufacturing expenses and fixed manufacturing cost per unit are considered for unit product cost;

- The income statement under this method requires following computations:

Cost of Goods Sold comprises of variable as well as fixed manufacturing cost

Total selling expenses comprise of variable as well as fixed selling cost

Given:

Sales volume, production volume and selling price per unit are given in the question.

Formulas:

Cost of Goods Sold:

Note: Unit product cost here is unit cost computed as per absorption costing.

Answer 2:

Variable Costing: is also known as Direct costing method. In this method, those costs which vary directly with production are considered in product cost. Fixed Manufacturing Expenses are treated as period cost and not product cost. Selling Expenses (since they do not vary with production), both variable and fixed, are charged off completely in the period in which the expenses get incurred.

Unit product Cost and Income statement May

Answer to Problem 20P

Solution:

| Computation of Unit Product Cost under Variable Costing | |

| Direct Material | $ 20 |

| Direct Labour | $ 8 |

| Variable Manufacturing Overhead | $ 2 |

| Total Product Cost | $ 30 |

| Income Statement under Variable Costing | ||

| May | ||

| A | Sales(Sales Volume X Sales Price) | 600,000 |

| B | Less: Cost of Goods Sold | |

| C | Beginning Inventory

Opening Inventory Quantity X Unit Product Cost of previous year | $ - |

| D | Add: Variable Manufacturing Cost

Production Quantity X Unit Product Cost | 300,000 |

| E | Less: Closing Inventory

Closing Inventory Quantity X Unit Product Cost of current year | $ 60,000 |

| B | Cost of Goods Sold (C+D-E) | $ 240,000 |

| F | Variable Selling & Admin Expenses(Sales quantity X Variable selling cost per unit) | $ 48,000 |

| G | Contribution Margin (A-B-F) | $ 312,000 |

| Sales Value - (Cost of Goods Sold + Variable selling expenses) | ||

| H | Fixed Manufacturing Overhead | $ 270,000 |

| I | Fixed Selling Overhead | $ 130,000 |

| J | Net Operating Income | $ (88,000) |

| Working Notes:

| ||

| May | Remarks | |

| Sales Volume | 8,000 | (as given in question) |

| Production Volume | 10,000 | (as given in question) |

| Opening Stock | - | (as given in question) |

| Closing Stock | 2,000 | (Opening Stock + Production - Sales) |

| Selling Price per unit | $75 | (as given in question) |

| Variable Selling Cost per unit | $6 |

Explanation of Solution

- In variable costing, direct material, direct labour and variable manufacturing expenses are considered for unit product cost;

- The income statement under this method requires following computations:

Variable cost comprises of variable cost of goods sold and variable selling expenses

Fixed cost comprises of fixed manufacturing cost and fixed selling cost

Given:

Sales volume, production volume, opening stock and selling price per unit are given in the question.

Formulas:

Variable Cost of Goods Sold:

Note: Unit product cost here is unit cost computed as per variable costing.

Answer 3

The difference between the ending inventory values under two costing methods would be on account of fixed cost element on inventory.

Under Variable costing, the inventory is valued at Unit product cost as per variable costing method which is direct material plus direct labour plus variable manufacturing expenses.

Whereas

Under Absorption costing, the inventory is valued at Unit product cost as per absorption costing method which is direct material plus direct labour plus variable manufacturing expenses plus fixed cost per unit.

Due to the inclusion of fixed cost in inventory in absorption costing, following is the impact:

- Opening inventory is higher resulting in decrease in profit

- Closing inventory is higher resulting in increase in profit

Reasons for differences in ending inventory

Explanation of Solution

| Ending inventory value under absorption costing | $ 114,000 |

| Ending inventory value under variable costing | $ 60,000 |

| Difference in inventory values | $ 54,000 |

| Closing Stock Quantity | 2,000 units |

| Fixed manufacturing cost per unit

(considered in unit product cost in absorption costing method) | $ 27 |

| Fixed manufacturing cost absorbed on closing stock

(2,000 units X $ 27 per unit) | 54,000 |

| Profit under absorption costing | $ (34,000) |

| Profit under variable costing | $ (88,000) |

| Difference | $ 54,000 |

As clear from above, the amount of Fixed manufacturing cost absorbed on closing stock is equal to the difference between inventory values under two costing methods.

Also, since closing stock is higher under absorption costing, as a result, loss is also less by

$ 54,000 as compared to variable costing.

Want to see more full solutions like this?

Chapter 7 Solutions

Introduction To Managerial Accounting

- Unearned revenue becomes revenue when:A. A sale is madeB. Cash is receivedC. The service is performedD. The revenue is recordedarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardIf total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forward

- Which of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College