Concept explainers

A multiple-choice exam has 100 questions. Each question has four choices, (a) What minimum score should be required to reduce the chance of passing by random guessing to 5 percent? (b) To 1 percent? (c) Find the

a.

Find the minimum score should be required to reduce the chance of passing by random guessing to 5%.

Answer to Problem 99CE

The minimum score should be required to reduce the chance of passing by random guessing to 5% is 32.12.

Explanation of Solution

Calculation:

It is given that a multiple-choice exam has 100 questions, with 4 options each.

Assume that the random variable X defines the number of correct answers by a student randomly guessing the answers. Consider choosing a correct answer as a success. Then, X has a binomial distribution.

Only 1 out of the 4 options is correct for each question. Thus, the probability of success is

Normal distribution:

A continuous random variable X is said to follow normal distribution if the probability density function of X is,

Binomial distribution:

A discrete random variable X is said to follow binomial distribution if the probability mass function is defined as,

It is known that, when

Here,

Hence,

As the conditions for approximation are satisfied, the normal approximation can be used.

The expected number of the random variable X is,

The standard deviation of the random variable X is,

The approximate normal probability that a student passes by random guessing is 5%.

Denote

Again, the probability

Variable value:

Software procedure:

Step-by-step software procedure to obtain variable value using EXCEL is as follows:

- • Open an EXCEL file.

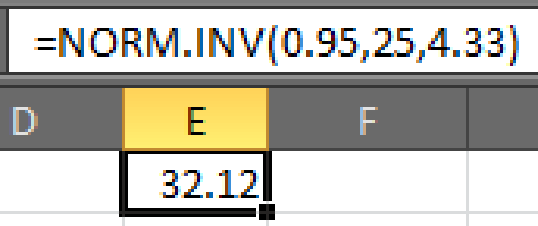

- • In cell E1, enter the formula “=NORM.INV(0.95,25,4.33)”.

- Output using EXCEL software is given below:

Hence,

Therefore,

Thus, the minimum score should be required to reduce the chance of passing by random guessing to 5% is 32.12.

b.

Find the minimum score should be required to reduce the chance of passing by random guessing to 1%.

Answer to Problem 99CE

The minimum score should be required to reduce the chance of passing by random guessing to 1% is 35.07.

Explanation of Solution

Calculation:

Denote

Again, the probability

Variable value:

Software procedure:

Step-by-step software procedure to obtain variable value using EXCEL is as follows:

- • Open an EXCEL file.

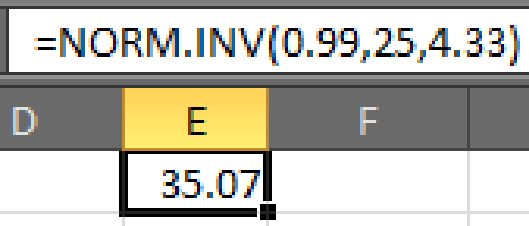

- • In cell E1, enter the formula “=NORM.INV(0.99,25,4.33)”.

- Output using EXCEL software is given below:

Hence,

Therefore,

Thus, the minimum score should be required to reduce the chance of passing by random guessing to 1% is 35.07.

c.

Find the quartiles for a student who guesses.

Answer to Problem 99CE

The first and third quartiles of scores for a student who guesses are respectively 22.08 and 27.92.

Explanation of Solution

Calculation:

The first quartile of a distribution is the value of the variable, below which, 25% of the observations lie. In other words, the probability that an observation lies below the first quartile is 0.25.

Denote

First quartile:

Software procedure:

Step-by-step software procedure to obtain the first quartile using EXCEL is as follows:

- • Open an EXCEL file.

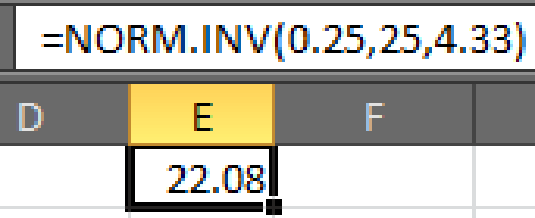

- • In cell E1, enter the formula “=NORM.INV(0.25,25,4.33)”.

- Output using EXCEL software is given below:

Here,

Hence,

The third quartile of a distribution is the value of the variable, below which, 75% of the observations lie. In other words, the probability that an observation lies below the third quartile is 0.75.

Denote

Third quartile:

Software procedure:

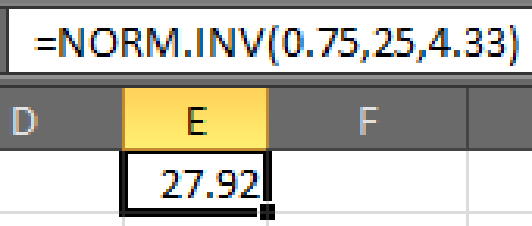

Step-by-step software procedure to obtain the third quartile using EXCEL is as follows:

- • Open an EXCEL file.

- • In cell E1, enter the formula “=NORM.INV(0.75,25,4.33)”.

- Output using EXCEL software is given below:

Here,

Hence,

Thus, the first and third quartiles of scores for a student who guesses are respectively 22.08 and 27.92.

Want to see more full solutions like this?

Chapter 7 Solutions

Applied Statistics in Business and Economics

- 1 No. 2 3 4 Binomial Prob. X n P Answer 5 6 4 7 8 9 10 12345678 8 3 4 2 2552 10 0.7 0.233 0.3 0.132 7 0.6 0.290 20 0.02 0.053 150 1000 0.15 0.035 8 7 10 0.7 0.383 11 9 3 5 0.3 0.132 12 10 4 7 0.6 0.290 13 Poisson Probability 14 X lambda Answer 18 4 19 20 21 22 23 9 15 16 17 3 1234567829 3 2 0.180 2 1.5 0.251 12 10 0.095 5 3 0.101 7 4 0.060 3 2 0.180 2 1.5 0.251 24 10 12 10 0.095arrow_forwardstep by step on Microssoft on how to put this in excel and the answers please Find binomial probability if: x = 8, n = 10, p = 0.7 x= 3, n=5, p = 0.3 x = 4, n=7, p = 0.6 Quality Control: A factory produces light bulbs with a 2% defect rate. If a random sample of 20 bulbs is tested, what is the probability that exactly 2 bulbs are defective? (hint: p=2% or 0.02; x =2, n=20; use the same logic for the following problems) Marketing Campaign: A marketing company sends out 1,000 promotional emails. The probability of any email being opened is 0.15. What is the probability that exactly 150 emails will be opened? (hint: total emails or n=1000, x =150) Customer Satisfaction: A survey shows that 70% of customers are satisfied with a new product. Out of 10 randomly selected customers, what is the probability that at least 8 are satisfied? (hint: One of the keyword in this question is “at least 8”, it is not “exactly 8”, the correct formula for this should be = 1- (binom.dist(7, 10, 0.7,…arrow_forwardKate, Luke, Mary and Nancy are sharing a cake. The cake had previously been divided into four slices (s1, s2, s3 and s4). What is an example of fair division of the cake S1 S2 S3 S4 Kate $4.00 $6.00 $6.00 $4.00 Luke $5.30 $5.00 $5.25 $5.45 Mary $4.25 $4.50 $3.50 $3.75 Nancy $6.00 $4.00 $4.00 $6.00arrow_forward

- Faye cuts the sandwich in two fair shares to her. What is the first half s1arrow_forwardQuestion 2. An American option on a stock has payoff given by F = f(St) when it is exercised at time t. We know that the function f is convex. A person claims that because of convexity, it is optimal to exercise at expiration T. Do you agree with them?arrow_forwardQuestion 4. We consider a CRR model with So == 5 and up and down factors u = 1.03 and d = 0.96. We consider the interest rate r = 4% (over one period). Is this a suitable CRR model? (Explain your answer.)arrow_forward

- Question 3. We want to price a put option with strike price K and expiration T. Two financial advisors estimate the parameters with two different statistical methods: they obtain the same return rate μ, the same volatility σ, but the first advisor has interest r₁ and the second advisor has interest rate r2 (r1>r2). They both use a CRR model with the same number of periods to price the option. Which advisor will get the larger price? (Explain your answer.)arrow_forwardQuestion 5. We consider a put option with strike price K and expiration T. This option is priced using a 1-period CRR model. We consider r > 0, and σ > 0 very large. What is the approximate price of the option? In other words, what is the limit of the price of the option as σ∞. (Briefly justify your answer.)arrow_forwardQuestion 6. You collect daily data for the stock of a company Z over the past 4 months (i.e. 80 days) and calculate the log-returns (yk)/(-1. You want to build a CRR model for the evolution of the stock. The expected value and standard deviation of the log-returns are y = 0.06 and Sy 0.1. The money market interest rate is r = 0.04. Determine the risk-neutral probability of the model.arrow_forward

- Several markets (Japan, Switzerland) introduced negative interest rates on their money market. In this problem, we will consider an annual interest rate r < 0. We consider a stock modeled by an N-period CRR model where each period is 1 year (At = 1) and the up and down factors are u and d. (a) We consider an American put option with strike price K and expiration T. Prove that if <0, the optimal strategy is to wait until expiration T to exercise.arrow_forwardWe consider an N-period CRR model where each period is 1 year (At = 1), the up factor is u = 0.1, the down factor is d = e−0.3 and r = 0. We remind you that in the CRR model, the stock price at time tn is modeled (under P) by Sta = So exp (μtn + σ√AtZn), where (Zn) is a simple symmetric random walk. (a) Find the parameters μ and σ for the CRR model described above. (b) Find P Ste So 55/50 € > 1). StN (c) Find lim P 804-N (d) Determine q. (You can use e- 1 x.) Ste (e) Find Q So (f) Find lim Q 004-N StN Soarrow_forwardIn this problem, we consider a 3-period stock market model with evolution given in Fig. 1 below. Each period corresponds to one year. The interest rate is r = 0%. 16 22 28 12 16 12 8 4 2 time Figure 1: Stock evolution for Problem 1. (a) A colleague notices that in the model above, a movement up-down leads to the same value as a movement down-up. He concludes that the model is a CRR model. Is your colleague correct? (Explain your answer.) (b) We consider a European put with strike price K = 10 and expiration T = 3 years. Find the price of this option at time 0. Provide the replicating portfolio for the first period. (c) In addition to the call above, we also consider a European call with strike price K = 10 and expiration T = 3 years. Which one has the highest price? (It is not necessary to provide the price of the call.) (d) We now assume a yearly interest rate r = 25%. We consider a Bermudan put option with strike price K = 10. It works like a standard put, but you can exercise it…arrow_forward

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning