Concept explainers

1.

To prepare: Sale budget of D Company.

1.

Explanation of Solution

Statement that shows the sales budget of D Company

| D Company | ||||

| Sales Budget | ||||

| Particulars | January ($) | February ($) | March ($) | Total ($) |

| Sales unit (A) | 7,000 | 9,000 | 11,000 | 27,000 |

| Selling price Per unit (B) | 55 | 55 | 55 | 55 |

| Total sales | 385,000 | 495,000 | 605,000 | 1,485,000 |

| Table (1) | ||||

2.

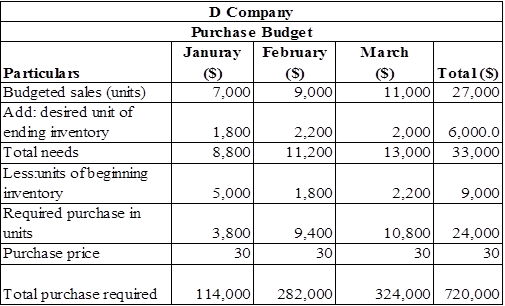

To prepare: Purchase budget of D Company.

2.

Explanation of Solution

Statement that shows the purchase budget of D Company

Table (2)

3.

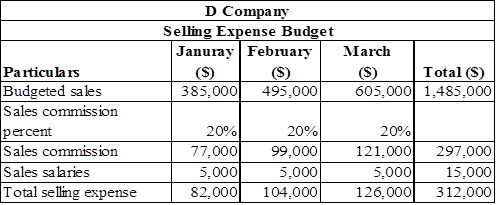

To prepare: Selling expense budget of D Company.

3.

Explanation of Solution

Statement that shows the selling expense budget of D Company,

Table (3)

4.

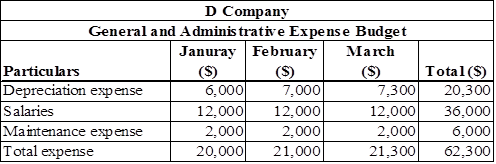

To prepare: General and administrative expense budget of D Company.

4.

Explanation of Solution

Statement that shows the General and administrative expense budget of D Company

Table (4)

Working notes:

Statement that shows the

| Particulars | January ($) | February ($) | March ($) | |

| Equipment in Beginning | 540,000 | 576,000 | 672,000 | |

| Add: Purchase of Equipment | 36,000 | 96,000 | 28,800 | |

| Less: equipment at the end | 576,000 | 672,000 | 700,800 | |

| Depreciation | 6,000 | 7,000 | 7,300 | |

| Table (5) | ||||

5.

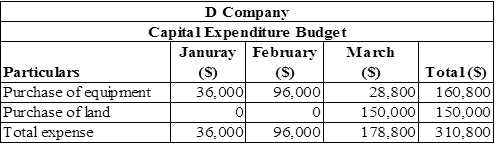

To prepare: Capital expenditure budget of D Company.

5.

Explanation of Solution

Statement that shows the capital expenditure budget of D Company

Table (6)

6.

To prepare:

6.

Explanation of Solution

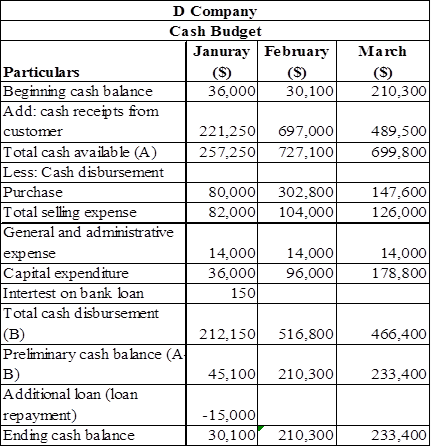

Statement that shows the Cash budget of D Company

Table (7)

Working notes:

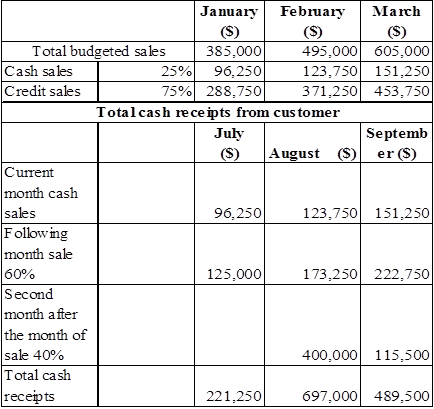

Calculation of expected cash collection

Table (8)

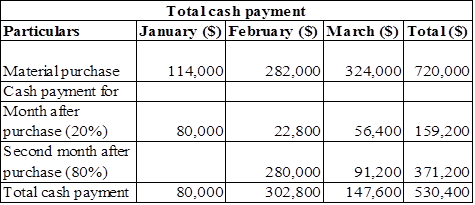

Calculation of cash payment from purchase,

Table (9)

7.

To prepare:

7.

Explanation of Solution

Prepare income statement.

| D Company | ||||

| Income Statement | ||||

| For three months ended March 31,2018 | ||||

| Particulars | Amount ($) | Amount ($) | ||

| Sales | 1,485,000 | |||

| Less: Cost of goods sold | 810,000 | |||

| Gross profit | 675,000 | |||

| Less: Operating expenses | ||||

| Total selling expense | 312,000 | |||

| General administrative salary | 62,300 | |||

| Interest on bank loan | 150 | |||

| Total operating expense | 374,450 | |||

| Earnings before taxes (A) | 300,550 | |||

| Less: Income tax | 120,220 | |||

| Net income | 180,330 | |||

| Table (10) | ||||

Thus, budgeted net income of D Company is $180,330.

8.

To prepare: Budgeted

8.

Explanation of Solution

Prepare balance sheet

| D Company | ||||

| Balance sheet | ||||

| For three months ended March 31,2018 | ||||

| Particulars | Amount ($) | |||

| Assets | ||||

| Cash | 233,400 | |||

| 602,250 | ||||

| Inventory | 60,000 | |||

| Total current assets | 895,650 | |||

| Equipment | 523,000 | |||

| Land | 150,000 | |||

| Net equipment | ||||

| Total Assets | 1,568,650 | |||

| Liabilities and | ||||

| Liabilities | ||||

| Accounts Payable | 549,600 | |||

| Income tax payable | 120,220 | |||

| Total liabilities | 669,820 | |||

| Stockholder’s Equity | ||||

| Common Stock | 472,500 | |||

| 426,330 | ||||

| Total stockholders’ equity | 898,830 | |||

| Total Liabilities and Stockholder’s equity | 1,568,650 | |||

| Table (11) | ||||

Working Notes:

Calculation of retained earnings,

Hence, the total of the balance sheet of the D Company as on March 31, 2018 is of $1,568,650.

Want to see more full solutions like this?

Chapter 7 Solutions

Managerial Accounting

- What is the ending inventory under variable costing for this general accounting question?arrow_forwardFusion Ltd. sold electronics on account for $72,000 and paid expenses totaling $30,000. What is Fusion's net income or net loss? a. Net income of $42,000 b. Net loss of $42,000 c. Net income of $72,000 d. Cannot determine from the data givenarrow_forwardHanover Corporation allocates the estimated $210,000 of its human resources department costs to its production and sales departments, since HR supports both in handling recruitment and employee benefits. The costs will be allocated based on the number of employees using the direct method. Information regarding costs and employees follows: • Human Resources Department: 5 employees Production Department: 32 employees Sales Department: 18 employees How much of the human resources department costs will be allocated to the production department?arrow_forward

- MOH Cost: Top Dog Company has a budget with sales of 7,500 units and $3,400,000. Variable costs are budgeted at $1,850,000, and fixed overhead is budgeted at $970,000.What is the budgeted manufacturing cost per unit?arrow_forwardPlease give me true answer this financial accounting questionarrow_forward4 POINTSarrow_forward

- For the year ended December 31, 2020, Greenhill Enterprises earned an ROI of 10.5%. Sales for the year were $18 million, and the average asset turnover was 2.5. Average stockholders' equity was $3.6 million. Required: a. Calculate Greenhill Enterprises' margin and net income. b. Calculate Greenhill Enterprises' return on equity.arrow_forwardDURING THE CURRENT YEAR, MERCHANDISE IS SOLD FOR $450,000 CASH AND $1,350,000 ON ACCOUNT. THE COST OF THE MERCHANDISE SOLD IS $1,100,000. WHAT IS THE AMOUNT OF THE GROSS PROFIT?arrow_forwardAt the beginning of 2021, Orion Ltd had accounts receivable of $100,000. At the end of 2021, the company had accounts receivable of $85,000. During 2021, Orion Ltd had total credit sales of $1,500,000. What was this company's average collection period for 2021?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education