Concept explainers

2.

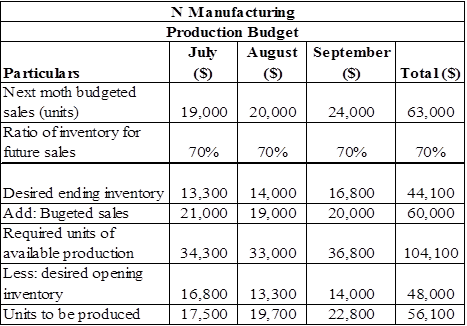

To prepare: Production budget of N manufacturing.

2.

Explanation of Solution

Statement that shows the Production budget of N manufacturing

Table (2)

3.

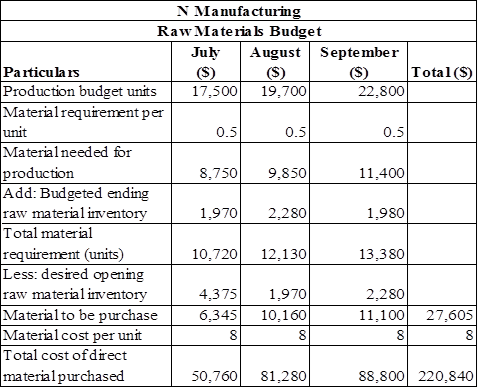

To prepare: Raw material budget of N manufacturing.

3.

Explanation of Solution

Statement that shows the raw material budget of N manufacturing

Table (3)

4.

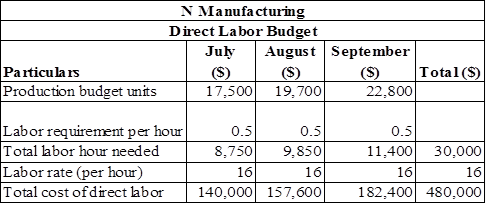

To prepare: Direct labor budget of N manufacturing.

4.

Explanation of Solution

Statement that shows the direct labor budget of N manufacturing

Table (4)

5.

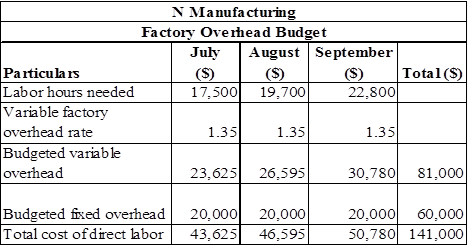

To prepare: Factory overhead budget of N manufacturing.

5.

Explanation of Solution

Statement that shows the factory overhead budget of N manufacturing

Table (5)

6.

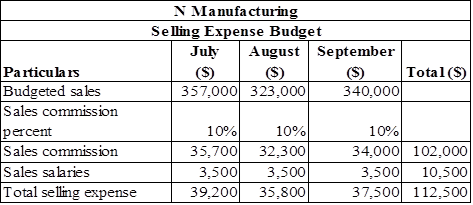

To prepare: Selling expense budget of N manufacturing.

6.

Explanation of Solution

Statement that shows the selling expense budget of N manufacturing

Table (6)

7.

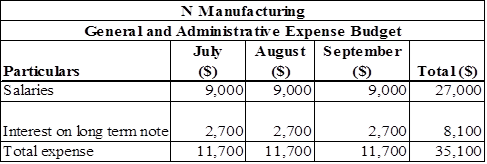

To prepare: General and administrative expense budget of N manufacturing.

7.

Explanation of Solution

Statement that shows the General and administrative expense budget of N manufacturing

Table (7)

8.

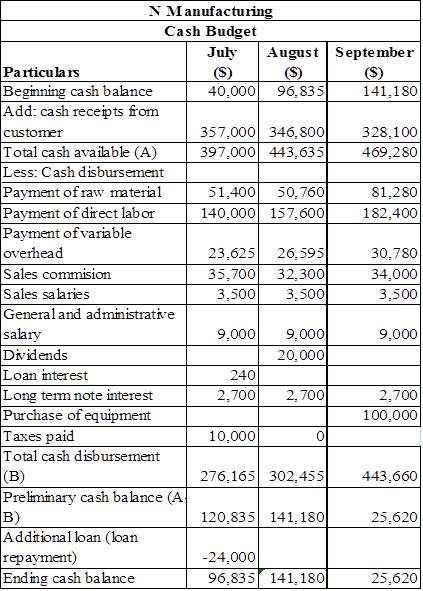

To prepare:

8.

Explanation of Solution

Statement that shows the Cash budget of N manufacturing

Table (8)

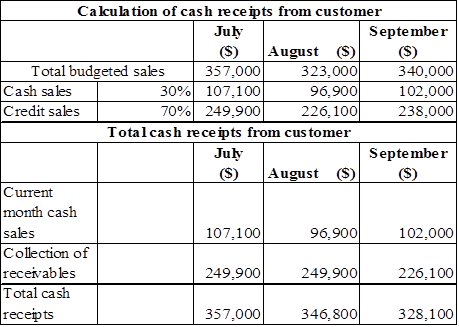

Working note:

Table (9)

9.

To prepare:

9.

Explanation of Solution

Prepare income statement.

| N. Manufacturing | ||||

| Income Statement | ||||

| For three months ended September 30,2017 | ||||

| Particulars | Amount ($) | Amount ($) | ||

| Sales | 1,020,000 | |||

| Less: Cost of goods sold | 861,000 | |||

| Gross profit | 159,000 | |||

| Less: Operating expenses | ||||

| Sales commission | 102,000 | |||

| Sales salaries | 10,500 | |||

| General administrative salary | 27,000 | |||

| Total operating expense | 139,500 | |||

| Earnings before interest and taxes | 19500 | |||

| Less: Interest on long term notes | 8100 | |||

| Interest on short term note | 240 | |||

| Earnings before taxes (A) | 11,160 | |||

| Less: Income tax | 3,906 | |||

| Net income | 7,254 | |||

| Table (10) | ||||

Thus, budgeted net income of N manufacturing is $7,254.

10.

To prepare: Budgeted

10.

Explanation of Solution

Prepare balance sheet

| N. Manufacturing | ||||

| Balance sheet | ||||

| For three months ended September 30,2017 | ||||

| Particulars | Amount ($) | |||

| Assets | ||||

| Cash | 40,000 | |||

| 238,000 | ||||

| Raw material inventory | 15,840 | |||

| Finished goods inventory | 241,080 | |||

| Total current assets | 534,920 | |||

| Equipment | 820,000 | |||

| Less: Accumulated | 300,000 | |||

| Net equipment | 520,000 | |||

| Total Assets | 1,054,920 | |||

| Liabilities and | ||||

| Liabilities | ||||

| Accounts Payable | 88,800 | |||

| Bank loan payable | 14,380 | |||

| Income tax payable | 3,906 | |||

| Total current liability | 107,086 | |||

| Long term note payables | 300,000 | |||

| Total liabilities | 407,086 | |||

| Stockholder’s Equity | ||||

| Common Stock | 600,000 | |||

| 47,834 | ||||

| Total stockholders’ equity | 647,834 | |||

| Total Liabilities and Stockholder’s equity | 1,054,920 | |||

| Table (11) | ||||

Working note:

Calculation of retained earnings,

Hence, the total of the balance sheet of the N Manufacturing as on September 30, 2017 is of $1,054,920.

Want to see more full solutions like this?

Chapter 7 Solutions

Managerial Accounting

- How much fixed manufacturing overhead will be expended during the year using full costing ?arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardPlease explain how to solve this financial accounting question with valid financial principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education