Concept explainers

Flexible budget, direct materials, and direct manufacturing labor variances. Emerald Statuary manufactures bust statues of famous historical figures. All statues are the same size. Each unit requires the same amount of resources. The following information is from the static budget for 2017:

| Expected production and sales | 7,000 units |

| Expected selling price per unit | $ 680 |

| Total fixed costs | $1,400,000 |

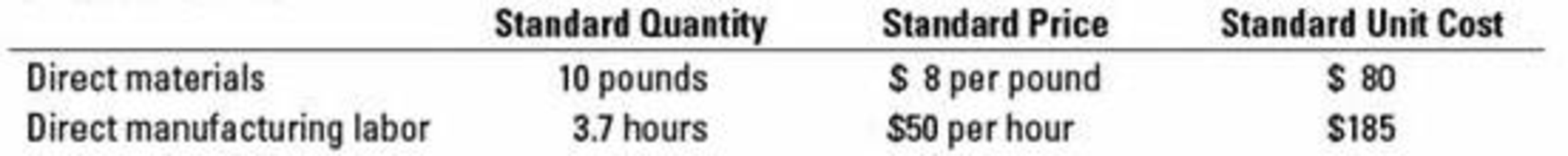

Standard quantities, standard prices, and standard unit costs follow for direct materials and direct manufacturing labor:

During 2017, actual number of units produced and sold was 4,800, at an average selling price of $720. Actual cost of direct materials used was $392,700, based on 66,000 pounds purchased at $5.95 per pound. Direct manufacturing labor-hours actually used were 18,300, at the rate of $48 per hour. As a result, actual direct

- 1. Calculate the sales-volume variance and flexible-

budget variance for operating income.

Required

- 2. Compute price and efficiency variances for direct materials and direct manufacturing labor.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

EBK HORNGREN'S COST ACCOUNTING

Additional Business Textbook Solutions

MARKETING:REAL PEOPLE,REAL CHOICES

Horngren's Accounting (12th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Intermediate Accounting (2nd Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- What is the firm's price earnings ratio?arrow_forwardBartletts Pears has a profit margin of 8.20 percent on sales of $24,300,000. If the firm has a debt of $10,400,000 and total assets of $21,000,000, what is the firm's ROA? Find out solution for this accounting questionarrow_forwardDiscuss the accounting treatment for business combinations.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,