Managerial Accounting: Tools for Business Decision Making

7th Edition

ISBN: 9781118334331

Author: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 7.1DI

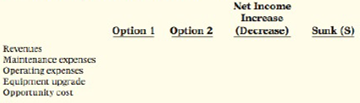

Nathan T Corporation is comparing two different options. Nathan T currently uses Option 1, with revenues of $65,000 per year, maintenance expenses of $5,000 per year, and operating expenses of $26,000 per year. Option 2 provides revenues of $60,000 per year, maintenance expenses of $5,000 per year, and operating expenses of $22,000 per year. Option 1 employs a piece of equipment which was upgraded 2 years ago at a cost of $17,000. If Option 2 is chosen, it will free up resources that will bring in an additional $4,000 of revenue. Complete the following table to show the change in income from choosing Option 2 versus Option 1. Designate Sunk costs with an “S.”

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the coupon rate of this financial accounting question?

Need true answer general Accounting

Need answer

Chapter 7 Solutions

Managerial Accounting: Tools for Business Decision Making

Ch. 7 - What steps are frequently involved in managements...Ch. 7 - Prob. 2QCh. 7 - Incremental analysis involves the accumulation of...Ch. 7 - Sydney Greene asks for your help concerning the...Ch. 7 - What data are relevant in deciding whether to...Ch. 7 - Prob. 6QCh. 7 - Prob. 7QCh. 7 - Prob. 8QCh. 7 - What are joint products? What accounting issue...Ch. 7 - Prob. 10Q

Ch. 7 - Your roommate. Gale Dunham, is confused about sunk...Ch. 7 - Prob. 12QCh. 7 - The steps in managements decision-making process...Ch. 7 - Determine incremental changes. (LO 1), AP Bogart...Ch. 7 - At Bargain Electronics, it costs 30 per unit (20...Ch. 7 - Prob. 7.4BECh. 7 - Prob. 7.5BECh. 7 - Prob. 7.6BECh. 7 - Prob. 7.7BECh. 7 - Lisah, Inc., manufactures golf clubs in three...Ch. 7 - Nathan T Corporation is comparing two different...Ch. 7 - Prob. 7.2DICh. 7 - Wilma Company must decide whether to make or buy...Ch. 7 - Prob. 7.4DICh. 7 - Prob. 7.5DICh. 7 - Prob. 7.6DICh. 7 - As a study aid. your classmate Pascal Adams has...Ch. 7 - Use incremental analysis for special-order...Ch. 7 - Moonbeam Company manufactures toasters. For the...Ch. 7 - Prob. 7.4ECh. 7 - Prob. 7.5ECh. 7 - Use incremental analysis for make-or-buy decision....Ch. 7 - Prob. 7.7ECh. 7 - Prepare incremental analysis concerning...Ch. 7 - Anna Garden recently opened her own basketweaving...Ch. 7 - Stahl Inc. produces three separate products from a...Ch. 7 - Kirk Minerals processes materials extracted from...Ch. 7 - Prob. 7.12ECh. 7 - On January 2, 2016, Twilight Hospital purchased a...Ch. 7 - Use incremental analysis for retaining or...Ch. 7 - Veronica Mars, a recent graduate of Bells...Ch. 7 - Cawley Company makes three models of lasers....Ch. 7 - Tharp Company operates a small factory in which it...Ch. 7 - Identify relevant costs for different decisions....Ch. 7 - ThreePoint Sports Inc. manufactures basketballs...Ch. 7 - Use incremental analysis related to make or buy....Ch. 7 - Prob. 7.3APCh. 7 - Compute gain or loss, and determine if equipment...Ch. 7 - Brislin Company has four operating divisions....Ch. 7 - CURRENT DESIGNS Current Designs faces a number of...Ch. 7 - Decision-Making Across the Organization Aurora...Ch. 7 - MiniTek manufactures private-label small...Ch. 7 - Prob. 7.3BYPCh. 7 - Communication Activity Hank Jewell is a production...Ch. 7 - Prob. 7.6BYPCh. 7 - Prob. 7.7BYPCh. 7 - Considering Your Costs and Benefits School costs...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1 of the current year (Year 1), CVX acquired a delivery van for $68,000. The estimated useful life of the van is 6 years or 120,000 miles. The residual value at the end of 6 years is estimated to be $8,000. The actual mileage for the van was 19,000 miles in Year 1 and 25,000 miles in Year 2. What is the depreciation expense for the second year of use (Year 2) if CVX uses the units of production method? Provide answerarrow_forwardDon't use ai given answer accounting questionsarrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License