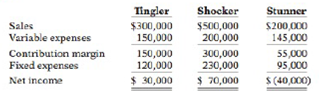

Cawley Company makes three models of lasers. Information on the three products is given below.

Fixed expenses consist of $300,000 of common costs allocated to the three products based on relative sales, and additional fixed expenses of $30,000 (Tingler), $80,000 (Shocker), and $35,000 (Stunner). The common costs will be incurred regardless of how many models arc produced. The other fixed expenses would be eliminated if a model is phased out.

James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company’s net income.

Instructions

(a) Compute current net income for Cawley Company.

(b) Compute net income by product line and in total for Cawley Company if the company discontinues the Stunner product line. (Hint: Allocate the $300,000 common costs to the two remaining product lines based on their relative sales.)

(c) Should Cawley eliminate the Stunner product line? Why or why not?

Use incremental analysis for elimination of a product line.

(LO 6), AN

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Managerial Accounting: Tools for Business Decision Making

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education