GEN COMBO LL FUNDAMENTALS OF FINANCIAL ACCOUNTING; CONNECT ACCESS CARD

6th Edition

ISBN: 9781260260083

Author: Fred Phillips Associate Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 5PB

(Supplement 7B) Analyzing and Interpreting the Effects of Inventory Errors

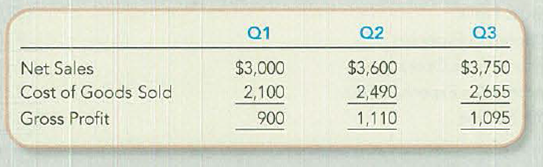

Spears & Cantrell announced inventory had been overstated by $30 at the end of its second quarter. The error wasn’t discovered and corrected in the company’s periodic inventory system until after the end of the third quarter. The following table shows the amounts that were originally reported by the company.

Required:

- 1. Restate the income statements to reflect the correct amounts, after fixing the inventory error.

- 2. Compute the gross profit percentage for each quarter (a) before the correction and (b) after the correction, rounding to the nearest percentage. Do the results lend confidence to your corrected amounts? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide Accurate Answer of this Financial Accounting Question

Need General Accounting Question Solution

Ivanhoe Equipment Company sells computers for $1,620 each and also gives each customer a 2-year warranty that requires the

company to perform periodic services and to replace defective parts. In 2025, the company sold 860 computers on account. Based on

experience, the company has estimated the total 2-year warranty costs as $40 for parts and $60 for labor per unit. (Assume sales all

occur at December 31, 2025.)

In 2026, Ivanhoe incurred actual warranty costs relative to 2025 computer sales of $13,200 for parts and $19,800 for labor.

What balance will be reported as a current liability in the 2025 balance sheet with regard to these transactions?

Current Liabilities-

eTextbook and Media

List of Accounts

Assistance Used

Chapter 7 Solutions

GEN COMBO LL FUNDAMENTALS OF FINANCIAL ACCOUNTING; CONNECT ACCESS CARD

Ch. 7 - What are three goals of inventory management?Ch. 7 - Describe the specific types of inventory reported...Ch. 7 - The chapter discussed four inventory costing...Ch. 7 - Which inventory cost flow method is most similar...Ch. 7 - Where possible, the inventory costing method...Ch. 7 - Contrast the effects of LIFO versus FIFO on ending...Ch. 7 - Contrast the income statement effect of LIFO...Ch. 7 - Several managers in your company are experiencing...Ch. 7 - Explain briefly the application of the LCM rule to...Ch. 7 - Prob. 10Q

Ch. 7 - You work for a made-to-order clothing company,...Ch. 7 - Prob. 12QCh. 7 - (Supplement 7B) Explain why an error in ending...Ch. 7 - Which of the following statements are true...Ch. 7 - The inventory costing method selected by a company...Ch. 7 - Which of the following is not a name for a...Ch. 7 - Which of the following correctly expresses the...Ch. 7 - A New York bridal dress designer that makes...Ch. 7 - If costs are rising, which of the following will...Ch. 7 - Which inventory method provides a better matching...Ch. 7 - Which of the following regarding the lower of cost...Ch. 7 - An increasing inventory turnover ratio a....Ch. 7 - In which of the following situations is an LCM/NRV...Ch. 7 - Matching Inventory Items to Type of Business Match...Ch. 7 - Reporting Goods in Transit Abercrombie Fitch Co....Ch. 7 - Prob. 3MECh. 7 - Reporting Inventory-Related Accounts in the...Ch. 7 - Matching Financial Statement Effects to Inventory...Ch. 7 - Matching Inventory Costing Method Choices to...Ch. 7 - Calculating Cost of Goods Available for Sale,...Ch. 7 - Calculating Cost of Goods Available for Sale,...Ch. 7 - Calculating Cost of Goods Available for Sale,...Ch. 7 - Prob. 10MECh. 7 - Calculating Cost of Goods Available for Sale, Cost...Ch. 7 - Calculating Cost of Goods Available for Sale, Cost...Ch. 7 - Calculating Cost of Goods Available for Sale, Cost...Ch. 7 - Reporting Inventory under Lower of Cost or...Ch. 7 - Preparing the Journal Entry to Record Lower of...Ch. 7 - Determining the Effects of Inventory Management...Ch. 7 - Interpreting LCM Financial Statement Note...Ch. 7 - Calculating the Inventory Turnover Ratio and Days...Ch. 7 - Prob. 19MECh. 7 - Prob. 20MECh. 7 - Prob. 21MECh. 7 - (Supplement 7A) Calculating Cost of Goods Sold and...Ch. 7 - (Supplement 7B) Determining the Financial...Ch. 7 - Prob. 24MECh. 7 - Reporting Goods in Transit and Consignment...Ch. 7 - Determining the Correct Inventory Balance Seemore...Ch. 7 - Determining the Correct Inventory Balance Seemore...Ch. 7 - Calculating Cost of Ending Inventory and Cost of...Ch. 7 - Calculating Cost of Ending Inventory and Cost of...Ch. 7 - Prob. 6ECh. 7 - Analyzing and Interpreting the Financial Statement...Ch. 7 - Evaluating the Effects of Inventory Methods on...Ch. 7 - Choosing LIFO versus FIFO When Costs Are Rising...Ch. 7 - Using FIFO for Multiproduct Inventory Transactions...Ch. 7 - Reporting Inventory at Lower of Cost or Market/Net...Ch. 7 - Reporting Inventory at Lower of Cost or Market/Net...Ch. 7 - Analyzing and Interpreting the Inventory Turnover...Ch. 7 - Analyzing and Interpreting the Effects of the...Ch. 7 - Prob. 15ECh. 7 - Analyzing and Interpreting the Financial Statement...Ch. 7 - Prob. 17ECh. 7 - Analyzing the Effects of Four Alternative...Ch. 7 - Evaluating the Income Statement and Income Tax...Ch. 7 - Calculating and Interpreting the Inventory...Ch. 7 - Prob. 4CPCh. 7 - (Supplement 7B) Analyzing and Interpreting the...Ch. 7 - Analyzing the Effects of Four Alternative...Ch. 7 - Evaluating the Income Statement and Income Tax...Ch. 7 - Prob. 3PACh. 7 - Prob. 4PACh. 7 - (Supplement 7B) Analyzing and Interpreting the...Ch. 7 - Prob. 1PBCh. 7 - Prob. 2PBCh. 7 - Prob. 3PBCh. 7 - Prob. 4PBCh. 7 - (Supplement 7B) Analyzing and Interpreting the...Ch. 7 - Prob. 1COPCh. 7 - (Supplement 7A) Recording Inventory Transactions,...Ch. 7 - (Supplement 7A) Recording Inventory Purchases,...Ch. 7 - (Supplement 7A) Recording Inventory Purchases,...Ch. 7 - Prob. 5COPCh. 7 - Prob. 6COPCh. 7 - Prob. 7COPCh. 7 - Prob. 8COPCh. 7 - Prob. 9COPCh. 7 - Prob. 10COPCh. 7 - Prob. 11COPCh. 7 - Prob. 12COPCh. 7 - Prob. 1SDCCh. 7 - Prob. 2SDCCh. 7 - Critical Thinking: Income Manipulation under the...Ch. 7 - Accounting for Changing Inventory Costs In...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help ! Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forwardFinancial Accounting 3.1arrow_forwardWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditneed helparrow_forward

- General Accounting Question 2.5arrow_forwardI will report your answer to Coursehero using chatgpt they block your account and will not give your payment!!! so don't answer with chatgpt. The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forwardWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forward

- I need help The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forwardHi This Question is Simple I want Answer step by step of this Financial Accountingarrow_forwardNeed help The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License