INTERM.ACCT.:REPORTING...-CENGAGENOWV2

3rd Edition

ISBN: 9781337709354

Author: WAHLEN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 5E

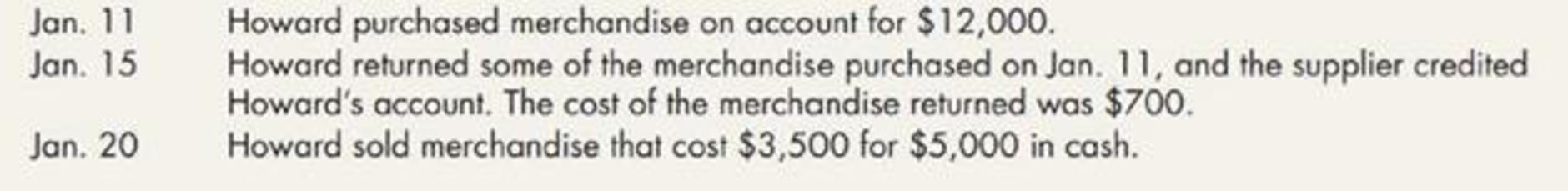

Perpetual versus Periodic Inventory Systems Howard, Inc. is a merchandising company that began operations on January 1, 2019. During January, the following inventory transactions occurred:

Required:

- 1. Assume that Howard uses a perpetual inventory system. Prepare the

journal entries to record the January inventory transactions. - 2. Assume that Howard uses a periodic inventory system. Prepare the journal entries to record the January inventory transactions. Be sure to include any

adjusting entries necessary. - 3. Next Level Howard’s CEO states that a perpetual inventory system would result in a better

inventory valuation . Evaluate this statement and provide a discussion of the benefits of each type of inventory system.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

hi expert please help me

Profit margin??

Chapter 18 Homework

8

1

points

QS 18-4 (Algo) Measuring costs using high-low method LO P1

The following information is available for a company's maintenance cost over the last seven months.

Month

June

July

Units Produced

190

eBook

110

140

200

230

August

September

October

November

December

Maintenance Cost

$ 3,950

5,390

4,110

5,558

6,038

3,150

Using the high-low method, estimate both the fixed and variable components of its maintenance cost.

Print

References

High-Low method - Calculation of variable cost per unit produced

Cost at highest volume - Cost at lowest volume

Highest volume - Lowest volume

Total cost at the highest volume

Variable costs at highest volume

Highest volume

Variable cost per unit produced

Total variable costs at highest volume

Total fixed costs

Total cost at the lowest volume

Variable costs at lowest volume:

Lowest volume

Variable cost per unit produced

Total variable costs at lowest volume

Total fixed costs

Mc

Graw

Hill

Help

Save & Exit

Submit

Check my work

Chapter 7 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

Ch. 7 - Distinguish among the types of inventory accounts...Ch. 7 - Prob. 2GICh. 7 - Describe the flow of costs for o merchandising...Ch. 7 - Describe the relationship between cost of goods...Ch. 7 - Prob. 5GICh. 7 - Does the use of a perpetual system eliminate the...Ch. 7 - What is the general rule used to determine if a...Ch. 7 - For goods in transit at the end of a period,...Ch. 7 - Prob. 9GICh. 7 - Prob. 10GI

Ch. 7 - Prob. 11GICh. 7 - Consider each of the following independent...Ch. 7 - Prob. 13GICh. 7 - Prob. 14GICh. 7 - Prob. 15GICh. 7 - Prob. 16GICh. 7 - Prob. 17GICh. 7 - Prob. 18GICh. 7 - Prob. 19GICh. 7 - Prob. 20GICh. 7 - Discuss the LIFO and FIFO cost flow assumptions...Ch. 7 - Prob. 22GICh. 7 - Prob. 23GICh. 7 - List the acceptable cost flow assumptions under...Ch. 7 - Prob. 25GICh. 7 - Explain the dollar-value LIFO method of inventory...Ch. 7 - Describe the double-extension and link-chain...Ch. 7 - Prob. 28GICh. 7 - Prob. 29GICh. 7 - What is the impact of LIFO inventory liquidation...Ch. 7 - Goods on consignment should be included in the...Ch. 7 - The following items were included in Venicio...Ch. 7 - During 2019, R Corp., a manufacturer of chocolate...Ch. 7 - Dixon Menswear Shop purchased shirts from Colt...Ch. 7 - The moving average inventory cost flow assumption...Ch. 7 - The cost of the inventory on January 31, 2019,...Ch. 7 - Questions M7-6 and M7-7 are based on the following...Ch. 7 - Assuming no beginning inventory, what can be said...Ch. 7 - On December 31, 2018, Kern Company adopted the...Ch. 7 - When the double-extension approach to the...Ch. 7 - On December 31, Pitts Manufacturing Company...Ch. 7 - On January 1, Pope Enterprises inventory was...Ch. 7 - Reid Company uses the periodic inventory system....Ch. 7 - Billings Company uses a periodic inventory system....Ch. 7 - Dani Corporation signed a binding commitment on...Ch. 7 - Stevens Company uses a perpetual inventory system....Ch. 7 - RE7-6 Stevens Company uses a perpetual inventory...Ch. 7 - Johnson Company uses a perpetual inventory system....Ch. 7 - RE7-8 Johnson Company uses a perpetual inventory...Ch. 7 - Jessie Stores uses the periodic system of...Ch. 7 - Jessie Stores uses the periodic system of...Ch. 7 - Carla Company uses the perpetual inventory system....Ch. 7 - Carla Company uses the perpetual inventory system....Ch. 7 - On January 1 of Year 1, Dorso Company adopted the...Ch. 7 - An evaluation of Bryces Bookstores inventory was...Ch. 7 - Inventory Accounts for a Manufacturing Company...Ch. 7 - Prob. 2ECh. 7 - Perpetual versus Periodic Inventory Systems Graham...Ch. 7 - Determining Net Purchases The following amounts...Ch. 7 - Perpetual versus Periodic Inventory Systems...Ch. 7 - Goods in Transit Gravais Company made two...Ch. 7 - Items Included in Inventory The following are...Ch. 7 - Prob. 8ECh. 7 - Prob. 9ECh. 7 - Discounts Nelson Company bought inventory for...Ch. 7 - Alternative Inventory Methods Nevens Company uses...Ch. 7 - Alternative Inventory Methods Park Companys...Ch. 7 - Alternative Inventory Methods Frate Company was...Ch. 7 - LIFO, Perpetual and Periodic Riedel Companys...Ch. 7 - Habicht Company was formed in 2018 to produce a...Ch. 7 - Dollar-Value LIFO A company adopted the LIFO...Ch. 7 - On January 1, 2018, Sato Company adopted the...Ch. 7 - Dollar-Value LIFO Beistock Company manufactures...Ch. 7 - Acute Company manufactures a single product. On...Ch. 7 - Inventory Pools Stone Shoe Company adopted...Ch. 7 - Grimstad Company uses FIFO for internal reporting...Ch. 7 - LIFO and Interim Financial Reports Assume prices...Ch. 7 - Applying the Cost of Goods Sold Model The...Ch. 7 - Items to Be Included in Inventory As the auditor...Ch. 7 - Valuation of Inventory The inventory on hand at...Ch. 7 - Prob. 4PCh. 7 - Cost of Goods Sold As an accountant for Lee...Ch. 7 - Alternative Inventory Methods Garrett Company has...Ch. 7 - Totman Company has the following transactions...Ch. 7 - Comprehensive The following information for 2019...Ch. 7 - LIFO Liquidation Profit Hammond Company adopted...Ch. 7 - LIFO and Inventory Pools On January 1, 2016,...Ch. 7 - Olson Company adopted the dollar-value LIFO method...Ch. 7 - Dollar-Value LIFO Kwestel Company adopted the...Ch. 7 - Webster Company adopted do liar-value LIFO on...Ch. 7 - Dollar-Value LIFOComprehensive Kelly Company...Ch. 7 - On January 1, 2019, Lucas Distributors Inc....Ch. 7 - Inventory Valuation You are engaged in an audit of...Ch. 7 - Allen Company is a wholesale distributor of...Ch. 7 - FIFO and LIFO A company may compute inventory...Ch. 7 - Prob. 2CCh. 7 - In January, Broome Inc. requested and secured...Ch. 7 - Prob. 4CCh. 7 - Prob. 5CCh. 7 - Interpretation of GAAP and Ethical Issues Robin...Ch. 7 - Selection of an Inventory Method and Ethical...Ch. 7 - Analyzing Starbuckss Inventory Disclosures Obtain...Ch. 7 - Fenimore Manufacturing Company uses the average...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the gross profit rate ?arrow_forwardWhitney received $75,200 of taxable income in 2024. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations. She is married but files a separate tax return. Her taxable income is $75,200. What is her income tax liability?arrow_forwardLacy is a single taxpayer. In 2024, her taxable income is $56,000. What is her tax liability in each of the following alternative situations.Her $56,000 of taxable income includes $10,000 of qualified dividends. What is her tax liability?arrow_forward

- Please help me with part B of this problem. I am having trouble. Fill all necessary cells as shown. I have provided the dropdown that includes the accounts.arrow_forwardWhat is a good response to this post? My chosen product is an ergonomic pet bed similar to a large bean bag called a Pooch Poof. And my proposed markets are the United States, as it currently has the largest share of pet product sales, Europe as the pet population is 324.4 million currently, and South America, as this country is expected to be one of the fastest growing markets for pet accessories and food (Shahbandeh, 2024). With my product in two stable markets, and one emerging market, financial risks will be minimized as much as possible when expanding into the emerging market of South America by the stability of the American and European markets that are established. My slogan will be “Pamper your pooch with softness and watch your worries about your pup’s good night sleep go “Poof”. A “poofed” pet is a proper pet!” This slogan works as in the United States and Europe, dogs are generally considered family members, and allowed in public spaces, and socialization, training, health…arrow_forwardWhat is its debt to equity ratio for WACC purposes?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY