Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 59P

Cost-Volume-Profit, Margin of Safety

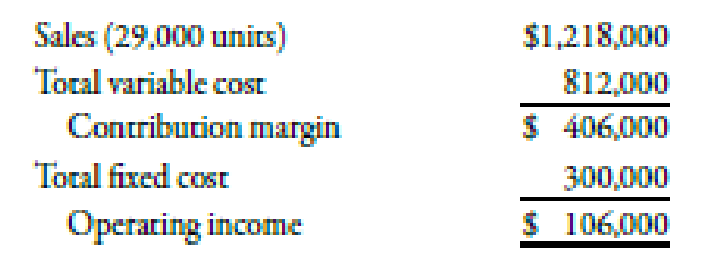

Victoria Company produces a single product. Last year’s income statement is as follows:

Required:

- 1. Compute the break-even point in units and sales dollars calculated using the break-even units.

- 2. What was the margin of safety for Victoria last year in sales dollars?

- 3. Suppose that Victoria is considering an investment in new technology that will increase fixed cost by $250,000 per year but will lower variable costs to 45% of sales. Units sold will remain unchanged. Prepare a

budgeted income statement assuming that Victoria makes this investment. What is the new break-even point in sales dollars, assuming that the investment is made?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Cost Account

Help me general account tutor

None

Chapter 7 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 7 - Prob. 1DQCh. 7 - Describe the difference between the units sold...Ch. 7 - Define the term break-even point.Ch. 7 - Prob. 4DQCh. 7 - What is the variable cost ratio? The contribution...Ch. 7 - Prob. 6DQCh. 7 - Define the term sales mix. Give an example to...Ch. 7 - Explain how CVP analysis developed for single...Ch. 7 - Prob. 9DQCh. 7 - How does targeted profit enter into the break-even...

Ch. 7 - Explain how a change in sales mix can change a...Ch. 7 - Define the term margin of safety. Explain how it...Ch. 7 - Explain what is meant by the term operating...Ch. 7 - How can sensitivity analysis be used in...Ch. 7 - Why is a declining margin of safety over a period...Ch. 7 - If the variable cost per unit goes down,Ch. 7 - The amount of revenue required to earn a targeted...Ch. 7 - Prob. 3MCQCh. 7 - Prob. 4MCQCh. 7 - An important assumption of cost-volume-profit...Ch. 7 - The use of fixed costs to extract higher...Ch. 7 - Prob. 7MCQCh. 7 - The contribution margin is the a. amount by which...Ch. 7 - Dartmouth Company produces a single product with a...Ch. 7 - Dartmouth Company produces a single product with a...Ch. 7 - If a companys total fixed cost decreases by...Ch. 7 - Prob. 12MCQCh. 7 - Variable Cost, Fixed Cost, Contribution Margin...Ch. 7 - Prob. 14BEACh. 7 - Variable Cost Ratio, Contribution Margin Ratio...Ch. 7 - Prob. 16BEACh. 7 - Units to Earn Target Income Head-First Company...Ch. 7 - Sales Needed to Earn Target Income Head-First...Ch. 7 - Break-Even Point in Units for a Multiple-Product...Ch. 7 - Prob. 20BEACh. 7 - Margin of Safety Head-First Company plans to sell...Ch. 7 - Degree of Operating Leverage Head-First Company...Ch. 7 - Impact of Increased Sales on Operating Income...Ch. 7 - Variable Cost, Fixed Cost, Contribution Margin...Ch. 7 - Prob. 25BEBCh. 7 - Variable Cost Ratio, Contribution Margin Ratio...Ch. 7 - Prob. 27BEBCh. 7 - Units to Earn Target Income Chillmax Company plans...Ch. 7 - Sales Needed to Earn Target Income Chillmax...Ch. 7 - Prob. 30BEBCh. 7 - Prob. 31BEBCh. 7 - Margin of Safety Chillmax Company plans to sell...Ch. 7 - Prob. 33BEBCh. 7 - Impact of Increased Sales on Operating Income...Ch. 7 - Basic Break-Even Calculations Suppose that Larimer...Ch. 7 - Price, Variable Cost per Unit, Contribution...Ch. 7 - Contribution Margin Ratio, Variable Cost Ratio,...Ch. 7 - Prob. 38ECh. 7 - Prob. 39ECh. 7 - Margin of Safety Comer Company produces and sells...Ch. 7 - Prob. 41ECh. 7 - Sales Revenue Approach, Variable Cost Ratio,...Ch. 7 - Prob. 43ECh. 7 - Cherry Blossom Products Inc. produces and sells...Ch. 7 - Prob. 45ECh. 7 - Lotts Company produces and sells one product. The...Ch. 7 - Klamath Company produces a single product. The...Ch. 7 - Margin of Safety and Operating Leverage Medina...Ch. 7 - Parker Pottery produces a line of vases and a line...Ch. 7 - Jellico Inc.s projected operating income (based on...Ch. 7 - Break-Even Units, Contribution Margin Ratio,...Ch. 7 - Prob. 52PCh. 7 - Aldovar Company produces a variety of chemicals....Ch. 7 - Basu Company produces two types of sleds for...Ch. 7 - Cost-Volume-Profit Equation, Basic Concepts,...Ch. 7 - Contribution Margin Ratio, Break-Even Sales,...Ch. 7 - Prob. 57PCh. 7 - Polaris Inc. manufactures two types of metal...Ch. 7 - Cost-Volume-Profit, Margin of Safety Victoria...Ch. 7 - Abraham Company had revenues of 830,000 last year...Ch. 7 - Prob. 61PCh. 7 - Prob. 62PCh. 7 - Prob. 63PCh. 7 - Suppose that Kicker had the following sales and...Ch. 7 - Danna Lumus, the marketing manager for a division...Ch. 7 - Cost-Volume-Profit Analysis, Single-Product...Ch. 7 - Cost-Volume-Profit Analysis, Single-Product...Ch. 7 - Prob. 3MTCCh. 7 - Prob. 4MTCCh. 7 - Sensitivity Cost-Volume-Profit Analysis and...Ch. 7 - Calculate the hotels margin of safety (both in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On November 1, 20Y9, Lexi Martin established an interior decorating business, Heritage Designs. During the month, Lexi completed the following transactions related to the business: Nov. 1 Lexi transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $50,000. 1 Paid rent for period of November 1 to end of month, $4,000. 6 Purchased office equipment on account, $15,000. 8 Purchased a truck for $38,500 paying $5,000 cash and giving a note payable for the remainder. 10 Purchased supplies for cash, $1,750. 12 Received cash for job completed, $11,500. 15 Paid annual premiums on property and casualty insurance, $2,400. 23 Recorded jobs completed on account and sent invoices to customers, $22,300. 24 Received an invoice for truck expenses, to be paid in November, $1,250. Enter the following transactions on Page 2 of the two-column journal: Nov. 29 Paid utilities expense, $4,500. 29…arrow_forwardAccounting 89arrow_forwardThe following labor standards have been established for a particular product: Standard hours per unit of output 6.3 hours Standard variable overhead rate $18.65 per hour The following data pertain to operations concerning the product for the last month: Actual hours 8,600 hours Actual total variable overhead cost $157,380 Actual output 1,100 What is the variable overhead efficiency variance for the month? a. $30, 561 U. b. $31, 146 U. c. $28, 136 U. d. $2, 426 U.arrow_forward

- Platz Company makes chairs and planned to sell 3, 200 chairs in its master budget for the coming year. The budgeted selling price is $45 per chair, variable costs are $15 per chair, and budgeted fixed costs are $40,000 per month. At the end of the year, it was determined that Platz actually sold 3,100 chairs for $145,700. Total variable costs were $50,375 and fixed costs were $38,000. The volume variance for sales revenue was: a. $4,500 unfavorable b. $100 unfavorable c. $4,500 favorable d. $1,700 favorablearrow_forwardThe contribution margin ratio is calculated as how? a) Gross margin divided by sales b) Operating income divided by sales c) Contribution margin divided by sales d) Net income divided by salesarrow_forwardAnswer. General Accountarrow_forward

- Colfax Company incurred production labor costs of $5,400 in February (payable In March) for work requiring 1,100 standard hours at a standard rate of $15 per hour; 1,200 actual direct labor hours were worked. Based on this information, which one of the following would be included in the journal entry to record the labor costs? a. $16,500 credit to Work-in-process Inventory. b. $1,500 credit to labor Efficiency Variance. c. $16,200 credit to Wages Payable. d. $1,500 credit to Labor Rate Variance.arrow_forwardConsider the following event: Owner made contribution to the firm. Which of the following combination of changes in the accounting equation describes the given event? a. Liabilities decrease; Owners' equity increase b. Assets decrease; Liabilities decrease c. Assets decrease; Owners' equity decrease d. Assets increase; Assets decrease e. Assets increase; Liabilities increase f. Assets increase; Owners' equity increasearrow_forwardSUBJECT = GENERAL ACCOUNTarrow_forward

- this is general account questionarrow_forwardThompson Company has a standard of 3.1 pounds of materials per unit, at $15.10 per pound. In producing 980 units, Thompson used 2,830 pounds of materials at a total cost of $44,500. What is Thompson's total materials variance? a. $1,767 Favorable b. $1,374 Favorable c. $1,374 Unfavorable d. $1,767 Unfavorablearrow_forwardFinancial Accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY