Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 56P

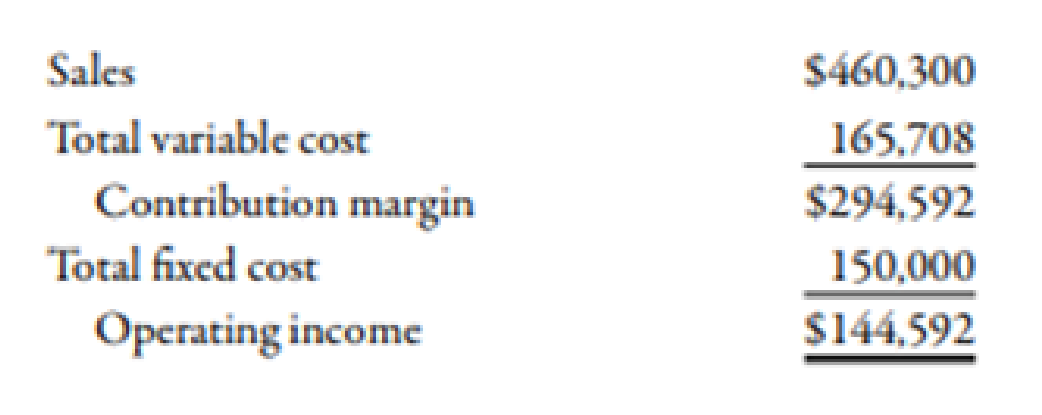

Contribution Margin Ratio, Break-Even Sales, Operating Leverage

Elgart Company produces plastic mailboxes. The

Required:

- 1. Compute the contribution margin ratio for the mailboxes.

- 2. How much revenue must Elgart earn in order to break even?

- 3. What is the effect on the contribution margin ratio if the unit selling price and unit variable cost each increase by 15%?

- 4. CONCEPTUAL CONNECTION Suppose that management has decided to give a 4% commission on all sales. The projected income statement does not reflect this commission. Recompute the contribution margin ratio, assuming that the commission will be paid. What effect does this have on the break-even point?

- 5. CONCEPTUAL CONNECTION If the commission is paid as described in Requirement 4, management expects sales revenues to increase by $80,000. How will this affect operating leverage? Is it a sound decision to implement the commission? Support your answer with appropriate computations.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

hello tutor please help me

What is the gross margin percentage of this financial accounting question?

managerial accoun

Chapter 7 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 7 - Prob. 1DQCh. 7 - Describe the difference between the units sold...Ch. 7 - Define the term break-even point.Ch. 7 - Prob. 4DQCh. 7 - What is the variable cost ratio? The contribution...Ch. 7 - Prob. 6DQCh. 7 - Define the term sales mix. Give an example to...Ch. 7 - Explain how CVP analysis developed for single...Ch. 7 - Prob. 9DQCh. 7 - How does targeted profit enter into the break-even...

Ch. 7 - Explain how a change in sales mix can change a...Ch. 7 - Define the term margin of safety. Explain how it...Ch. 7 - Explain what is meant by the term operating...Ch. 7 - How can sensitivity analysis be used in...Ch. 7 - Why is a declining margin of safety over a period...Ch. 7 - If the variable cost per unit goes down,Ch. 7 - The amount of revenue required to earn a targeted...Ch. 7 - Prob. 3MCQCh. 7 - Prob. 4MCQCh. 7 - An important assumption of cost-volume-profit...Ch. 7 - The use of fixed costs to extract higher...Ch. 7 - Prob. 7MCQCh. 7 - The contribution margin is the a. amount by which...Ch. 7 - Dartmouth Company produces a single product with a...Ch. 7 - Dartmouth Company produces a single product with a...Ch. 7 - If a companys total fixed cost decreases by...Ch. 7 - Prob. 12MCQCh. 7 - Variable Cost, Fixed Cost, Contribution Margin...Ch. 7 - Prob. 14BEACh. 7 - Variable Cost Ratio, Contribution Margin Ratio...Ch. 7 - Prob. 16BEACh. 7 - Units to Earn Target Income Head-First Company...Ch. 7 - Sales Needed to Earn Target Income Head-First...Ch. 7 - Break-Even Point in Units for a Multiple-Product...Ch. 7 - Prob. 20BEACh. 7 - Margin of Safety Head-First Company plans to sell...Ch. 7 - Degree of Operating Leverage Head-First Company...Ch. 7 - Impact of Increased Sales on Operating Income...Ch. 7 - Variable Cost, Fixed Cost, Contribution Margin...Ch. 7 - Prob. 25BEBCh. 7 - Variable Cost Ratio, Contribution Margin Ratio...Ch. 7 - Prob. 27BEBCh. 7 - Units to Earn Target Income Chillmax Company plans...Ch. 7 - Sales Needed to Earn Target Income Chillmax...Ch. 7 - Prob. 30BEBCh. 7 - Prob. 31BEBCh. 7 - Margin of Safety Chillmax Company plans to sell...Ch. 7 - Prob. 33BEBCh. 7 - Impact of Increased Sales on Operating Income...Ch. 7 - Basic Break-Even Calculations Suppose that Larimer...Ch. 7 - Price, Variable Cost per Unit, Contribution...Ch. 7 - Contribution Margin Ratio, Variable Cost Ratio,...Ch. 7 - Prob. 38ECh. 7 - Prob. 39ECh. 7 - Margin of Safety Comer Company produces and sells...Ch. 7 - Prob. 41ECh. 7 - Sales Revenue Approach, Variable Cost Ratio,...Ch. 7 - Prob. 43ECh. 7 - Cherry Blossom Products Inc. produces and sells...Ch. 7 - Prob. 45ECh. 7 - Lotts Company produces and sells one product. The...Ch. 7 - Klamath Company produces a single product. The...Ch. 7 - Margin of Safety and Operating Leverage Medina...Ch. 7 - Parker Pottery produces a line of vases and a line...Ch. 7 - Jellico Inc.s projected operating income (based on...Ch. 7 - Break-Even Units, Contribution Margin Ratio,...Ch. 7 - Prob. 52PCh. 7 - Aldovar Company produces a variety of chemicals....Ch. 7 - Basu Company produces two types of sleds for...Ch. 7 - Cost-Volume-Profit Equation, Basic Concepts,...Ch. 7 - Contribution Margin Ratio, Break-Even Sales,...Ch. 7 - Prob. 57PCh. 7 - Polaris Inc. manufactures two types of metal...Ch. 7 - Cost-Volume-Profit, Margin of Safety Victoria...Ch. 7 - Abraham Company had revenues of 830,000 last year...Ch. 7 - Prob. 61PCh. 7 - Prob. 62PCh. 7 - Prob. 63PCh. 7 - Suppose that Kicker had the following sales and...Ch. 7 - Danna Lumus, the marketing manager for a division...Ch. 7 - Cost-Volume-Profit Analysis, Single-Product...Ch. 7 - Cost-Volume-Profit Analysis, Single-Product...Ch. 7 - Prob. 3MTCCh. 7 - Prob. 4MTCCh. 7 - Sensitivity Cost-Volume-Profit Analysis and...Ch. 7 - Calculate the hotels margin of safety (both in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY