Concept explainers

Cost Flows through Accounts

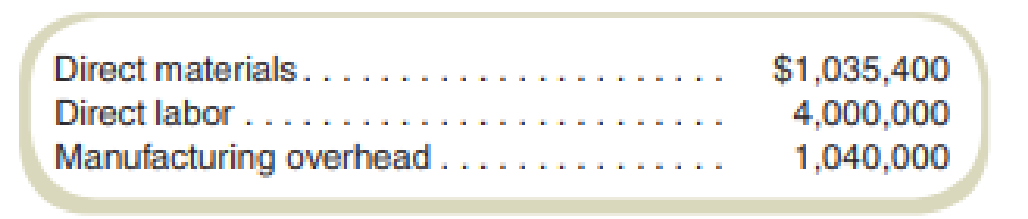

Brighton Services repairs locomotive engines. It employs 100 full-time workers at $20 per hour. Despite operating at capacity, last year’s performance was a great disappointment to the managers. In total, 10 jobs were accepted and completed, incurring the following total costs:

Of the $1,040,000 manufacturing

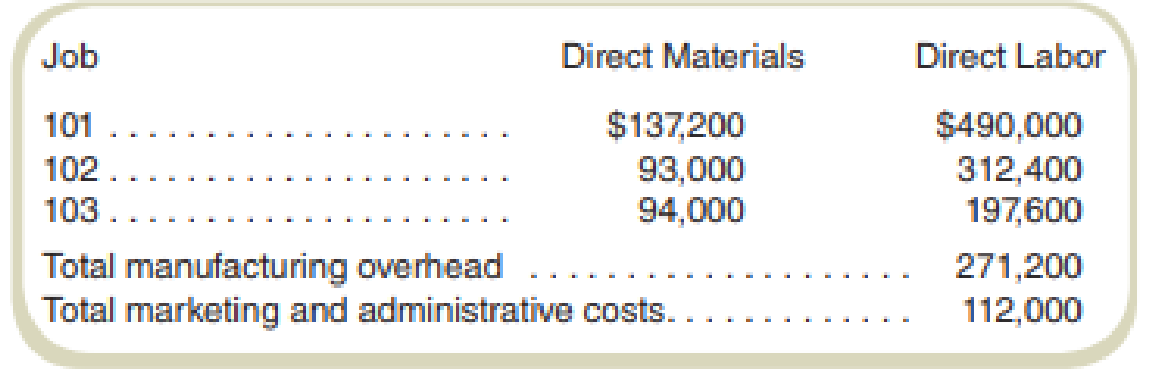

This year, Brighton Services expects to operate at the same activity level as last year, and overhead costs and the wage rate are not expected to change. For the first quarter of this year, Brighton Services completed two jobs and was beginning the third (Job 103). The costs incurred follow:

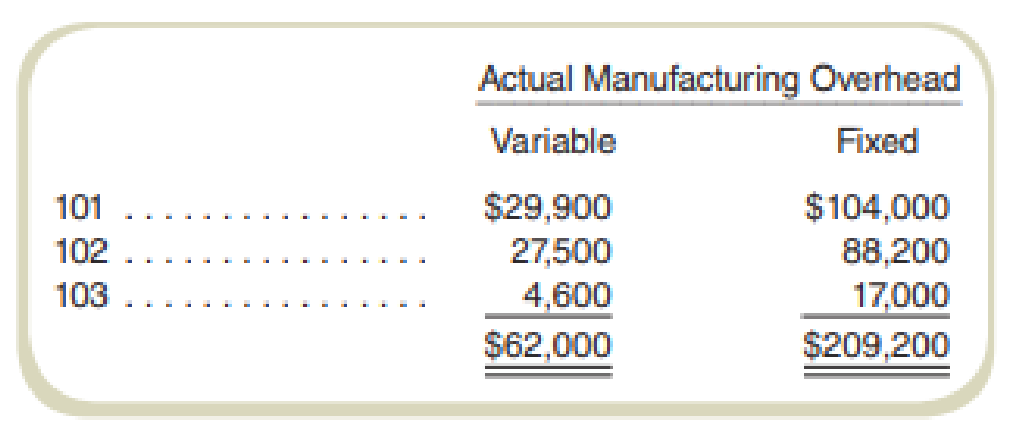

You are a consultant associated with Lodi Consultants, which Brighton Services has asked for help. Lodi’s senior partner has examined Brighton Services’s accounts and has decided to divide actual factory overhead by job into fixed and variable portions as follows:

In the first quarter of this year, 40 percent of marketing and administrative cost was variable and 60 percent was fixed. You are told that Jobs 101 and 102 were sold for $850,000 and $550,000, respectively. All over- or underapplied overhead for the quarter is written off to Cost of Goods Sold.

Required

- a. Present in T-accounts the actual

manufacturing cost flows for the three jobs in the first quarter of this year. - b. Using last year’s overhead costs and direct labor-hours as this year’s estimate, calculate predetermined overhead rates per direct labor-hour for variable and fixed overhead.

- c. Present in T-accounts the normal manufacturing cost flows for the three jobs in the first quarter of this year. Use the overhead rates derived in requirement (b).

- d. Prepare income statements for the first quarter of this year under the following costing systems:

- (1) Actual.

- (2) Normal.

a.

Compute in T-accounts: the actual manufacturing cost flows for the three jobs in the first quarter of this year.

Explanation of Solution

T-accounts in job costing: The ledger accounts are also termed as T-accounts which are prepared after the recording of the journal entry of the transactions. The balances of raw materials, work-in-process, finished goods inventory and overheads from the journal book are transferred to the respective T-accounts.

T-account of materials inventory:

| Materials inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 137,200 | |||||

| $ 93,000 | |||||

| $ 94,000 | |||||

Table: (1)

T-account of wages payable:

| Wages payable | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 490,000 | |||||

| $ 312,400 | |||||

| $ 197,600 | |||||

Table: (2)

T-account of variable manufacturing overhead:

| Variable manufacturing overhead | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 62,000 | $ 29,900 | ||||

| $ 27,500 | |||||

| $ 4,600 | |||||

Table: (3)

T-account of fixed manufacturing overhead:

| Fixed manufacturing overhead | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 209,200 | $ 104,000 | ||||

| $ 88,200 | |||||

| $ 17,000 | |||||

Table: (4)

T-account of work-in-process inventory:

| Work-in-process inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 324,200 | $ 761,100 | ||||

| $ 1,000,000 | $ 521,100 | ||||

| $ 62,000 | |||||

| $ 209,200 | |||||

Table: (5)

T-account of finished goods inventory:

| Finished goods inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 761,100 | |||||

| $ 521,100 | $ 1,282,200 | ||||

Table: (6)

T-account of the cost of goods sold:

| Cost of goods sold | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 1,282,200 | |||||

Table: (7)

b.

Calculate predetermined overhead rates per direct labor-hour for variable and fixed overhead by using last year’s overhead costs and direct labor-hours.

Explanation of Solution

Predetermined overhead rate: The predetermined overhead rate is the rate computed for applying manufacturing overheads to the work-in-process inventory. This rate can be computed by dividing the total amount of manufacturing overheads by the base of allocation. The formula for calculating the predetermined overhead rate is:

Compute the predetermined variable overhead rate:

Compute the predetermined fixed overhead rate:

Working note 1:

Compute the total direct labor-hours:

Working note 2:

Compute the variable manufacturing overhead:

Working note 3:

Compute the fixed manufacturing overhead:

c.

Present in T-accounts the normal manufacturing cost flows for the three jobs in the first quarter of this year by using the overhead rates derived as per the previous part.

Explanation of Solution

T-accounts in job costing: The ledger accounts are also termed as T-accounts which are prepared after the recording of the journal entry of the transactions. The balances of raw materials, work-in-process, finished goods inventory and overheads from the journal book are transferred to the respective T-accounts.

T-account of materials inventory:

| Materials inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 137,200 | |||||

| $ 93,000 | |||||

| $ 94,000 | |||||

Table: (8)

T-account of wages payable:

| Wages payable | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 490,000 | |||||

| $ 312,400 | |||||

| $ 197,600 | |||||

Table: (9)

T-account of variable manufacturing overhead:

| Variable manufacturing overhead | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 62,000 | $ 38,220 | ||||

| $ 16,000 | $ 24,367 | ||||

| $ 15,413 | |||||

Table: (10)

T-account of fixed manufacturing overhead:

| Fixed manufacturing overhead | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 182,000 | $ 89,180 | ||||

| $ 56,857 | |||||

| $ 35,963 | |||||

| $ 27,200 | |||||

Table: (11)

T-account of work-in-process inventory:

| Work-in-process inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 324,200 | $ 754,600 | ||||

| $ 1,000,000 | $ 486,624 | ||||

| $ 78,000 | |||||

| $ 182,000 | |||||

Table: (12)

T-account of finished goods inventory:

| Finished goods inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 754,600 | |||||

| $ 486,624 | $ 1,241,224 | ||||

Table: (13)

T-account of the cost of goods sold:

| Cost of goods sold | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 1,241,224 | |||||

Table: (14)

T-account of under-or over-applied overhead

| Under-or over-applied overhead | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 27,200 | $ 16,000 | ||||

Table: (15)

d.

Prepare the income statement for the first quarter of this year using actual and normal systems.

Explanation of Solution

Normal system of costing: Under normal costing, the cost of a job is determined by using the actual direct material, and the labor cost by adding overhead applied using a predetermined rate and an actual allocation base.

Actual system of costing: The cost of a job is determined by using the actual direct material, and the labor cost by adding overhead applied using an actual overhead rate and an actual allocation base under actual costing.

Income statement using actual system:

| Particulars | Amount |

| Sales Revenue | $ 1,400,000 |

| Less: Cost of goods sold | ($ 1,282,200) |

| Gross margin | $ 117,800 |

| Less: (Under-) Over applied overhead | $ 0 |

| Marketing and administrative costs | ($ 112,000) |

| Operating profit (loss) | $ 5,800 |

Income statement using normal system:

| Particulars | Normal |

| Sales Revenue | $ 1,400,000 |

| Less: Cost of goods sold | ($ 1,241,224) |

| Gross margin | $ 158,776 |

| Less: (Under-) Over applied overhead | $ 11,200 |

| Marketing and administrative costs | ($ 112,000) |

| Operating profit (loss) | $ 35,576 |

Want to see more full solutions like this?

Chapter 7 Solutions

FUNDAMENTALS OF COST ACCOUNTING W/CONNE

- Using the Hofstede Country Comparison ToolLinks to an external site., compare your nation to two other nations on Hofstede’s dimensions. Based on what you know about these national cultures and the cultural dimensions discussed in class, how do you interpret the accuracy of this information?arrow_forwardI need help with this solution for accountingarrow_forwardGeneral accountingarrow_forward

- You want to buy a $259,000 home. You plan to pay 10% as a down payment and take out a 30- year loan for the rest. a) How much is the loan amount going to be? b) What will your monthly payments be if the interest rate is 5%? c) What will your monthly payments be if the interest rate is 6%?arrow_forwardI need help with solution accountingarrow_forwardPlease provide correct solution and accountingarrow_forward

- Mega Company believes the price of oil will increase in the coming months. Therefore, it decides to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X1, Mega purchases call options for 14,000 barrels of oil at $30 per barrel at a premium of $2 per barrel with a March 1, 20X2, call date. The following is the pricing information for the term of the call: Date Spot Price Futures Price (for March 1, 20X2, delivery) November 30, 20X1 $ 30 $ 31 December 31, 20X1 31 32 March 1, 20X2 33 The information for the change in the fair value of the options follows: Date Time Value Intrinsic Value Total Value November 30, 20X1 $ 28,000 $ –0– $ 28,000 December 31, 20X1 6,000 14,000 20,000 March 1, 20X2 42,000 42,000 On March 1, 20X2, Mega sells the options at their value on that date and acquires 14,000 barrels of oil at the spot price. On June 1, 20X2, Mega sells the…arrow_forwardTex Hardware sells many of its products overseas. The following are some selected transactions. Tex sold electronic subassemblies to a firm in Denmark for 120,000 Danish kroner (Dkr) on June 6, when the exchange rate was Dkr 1 = $0.1750. Collection was made on July 3 when the rate was Dkr 1 = $0.1753. On July 22, Tex sold copper fittings to a company in London for £35,000 with payment due on September 20. Also, on July 22, Tex entered into a 60-day forward contract to sell £35,000 at a forward rate of £1 = $1.630. The forward contract is not designated as a hedge. The spot rates follow: July 22 £1 = $1.580 September 20 £1 = $1.612 Tex sold storage devices to a Canadian firm for C$71,000 (Canadian dollars) on October 11, with payment due on November 10. On October 11, Tex entered into a 30-day forward contract to sell Canadian dollars at a forward rate of C$1 = $0.730. The forward contract is not designated as a hedge. The spot rates were as follows: October 11 C$1 =…arrow_forwardI want the correct answer is accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College