Assigning Costs: Missing Data

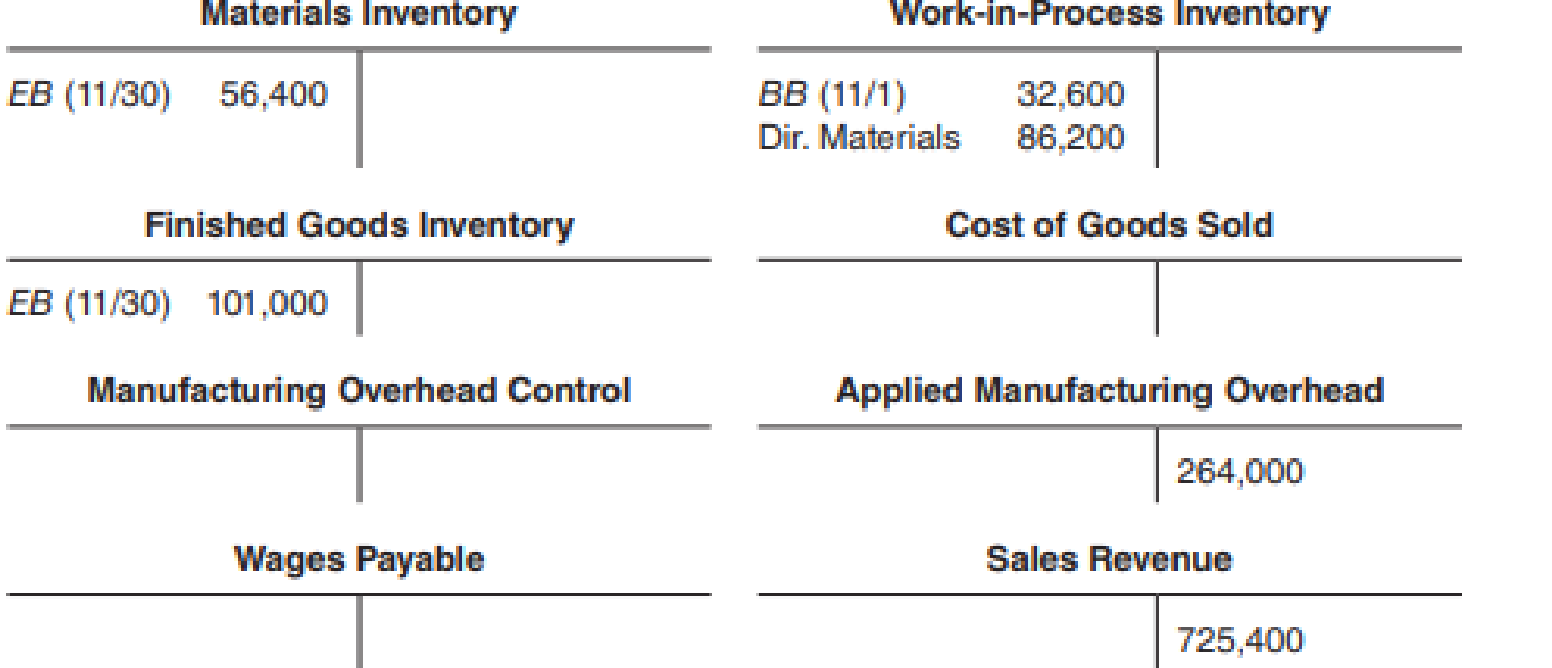

The following T-accounts represent November activity:

Additional Data

- Materials of $113,600 were purchased during the month, and the balance in the Materials Inventory account increased by $11,000.

Overhead is applied at the rate of 150 percent of direct labor cost.- Sales are billed at 180 percent of cost of goods sold before the over- or underapplied overhead is prorated.

- The balance in the Finished Goods Inventory account decreased by $28,600 during the month before any proration of under- or overapplied overhead.

- Total credits to the Wages Payable account amounted to $202,000 for direct and indirect labor.

- Factory

depreciation totaled $48,200. - Overhead was underapplied by $25,080. Overhead other than indirect labor, indirect materials, and depreciation was $198,480, which required payment in cash. Underapplied overhead is to be allocated.

- The company has decided to allocate 25 percent of underapplied overhead to Work-in-Process Inventory, 15 percent to Finished Goods Inventory, and the balance to Cost of Goods Sold. Balances shown in T-accounts are before any allocation.

Required

Complete the T-accounts.

Complete the T-accounts given in the question.

Explanation of Solution

The T-accounts with complete information:

T-accounts in job costing: The ledger accounts are also termed as T-accounts which are prepared after the recording of the journal entry of the transactions. The balances of raw materials, work-in-process, finished goods inventory and overheads from the journal book are transferred to the respective T-accounts.

Journal entries (job costing): The journal entries are prepared in order to record the day to day transactions of the entity. The journal entries in job costing are prepared by starting from the materials inventory. The balances are then transferred to work-in-process inventory and after that to finished goods inventory.

T-account of materials inventory:

| Materials inventory | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| BB | $ 45,500 | $ 86,200 | ||||

| Purchases | $ 113,600 | $ 16,400 (1) | ||||

| EB | $ 56,400 | |||||

Table: (1)

T-account of work-in-process inventory:

| Work-in-process inventory | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| BB | $ 32,600 | $ 374,400 (5) | ||||

| Direct materials | $ 86,200 | |||||

| Direct labor | $ 176,000 (2) | |||||

| Overhead applied | $ 264,000 | |||||

| Balance | $ 184,400 (6) | |||||

| Proration | $ 6,270 (8) | |||||

| Balance | $ 190,670 | |||||

Table: (2)

T-account of finished goods inventory:

| Finished goods inventory | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| Balance | $ 129,600 (4) | |||||

| Overhead applied | $ 374,400 (5) | $ 403,000 (3) | ||||

| EB | $ 101,000 | |||||

| Proration | $ 3,762 (9) | |||||

| Balance | $ 104,762 | |||||

Table: (3)

T-account of the cost of goods sold:

| Cost of goods sold | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| Finished goods inventory | $ 403,000 (3) | |||||

| Proration | $ 15,048 (10) | |||||

Table: (4)

T-account of manufacturing overhead control:

| Manufacturing overhead control | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 16,400 (1) | ||||||

| $ 26,000 (7) | ||||||

| $ 48,200 | ||||||

| $ 198,480 | $ 289,080 | |||||

Table: (5)

T-account of applied overhead control:

| Applied overhead control | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 264,000 | $ 264,000 | |||||

Table: (6)

T-account of wages payable:

| Wages payable | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 176,000 (2) | ||||||

| $ 26,000 (7) | ||||||

Table: (7)

T-account of sales revenue:

| Sales revenue | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 725,400 | ||||||

Table: (8)

Working note 1:

Amount of $86,200 has been taken from the direct materials used.

Compute the unaccounted balance:

Working note 2:

Overheads applied are 150% of direct labor cost.

Compute the direct labor costs:

Assume X to be direct labor costs.

Working note 3:

Compute the cost of goods sold:

Assume X to be the cost of goods sold.

Working note 4:

Compute the beginning balance of finished goods:

Working note 5:

Compute the cost of goods manufactured:

Working note 6:

Compute the work-in-process ending balance:

Working note 7:

Compute the indirect labor:

Working note 8:

Compute the proration of work-in-process:

Working note 9:

Compute the proration of finished goods:

Working note 10:

Compute the proration of the cost of goods sold:

Want to see more full solutions like this?

Chapter 7 Solutions

FUNDAMENTALS OF COST ACCOUNTING W/CONNE

- Financial Accounting Question please answerarrow_forwardHow much of every retail sales dollar is made up of merchandise cost on these general accounting question?arrow_forwardThe company where Daniel works produces skateboards locally but sells them globally for $60 each. Daniel is one of the production managers in a meeting to discuss preliminary results from the year just ended. Here is the information they had in front of them: Standard Quantity per Unit Standard Price Wood 2.50 feet $4.00 per foot Wheels 5.00 wheels $0.50 per wheel Direct labor 0.30 hours $14.00 per hour Actual results: . • Quantity of wood purchased, 225,000 feet; quantity of wood used, 220,000 feet. Quantity of wheels purchased, 418,800 wheels; quantity of wheels used, 400,800 wheels. Actual cost of the wood, $4.20 per foot. Actual cost of the wheels, $0.55 per wheel. • Quantity of DL hours used, 26,400 hours; actual cost of DL hours, $15.20 per hour. Actual units produced, 80,000 skateboards. (a) Complete a variance analysis for DM (both wood and wheels) and DL, determining the price and efficiency variances for each; be sure to specify the amount and sign of each variance. DM- Wood…arrow_forward

- Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $7,000, direct labor of $3,400, and applied overhead of $2,890. Custom Cabinetry applies overhead at the rate of 85% of direct labor cost. During July, Job 120 is sold (on credit) for $26,000, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. Job 120 Direct materials used Direct labor used $ 2,300 3,400 Job 121 $ 7,100 4,700 Job 122 $ 2,600 3,700 1. Prepare journal entries for the following July transactions and events a through e. a. Direct materials used. b. Direct labor used. c. Overhead applied. d. Sale of Job 120. e. Cost of goods sold for Job 120. Hint. Job 120 has costs from June and July. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory at June…arrow_forwardIn 2014, LL Bean sold 450,000 pairs of boots. At one point in 2014, it had a back order of 100,000. In 2015, LL Bean expects to sell 500,000 pairs of boots. As of late November 2015, it has a back order of 50,000.Question: When would LL Bean see sales revenue from the sale of its back order on the boots?arrow_forwardHelp me to solve this questionsarrow_forward

- correct answer pleasearrow_forwardGive this question financial accountingarrow_forward1.3 1.2.5 za When using a computerised accounting system, the paper work will be reduced in the organisation. Calculate the omitting figures: Enter only the answer next to the question number (1.3.1-1.3.5) in the NOTE. Round off to TWO decimals. VAT report of Comfy shoes as at 30 April 2021 OUTPUT TAX INPUT TAX NETT TAX Tax Gross Tax(15%) Gross (15%) Standard 75 614,04 1.3.1 Capital 1.3.2 9 893,36 94 924,94 Tax (15%) 1.3.3 Gross 484 782,70 75 849,08 -9 893,36 -75 849,08 Bad Debts TOTAL 1.3.4 4 400,00 1 922,27 14 737,42 -1 348,36 1.3.5 (5 x 2) (10arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning