Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 49P

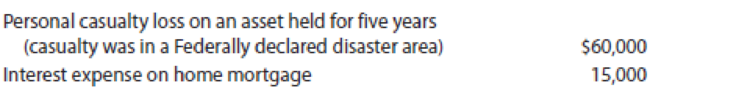

Assume that in addition to the information in Problems 47 and 48, Nell had the following items in 2019:

The casualty loss is net of the $100-per-event floor. Determine Nell’s taxable income and NOL for 2019.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you help me solve this general accounting problem using the correct accounting process?

Can you demonstrate the proper approach for solving this financial accounting question with valid techniques?

Can you demonstrate the accurate steps for solving this financial accounting problem with valid procedures?

Chapter 7 Solutions

Individual Income Taxes

Ch. 7 - Prob. 1DQCh. 7 - Prob. 2DQCh. 7 - Prob. 3DQCh. 7 - Prob. 4DQCh. 7 - Many years ago, Jack purchased 400shares of Canary...Ch. 7 - Scan is in the business of buying and selling...Ch. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Prob. 9DQCh. 7 - Prob. 10DQ

Ch. 7 - Prob. 11DQCh. 7 - Prob. 12DQCh. 7 - Prob. 13DQCh. 7 - Prob. 14DQCh. 7 - Prob. 15DQCh. 7 - Prob. 16DQCh. 7 - Prob. 17DQCh. 7 - Prob. 18DQCh. 7 - Prob. 19DQCh. 7 - Prob. 20DQCh. 7 - Last year Aleshia identified 15,000 as a...Ch. 7 - Prob. 22CECh. 7 - Prob. 23CECh. 7 - Prob. 24CECh. 7 - Prob. 25CECh. 7 - Belinda was involved in a boating accident in...Ch. 7 - Prob. 27CECh. 7 - Prob. 28CECh. 7 - Prob. 29CECh. 7 - Phillis and Trey are married and file a joint tax...Ch. 7 - Emily, who is single, sustains an NOL of 7,800 in...Ch. 7 - Prob. 32PCh. 7 - Monty loaned his friend Ned 20,000 three years...Ch. 7 - Sally is in the business of purchasing accounts...Ch. 7 - Prob. 35PCh. 7 - Prob. 36PCh. 7 - Olaf lives in the state of Minnesota. In 2019, a...Ch. 7 - Prob. 38PCh. 7 - On July 24 of the current year, Sam Smith was...Ch. 7 - Prob. 40PCh. 7 - During 2019, Leisel, a single taxpayer, operates a...Ch. 7 - Prob. 42PCh. 7 - Prob. 43PCh. 7 - Xinran, who is married and files a joint return,...Ch. 7 - During 2019, Rick and his wife, Sara, had the...Ch. 7 - Soong, single and age 32, had the following items...Ch. 7 - Prob. 47PCh. 7 - Prob. 48PCh. 7 - Assume that in addition to the information in...Ch. 7 - Jed, age 55, is married with no children. During...Ch. 7 - Prob. 51CPCh. 7 - Mason Phillips, age 45, and his wife, Ruth, live...Ch. 7 - During 2019, John was the chief executive officer...Ch. 7 - Prob. 2RP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Titan Manufacturing applies overhead cost to jobs on the basis of 85% of direct labor cost. If Job 427 shows $93,500 of manufacturing overhead applied, the direct labor cost on the job was: a. $79,475 b. $110,000 c. $120,000 answer?arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPreview Ltd is considering an investment in a new machine for the production of a new product X. There are two possibilities, Machine A and Machine B. Both the product and the machine would have an expected life of five years. The following information is available:Product X Selling price N$50 Variable cost N$32Increase in fixed overhead (excluding depreciation of the new machine) is N$90,000 per year.Sales unitsYear 1 10,000 2 15,000 3 20,000 4 20,000 5 5,000Machine A Machine BInitial cost (N$000) 550 480Residual value (N$000) 50 30The company’s cost of capital is 10%, the appropriate discount factors are:Year 1 0.909Year 2 0.826Year 3 0.751Year 4 0.682Year 5 0.621Required:a) Evaluate each machine, A and B, using the following methods:(i) Accounting rate of return (using average investment) (ii) Payback (iii) Net present valueb) On the basis of your figures in (a) above, advice management as to which machine to purchase, stating reasons for your decision.arrow_forward

- general accountingarrow_forwardDuring 2022, Crystal Resort reported revenue of $45,000. Total expenses for the year were $29,000. Crystal Resort ended the year with total assets of $34,000, and it owed debts totaling $12,500. At year-end 2021, the business reported total assets of $28,600 and total liabilities of $11,000. A. Compute Crystal Resort's net income for 2022. B. Did Crystal Resort's stockholders' equity increase or decrease during 2022? By how much?arrow_forwardWhat is gamma's direct labor price variance ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License