Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 45P

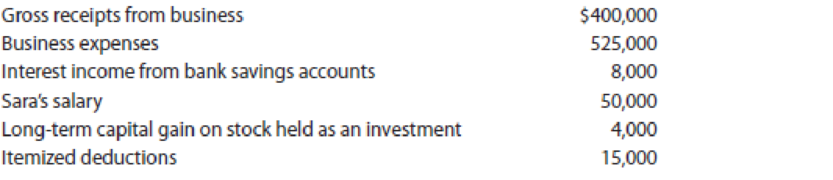

During 2019, Rick and his wife, Sara, had the following items of income and expense to report:

- a. Assuming that Rick and Sara file a joint return, what is their taxable income for 2019?

- b. What is the amount of Rick and Sara’s NOL for 2019?

- c. c To what years can Rick and Sara’s NOL be carried?

- d. Based on your compulations, identify the components of their NOL. What is the rationale for excluding the items that do not affect the NOL compulation?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need assistance with this general accounting question using appropriate principles.

Please provide the answer to this general accounting question using the right approach.

Can you help me solve this general accounting problem with the correct methodology?

Chapter 7 Solutions

Individual Income Taxes

Ch. 7 - Prob. 1DQCh. 7 - Prob. 2DQCh. 7 - Prob. 3DQCh. 7 - Prob. 4DQCh. 7 - Many years ago, Jack purchased 400shares of Canary...Ch. 7 - Scan is in the business of buying and selling...Ch. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Prob. 9DQCh. 7 - Prob. 10DQ

Ch. 7 - Prob. 11DQCh. 7 - Prob. 12DQCh. 7 - Prob. 13DQCh. 7 - Prob. 14DQCh. 7 - Prob. 15DQCh. 7 - Prob. 16DQCh. 7 - Prob. 17DQCh. 7 - Prob. 18DQCh. 7 - Prob. 19DQCh. 7 - Prob. 20DQCh. 7 - Last year Aleshia identified 15,000 as a...Ch. 7 - Prob. 22CECh. 7 - Prob. 23CECh. 7 - Prob. 24CECh. 7 - Prob. 25CECh. 7 - Belinda was involved in a boating accident in...Ch. 7 - Prob. 27CECh. 7 - Prob. 28CECh. 7 - Prob. 29CECh. 7 - Phillis and Trey are married and file a joint tax...Ch. 7 - Emily, who is single, sustains an NOL of 7,800 in...Ch. 7 - Prob. 32PCh. 7 - Monty loaned his friend Ned 20,000 three years...Ch. 7 - Sally is in the business of purchasing accounts...Ch. 7 - Prob. 35PCh. 7 - Prob. 36PCh. 7 - Olaf lives in the state of Minnesota. In 2019, a...Ch. 7 - Prob. 38PCh. 7 - On July 24 of the current year, Sam Smith was...Ch. 7 - Prob. 40PCh. 7 - During 2019, Leisel, a single taxpayer, operates a...Ch. 7 - Prob. 42PCh. 7 - Prob. 43PCh. 7 - Xinran, who is married and files a joint return,...Ch. 7 - During 2019, Rick and his wife, Sara, had the...Ch. 7 - Soong, single and age 32, had the following items...Ch. 7 - Prob. 47PCh. 7 - Prob. 48PCh. 7 - Assume that in addition to the information in...Ch. 7 - Jed, age 55, is married with no children. During...Ch. 7 - Prob. 51CPCh. 7 - Mason Phillips, age 45, and his wife, Ruth, live...Ch. 7 - During 2019, John was the chief executive officer...Ch. 7 - Prob. 2RP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please show me the correct approach to solving this financial accounting question with proper techniques.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardI am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License