a.

Record the given events in the

a.

Explanation of Solution

Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below.

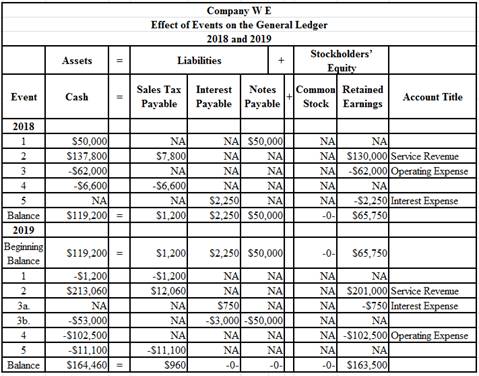

Record the given events in accounting equation.

Table (1)

Working notes:

Determine the sales tax payable on the service rendered in 2018.

Determine the sales tax due for the year 2018.

Calculate the amount of accrued interest expense at December 31, 2018.

Determine the sales tax payable on the service rendered in 2019.

Determine the sales tax due for the year 2019.

Calculate the amount of accrued interest expense at April 1, 2019.

b.

Prepare an income statement, a statement of changes in

b.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Statement of changes in the stockholders’ equity: This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Prepare the income statement for Company WE for the year ended December 31, 2018.

| Company WE | ||

| Statement of income | ||

| For the year ended December 31, 2018 | ||

| Particulars | Amount $ | Amount $ |

| Service Revenue | 130,000 | |

| Expenses: | ||

| Operating Expenses | 62,000 | |

| Total operating expense | (62,000) | |

| Operating income | 68,000 | |

| Interest expense | (2,250) | |

| Net income | 65,750 | |

Table (2)

Prepare the statement of changes in stockholders’ equity of Company WE for the year ended December 31, 2018.

| Company WE | ||

| Statement of changes in stockholders' equity | ||

| For the year ended December 31, 2018 | ||

| Particulars | Amount $ | Amount $ |

| Common Stock | 0 | |

| Beginning | 0 | |

| Add/Less: Net Income (Loss) | 65,750 | |

| Ending Retained Earnings | 65,750 | |

| Total stockholder's equity | 65,750 | |

Table (3)

Prepare the balance sheet of Company WE as on December 31, 2018.

| Company WE | ||

| Balance sheet | ||

| As on December 31, 2018 | ||

| Assets | Amount $ | Amount $ |

| Cash | 119,200 | |

| Total Assets | 119,200 | |

| Liabilities and stockholders' equity | ||

| Liabilities | ||

| Sales tax Payable | 1,200 | |

| Interest Payable | 2,250 | |

| Notes Payable | 50,000 | |

| Total Liabilities | 53,450 | |

| Stockholders’ Equity | ||

| Retained Earnings | 66,750 | |

| Total Stockholders’ Equity | 65,750 | |

| Total liabilities and stockholders' equity | 119,200 | |

Table (4)

Prepare the statement of cash flows of Company WE for the year ended December 31, 2018.

| Company WE | ||

| Statement of cash flows | ||

| For the year ended December 31, 2018 | ||

| Particulars | Amount $ | Amount $ |

| Cash flow from operating activities: | ||

| Inflow from Customers | 130,000 | |

| Inflow from Sales Tax | 7,800 | |

| Outflow for Expenses | (62,000) | |

| Outflow for Sales Tax | (6,600) | |

| Net Cash Flow from Operating Activities | 69,200 | |

| Cash Flows From Investing Activities: | ||

| Net Cash Flow From Investing Activities | 0 | |

| Cash Flows From Financing Activities: | ||

| Inflow from loan | 50,000 | |

| Net Cash Flow From Financing Activities | 50,000 | |

| Net Change in Cash | 119,200 | |

| Add: Beginning Cash Balance | 0 | |

| Ending Cash Balance | 119,200 | |

Table (5)

Prepare the income statement for Company WE for the year ended December 31, 2019.

| Company WE | ||

| Statement of income | ||

| For the year ended December 31, 2019 | ||

| Particulars | Amount $ | Amount $ |

| Service Revenue | 201,000 | |

| Expenses: | ||

| Operating Expenses | 102,500 | |

| Total operating expense | (102,500) | |

| Operating income | 98,500 | |

| Interest expense | (750) | |

| Net income | 97,750 | |

Table (6)

Prepare the statement of changes in stockholders’ equity of Company WE for the year ended December 31, 2019.

| Company WE | ||

| Statement of changes in stockholders' equity | ||

| For the year ended December 31, 2019 | ||

| Particulars | Amount $ | Amount $ |

| Common Stock | 0 | |

| Beginning retained earnings | 65,750 | |

| Add/Less: Net Income (Loss) | 97,750 | |

| Ending Retained Earnings | 163,500 | |

| Total stockholder's equity | 163,500 | |

Table (7)

Prepare the balance sheet of Company WE as on December 31, 2019.

| Company WE | ||

| Balance sheet | ||

| As on December 31, 2019 | ||

| Assets | Amount $ | Amount $ |

| Cash | 164,460 | |

| Total Assets | 164,460 | |

| Liabilities and stockholders' equity | ||

| Liabilities | ||

| Sales tax Payable | 960 | |

| Total Liabilities | 960 | |

| Stockholders’ Equity | ||

| Retained Earnings | 163,500 | |

| Total Stockholders’ Equity | 163,500 | |

| Total liabilities and stockholders' equity | 164,460 | |

Table (8)

Prepare the statement of cash flows of Company WE for the year ended December 31, 2019.

| Company WE | ||

| Statement of cash flows | ||

| For the year ended December 31, 2019 | ||

| Particulars | Amount $ | Amount $ |

| Cash flow from operating activities: | ||

| Cash reeipts from Customers | $201,000 | |

| Inflow from Sales Tax | 12,060 | |

| Cash paid for Expenses | (102,500) | |

| Cash paid for Sales Tax expense | (12,300) | |

| Cash paid for Interest exepnse | (3,000) | |

| Net Cash Flow from Operating Activities | 95,260 | |

| Cash Flows From Investing Activities: | ||

| Net Cash Flow From Investing Activities | 0 | |

| Cash Flows From Financing Activities: | ||

| Repayment of loan | (50,000) | |

| Net Cash Flow From Financing Activities | (50,000) | |

| Net Change in Cash | 45,260 | |

| Add: Beginning Cash Balance | 119,200 | |

| Ending Cash Balance | 164,460 | |

Table (9)

Want to see more full solutions like this?

Chapter 7 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning