a.

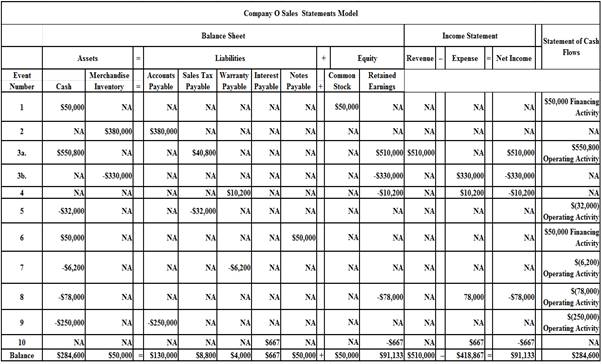

Show the effect of the given transactions using horizontal statement model.

a.

Explanation of Solution

Show the effect of the given transactions using horizontal statement model.

Table (1)

- Receiving money of $50,000 from the issue of common stock increases the value of an asset and the stockholder’s equity and affects the statement of

cash flow by increasing the financing activity. - Purchase equipment for $380,000 on account increase the value of an asset and the value of liability of the company.

- Sale of equipment for $510,000 cash increases the value of an asset and the value of the stockholder’s equity. Sale of equipment increases the net income of the company by increasing the value of the revenue in the income statement and it affects the statement of cash flow by increasing the operating activity.

- The cost of the goods sold (inventory) $330,000 decreases the value of an asset and the value of the stockholder’s equity; cost of the merchandise decreases the net income of the company by increasing the value of an expense.

- Providing six month warranty on the equipment increases the value of a liability and decreases the value of the stockholder’s equity; providing six month warranty on the equipment decreases the net income of the company by increasing the value of an expense.

- Paying sales tax to the state agency decreases the value of assets and it affects the statement of the cash flow by decreasing the value of an operating activity.

- Borrowing $50,000 note from the local bank increases the value of an asset and the liability; borrowing money from the local bank affects the statement of cash flow by increasing the value of the financing activity.

- Amount paid on warranty repairs during the year decreases the value of an asset and the liability; paying $6,200 for warranty repairs affects the statement of the cash flow by decreasing the value of an operating activity.

- Amount of $78,000 paid on operating expense decreases the value of an asset and the value of the stockholder’s equity; it decreases the value of the income by increasing the value of an expenses and amount paid on operating expense affects the statement of the cash flow by decreasing the value of an operating activity.

- Amount of $250,000 paid on accounts payable decreases the value of an asset and the liability; amount paid on accounts payable affects the statement of the cash flow by decreasing the value of an operating activity.

- Recording accrued interest of $667 on the note issued increases the value of a liability and decreases the value of a stockholder’s equity; it decreases the value of the income by increasing the value of an expenses.

Working notes:

Calculate the amount of cash collected on the sale of equipment.

Calculate the amount of interest expense.

b.

Prepare the income statement,

b.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period.

Balance Sheet: Balance Sheet summarizes the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the income statement of Company O for 2018.

| Company O | ||

| Income Statement | ||

| For the Year Ended December 31, 2018 | ||

| Particulars | Amount in $ | Amount in $ |

| Sales Revenue | 510,000 | |

| Cost of Goods Sold | (330,000) | |

| Gross Margin | 180,000 | |

| Expense: | ||

| Operating expense | 78,000 | |

| Warranty expense | 10,200 | |

| Total operating expense | (88,200) | |

| Operating income | 91,800 | |

| Interest expense | (667) | |

| Net Income | 91,133 | |

Table (2)

Prepare the balance sheet of Company O for 2018.

| Company O | ||

| Balance Sheet | ||

| As of December 31, 2018 | ||

| Particulars | Amount in $ | Amount in $ |

| Assets: | ||

| Cash | 284,600 | |

| Merchandise Inventory | 50,000 | |

| Total Assets | 334,600 | |

| Total Liabilities and | ||

| Liabilities: | ||

| Accounts Payable | 130,000 | |

| Sales Tax Payable | 8,800 | |

| Warranties Payable | 4,000 | |

| Interest Payable | 667 | |

| Notes Payable | 50,000 | |

| Total Liabilities | 193,467 | |

| Stockholders’ Equity: | ||

| Common Stock | 50,000 | |

| 91,133 | ||

| Total Stockholders’ Equity | 141,133 | |

| Total Liabilities and Stockholders’ Equity | 334,600 | |

Table (3)

Prepare the statement of cash flow of the Company O for 2018.

| Company O | ||

| Statement of Cash Flows | ||

| For the Year Ended December 31, 2018 | ||

| Particulars | Amount in $ | Amount in $ |

| Cash Flows From Operating Activities: | ||

| Inflow from Customers | 510,000 | |

| Inflow from Sales Tax | 40,800 | |

| Outflow to Purchase Inventory | (250,000) | |

| Outflow for Expenses | (84,200) | |

| Outflow for Sales Tax | (32,000) | |

| Net Cash Flow from Operating Activities | 184,600 | |

| Cash Flows From Investing Activities: | 0 | |

| Cash Flows From Financing Activities: | ||

| Inflow from Stock Issue | 50,000 | |

| Inflow from Loan | 50,000 | |

| Net Cash Flow from Financing Activities | 100,000 | |

| Net Change in Cash | 284,600 | |

| Add: Beginning Cash Balance | 0 | |

| Ending Cash Balance | 284,600 | |

Table (4)

Working Note:

c.

Calculate the total amount of current liabilities at December 31, 2018.

c.

Explanation of Solution

Calculate the total amount of current liabilities at December 31, 2018.

| Particulars | Amount in $ |

| Current Liabilities: | |

| Accounts Payable | 130,000 |

| Sales Tax Payable | 8,800 |

| Warranty Payable | 4,000 |

| Interest Payable | 667 |

| Notes Payable | 50,000 |

| Total Current Liabilities | 193,467 |

Table (5)

Therefore, the total amount of current liabilities at December 31, 2018 is $193,467.

Want to see more full solutions like this?

Chapter 7 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- i need financial question answerarrow_forwardIf your estimate is that Gravity Computers is going to sell 4,200 units at $35 per piece and each item costs $12, your estimated cost of goods sold in dollars would be: A. $35,400 B. $50,400 C. $147,000 D. None of the abovearrow_forwardWhat is the net operating income for the month under variable costing?arrow_forward

- Nexus Builders Inc. reported a Cost of Goods Sold (COGS) for the current year of $560,000. During the same period, the Inventory account increased by $25,000, and the Accounts Payable account decreased by $15,000. The amount of cash paid to suppliers for inventory is: A. $520,000 B. $585,000 C. $600,000 D. $535,000arrow_forwardPlease solve this question General accounting and step by step explanationarrow_forwardCan you provide a detailed solution to this financial accounting problem using proper principles?arrow_forward

- How much is the budgeted cost of goods sold for 2024?arrow_forwardDetermine net sales for the companyarrow_forwardThe ending inventory of Thornton Supplies Inc. is $45,000. If the beginning inventory was $62,000 and goods available for sale totaled $148,000, what is the cost of goods sold?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning