Concept explainers

a.

Record the events in the

a.

Explanation of Solution

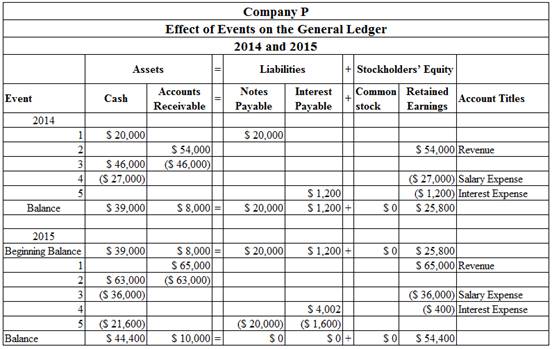

Record the events in accounting equation:

Table (1)

Working note 1: Calculate the amount of Accrued interest for 2014:

Working note 2: Calculate the amount of Accrued interest for 2015:

b.

Identify the amount of net

b.

Explanation of Solution

Cash flows from operating activities refer to the cash received or cash paid in day-to-day operating activities of a company.

Calculate the cash flow from operating activities:

| Corporation I | ||

| Statement of cash flow | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flow from operating activities | ||

| Cash collected from revenue | $46,000 | |

| Cash paid for operating expenses | ($27,000) | |

| Net cash flow from operating activities | $19,000 | |

Table (2)

Thus, the cash flow operating activities is $19,000 is the amount that would be reported on the statement of cash flows.

c.

Identify the amount of interest expense that would be reported on the 2014 income statement.

c.

Explanation of Solution

Interest expense refers to the cost of debt which is incurred during a particular accounting period. The interest amount is a fixed interest rate payable on the principal amount of debt.

The amount of interest expense that would be reported on the 2014 income statement is $1,200 (1).

Thus, the interest expense is $1,200 the amount that would be reported on the income statement.

d.

Identify the amount of total liabilities that would be reported on the 2014

d.

Explanation of Solution

Total liabilities are the sum of financial obligations and debt owed by business.

Calculate the total liabilities:

| Particulars | Amount ($) | Amount ($) |

| Notes payable | 20,000 | |

| Interest payable | 1,200 | |

| Total liabilities | 21,200 |

Table (3)

Thus, the amount of total liabilities that would be reported on the 2014 balance sheet is $21,200.

e.

Identify the amount of

e.

Explanation of Solution

Retained earnings are the portion of earnings kept by the business for the purpose of reinvestments, payment of debts, or for future growth.

The amount of retained earnings that would be reported on the 2014 balance sheet is $25,800.

f.

Identify the amount net cash flow from financing activities that would be reported on the 2014 statement of cash flows.

f.

Explanation of Solution

Cash flow from financing activities:

This section of cash flows statement provides information about the

Compute the cash from operating activities:

| Corporation I | ||

| Statement of cash flow | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flow from financing activities | ||

| Loan borrowed | $20,000 | |

| Net cash flow from operating activities | $20,000 | |

Table (4)

Thus, the amount of cash flow from financing activities that would be reported on the statement of cash flow is $20,000.

g.

Identify the amount of interest expense that would be reported on the 2015 income statement.

g.

Explanation of Solution

Interest expense refers to the cost of debt which is incurred during a particular accounting period. The interest amount is a fixed interest rate payable on the principal amount of debt.

The amount of interest expense that would be reported on the 2015 income statement is $400 (2).

h.

Identify the amount of net cash flow from operating activities that would be reported on the 2015 Statement of cash flows.

h.

Explanation of Solution

Cash flows from operating activities refer to the cash received or cash paid in day-to-day operating activities of a company.

Calculate the cash flow from operating activities:

| Corporation I | ||

| Statement of cash flow | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flow from operating activities | ||

| Cash collected from accounts receivable | $63,000 | |

| Cash paid for operating expenses | ($36,000) | |

| Cash paid for interest | ($1,600) | |

| Net cash flow from operating activities | $25,400 | |

Table (5)

Thus, the cash flow operating activities that would be reported on the statement of cash flows is $25,400.

i.

Identify the amount of total assets that would be reported on the 2015 balance sheet.

i.

Explanation of Solution

Calculate the total assets:

| Particulars | Amount ($) | Amount ($) |

| Cash | 44,400 | |

| Accounts receivable | 10,000 | |

| Total liabilities | 54,400 |

Table (6)

Thus, the amount of total assets that would be reported on the 2015 balance sheet is $54,400

Want to see more full solutions like this?

Chapter 7 Solutions

Survey Of Accounting

- General accounting questionarrow_forwardA company uses the weighted-average method for inventory costing. At the end of the period, 19,500 units were in the ending Work in Process inventory and are 100% complete for materials and 72% complete for conversion. The equivalent costs per unit are; materials, $2.75, and conversion $2.40. Compute the cost that would be assigned to the ending Work in Process inventory for the period.arrow_forwardWhat is the amount of manufacturing overhead incurred by silverstone ? General accountingarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education