a.

Indicate the event that affects the

a.

Explanation of Solution

Income statement:

Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Balance Sheet:

Balance sheet summarizes the assets, the liabilities, and the

Statement of cash flows

The financial statement that shows the changes in cash flows from operating, investing, and financing activities is referred to as statement of cash flows.

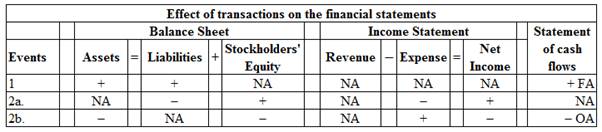

Indicate the event that affects the balance sheet, income statement, and statement of cash flows and also indicate whether the increases (+), decreases (-), or does not affect (NA) each element of the financial statements as follows:

Table (1)

b.

Ascertain the carrying value (face value less discount or plus premium) of the bond liability as of December 31, year 2014.

b.

Explanation of Solution

Bonds

Bonds are a kind of interest bearing notes payable, usually issued by companies, universities and governmental organizations. It is a debt instrument used for the purpose of raising fund of the corporations or governmental agencies. If selling price of the bond is equal to its face value, it is called as par on bond. If selling price of the bond is lesser than the face value, it is known as discount on bond. If selling price of the bond is greater than the face value, it is known as premium on bond.

Straight-line amortization bond

Ascertain the carrying value (face value less discount or plus premium) of the bond liability as of December 31, year 2014 as follows:

| Particulars | $ |

| Bonds payable | 300,000 |

| Add: Premium on bonds payable (4) | 4,050 |

| Carrying value of the bond at December 31, Year 2014 | 304,050 |

Table (2)

Therefore, the carrying value of the bond at December 31, year 2014 is $304,050.

Working note 1: Calculate the premium rate:

Working note 2: Calculate the value of premium:

Working note 3: Calculate bond premium amortized during the current year:

Working note 4: Calculate the premium on bonds payable at the end of the 2014:

c.

Calculate the interest expense paid during the year 2014.

c.

Explanation of Solution

Interest Expense: The cost of debt which is incurred during a particular accounting period is called interest expense. The interest amount is a fixed interest rate payable on the principal amount of debt.

Calculate the interest expense paid during the year 2014 as follows:

| Particulars | $ |

| Interest expense (5) | 18,000 |

| Less: Bond premium amortized during the current year 1 (3) | (450) |

| Interest expense paid during the current year 2014 | 17,550 |

Table (3)

Therefore, the interest expense paid during the current year is $17,550.

Working note 5: Calculate the value of interest expense:

d.

Ascertain the carrying value (face value less discount or plus premium) of the bond liability as of December 31, year 2015.

d.

Explanation of Solution

Ascertain the carrying value (face value less discount or plus premium) of the bond liability as of December 31, year 2015 as follows:

| Particulars | $ |

| Bonds payable | 300,000 |

| Add: Premium on bonds payable (7) | 3,600 |

| Carrying value of the bond at December 31, Year 2015 | 303,600 |

Table (4)

Therefore, the carrying value of the bond at December 31, year 2015 is $303,600.

Working note 6: Calculate bond premium amortized during the current year:

Working note 7: Calculate the premium on bonds payable at the end of the year 2015:

e.

Calculate the interest expense paid during the year 2015.

e.

Explanation of Solution

Calculate the interest expense paid during the year 2015:

| Particulars | $ |

| Interest expense (5) | 18,000 |

| Less: Bond premium amortized during the current year 2014 (6) | 450 |

| Interest expense paid during the current year 2015 | 17,550 |

Table (5)

Therefore, the interest expense paid during the current year 2015 is $17,550.

Want to see more full solutions like this?

Chapter 7 Solutions

Survey Of Accounting

- Kensington Textiles, Inc. manufactures customized tablecloths. An experienced worker can sew and embroider 10 tablecloths per hour. Due to the repetitive nature of the work, employees take a 10-minute break after every 10 tablecloths. Additionally, before starting each batch of 10 tablecloths, workers spend 8 minutes cleaning and setting up their sewing machines. Calculate the standard quantity of direct labor for one tablecloth.arrow_forwardSolvearrow_forwardProblem: The bank statement balance of $7,000 does not include a check outstanding of $1,000, a deposit in transit of $275, and another company's $250 check erroneously charged against your firm's account. The reconciled bank balance is__?arrow_forward

- Please help mearrow_forwardDo fast answer of this accounting questionsarrow_forwardNick and Partners, a law firm, worked on a total of 1,000 cases this month, 800 of which were completed during the period. The remaining cases were 40% complete. The firm incurred $180,000 in direct labor and overhead costs during the period and had $4,800 in direct labor and overhead costs in beginning inventory. Using the weighted average method, what was the total cost of cases completed during the period?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education