Prepare and Interpret Income Statements; Changes ¡n Both Sales and Production; Lean Production L07—1, L07—2, L07—3

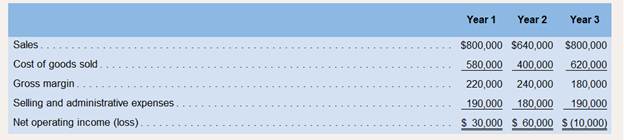

Starfax, Inc., manufactures a small part that is widely used in various electronic products such as home computers. Results for the first threeyears of operations were as follows (absorption costing basis):

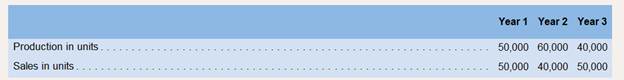

In the latter part of Year 2, a competitor went out of business and in the process dumped a large number of units on the market. As a result,Starfax’s sales dropped by 20% during Year 2 even though production increased during the year. Management had expected sales to remain constant at 50,000 units; the increased production was designed to provide the company with a buffer of protection against unexpected spurts in demand. By the start of Year 3, management could see that it had excess inventory and that spurts in demand were unlikely. To reduce the excessive inventories, Starfax cut back production during Year 3, as shown below:

In the latter part of Year 2, a competitor went out of business and in the process dumped a large number of units on the market. As a result,Starfax’s sales dropped by 20% during Year 2 even though production increased during the year. Management had expected sales to remain constant at 50,000 units; the increased production was designed to provide the company with a buffer of protection against unexpected spurts in demand. By the start of Year 3, management could see that it had excess inventory and that spurts in demand were unlikely. To reduce the excessive inventories, Starfax cut back production during Year 3, as shown below:

Additional information about the company follows:

Additional information about the company follows:

a. The company’s plant is highly automated. Variable manufacturing expenses (direct materials, direct labor. and variablemanufacturing

b. A new fixed manufacturing overhead rate is computed each year based that year’s actual fixed manufacturing overhead costsdivided by the actual number of units produced.

c. Variable selling and administrative expenses were $1 per unit sold in each year. Fixed selling and administrative expensestotaled $140.000 per year.

d. The company uses a FIFO inventory flow assumption. (FIFO means first-in first-out. In other words, it assumes that theoldest units in inventory are sold first.)

Starfax’s management can’t understand why profits doubled during Year 2 when sales dropped by 20% and why a loss was incurred during Year3 when sales recovered to previous levels.

Required:

1. Prepare a contribution format variable costing income statement for each year.

2. Refer to the absorption costing income statements above.

a. Compute the unit product cost in each year under absorption costing. Show how much of this cost is variable and how much is fixed.

b. Reconcile the variable costing and absorption costing net operating income figures for each year.

3. Refer again to the absorption costing income statements. Explain why net operating income was higher in Year 2 than it was in Year 1under the absorption approach, in light of the fact that fewer units were sold in Year 2 than in Year 1.

4. Refer again to the absorption costing income statements. Explain why the company suffered a loss in Year 3 but reported a profit in Year1 although the same number of units was sold in each year.

5. a. Explain how operations would have differed in Year 2 and Year 3 if the company had been using Lean Production, with the result thatending inventory was zero.

b. If Lean Production had been used during Year 2 and Year 3, what would the company’s net operating income (or loss) have been ineach year under absorption costing? No computations are necessary.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- Determine the cost per equivalent unit of conversion on these general accounting questionarrow_forwardCarla Vista Corporation had a projected benefit obligation of $2,890,000 and plan assets of $3,097,000 at January 1, 2025. Carla Vista also had a net actuarial loss of $437,680 in accumulated OCI at January 1, 2025. The average remaining service period of Carla Vista's employees is 7.9 years. Compute Carla Vista's minimum amortization of the actuarial loss. Minimum amortization of the actuarial lossarrow_forwardChapter 15 Homework i 10 0.83 points Saved Help Save & Exit Submit Check my work QS 15-8 (Algo) Computing predetermined overhead rates LO P3 A company estimates the following manufacturing costs at the beginning of the period: direct labor, $520,000; direct materials, $216,000; and factory overhead, $141,000. Required: eBook 1. Compute its predetermined overhead rate as a percent of direct labor. 2. Compute its predetermined overhead rate as a percent of direct materials. Ask Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 References Mc Graw Hill Compute its predetermined overhead rate as a percent of direct labor. Overhead Rate Numerator: 1 Denominator: = Overhead Rate = Overhead Rate = 0arrow_forward

- hello teacher please solve questions general accountingarrow_forwardCampbell Soup Company reported pension expense of $94 million and contributed $81.5 million to the pension fund. Prepare Campbell's journal entry to record pension expense and funding, assuming campbell has no OCI amounts.arrow_forwardProvide accounting questionarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning