Segmented Income Statement L07—4

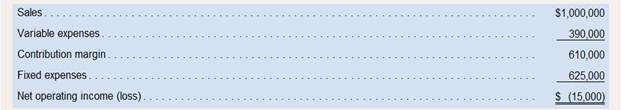

Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most recentmonthly contribution format income statement:

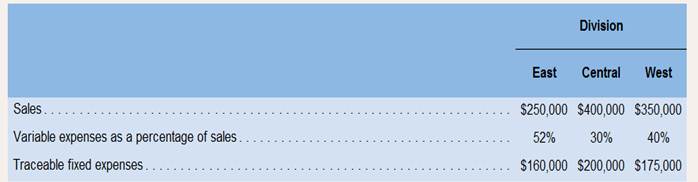

In an effort to resolve the problem, the company would like to prepare an income statement segmented by division. Accordingly, theAccounting Department has developed the following information:

Required:

Required:

1. Prepare a contribution format income statement segmented by divisions.

2. The Marketing Department has proposed increasing the West Division’s monthly advertising by $1 5:000 based on the belief that it wouldincrease that division’s sales by 20%. Assuming these estimates are accurate, how much would the Company’s net operating incomeincrease (decrease) if the proposal is implemented?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- Which of the following is classified as a current liability?A. Mortgage Payable due in 10 yearsB. Accounts PayableC. Bonds PayableD. Equipment Loan due in 5 yearsneed helparrow_forwardCan you help me solve this financial accounting problem using the correct accounting process?arrow_forwardWhich of the following is classified as a current liability?A. Mortgage Payable due in 10 yearsB. Accounts PayableC. Bonds PayableD. Equipment Loan due in 5 years Dont use AIarrow_forward

- I need correct answer A company purchased equipment for $50,000. The equipment has a useful life of 10 years and no salvage value. Which of the following journal entries is correct for recording one year of straight-line depreciation? A.Debit: Equipment $5,000Credit: Cash $5,000 B.Debit: Depreciation Expense $5,000Credit: Accumulated Depreciation $5,000 C.Debit: Accumulated Depreciation $5,000Credit: Equipment $5,000 D.Debit: Depreciation Expense $50,000Credit: Equipment $50,000arrow_forwardWhat type of account is Unearned Revenue?A. AssetB. EquityC. LiabilityD. Expense Dont use AIarrow_forwardA company purchased equipment for $50,000. The equipment has a useful life of 10 years and no salvage value. Which of the following journal entries is correct for recording one year of straight-line depreciation? A.Debit: Equipment $5,000Credit: Cash $5,000 B.Debit: Depreciation Expense $5,000Credit: Accumulated Depreciation $5,000 C.Debit: Accumulated Depreciation $5,000Credit: Equipment $5,000 D.Debit: Depreciation Expense $50,000Credit: Equipment $50,000Need helparrow_forward

- A company purchased equipment for $50,000. The equipment has a useful life of 10 years and no salvage value. Which of the following journal entries is correct for recording one year of straight-line depreciation? A.Debit: Equipment $5,000Credit: Cash $5,000 B.Debit: Depreciation Expense $5,000Credit: Accumulated Depreciation $5,000 C.Debit: Accumulated Depreciation $5,000Credit: Equipment $5,000 D.Debit: Depreciation Expense $50,000Credit: Equipment $50,000arrow_forwardI need help. Which of the following transactions would not affect owner’s equity?A. Earning revenueB. Paying rent expenseC. Receiving a loan from the bankD. Paying dividendsarrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,