Enterprise Fund

Required

- a. For fiscal year 2020, prepare general journal entries for the Water Utility Fund using the following information.

- 1. The amount in the Accrued Utility Revenue account was reversed.

- 2. Billings to customers for water usage during fiscal year 2020 totaled $2,982,557; $193,866 of the total was billed to the General Fund.

- 3. Cash in the amount of $260,000 was received. The cash was for interest earned on investments and $82,000 in accrued interest.

- 4. Expenses accrued for the period were management and administration, $360,408; maintenance and distribution, $689,103; and treatment plant, $695,237.

- 5. Cash receipts for customer deposits totaled $2,427.

- 6. Cash collections on customer accounts totaled $2,943,401, of which $209,531 was from the General Fund.

- 7. Cash payments for the period were as follows: Accounts Payable, $1,462,596; interest (which includes the interest payable), $395,917; bond principal, $400,000; machinery and equipment, $583,425; and return of customer deposits, $912.

- 8. A state grant amounting to $475,000 was received to help pay for new water treatment equipment.

- 9. Accounts written off as uncollectible totaled $10,013.

- 10. The utility fund transferred $800,000 in excess operating income to the General Fund.

- 11.

Adjusting entries for the period were recorded as follows:depreciation on buildings was $240,053 and on machinery and equipment was $360,079; the allowance for uncollectible accounts was increased by $14,913; an accrual for unbilled customer receivables was made for $700,000; accrued interest income was $15,849; and accrued interest expense was $61,406. - 12. The Revenue Bond Payable account was adjusted by $400,000 to record the current portion of the bond.

- 13. Closing entries and necessary adjustments were made to the net position accounts.

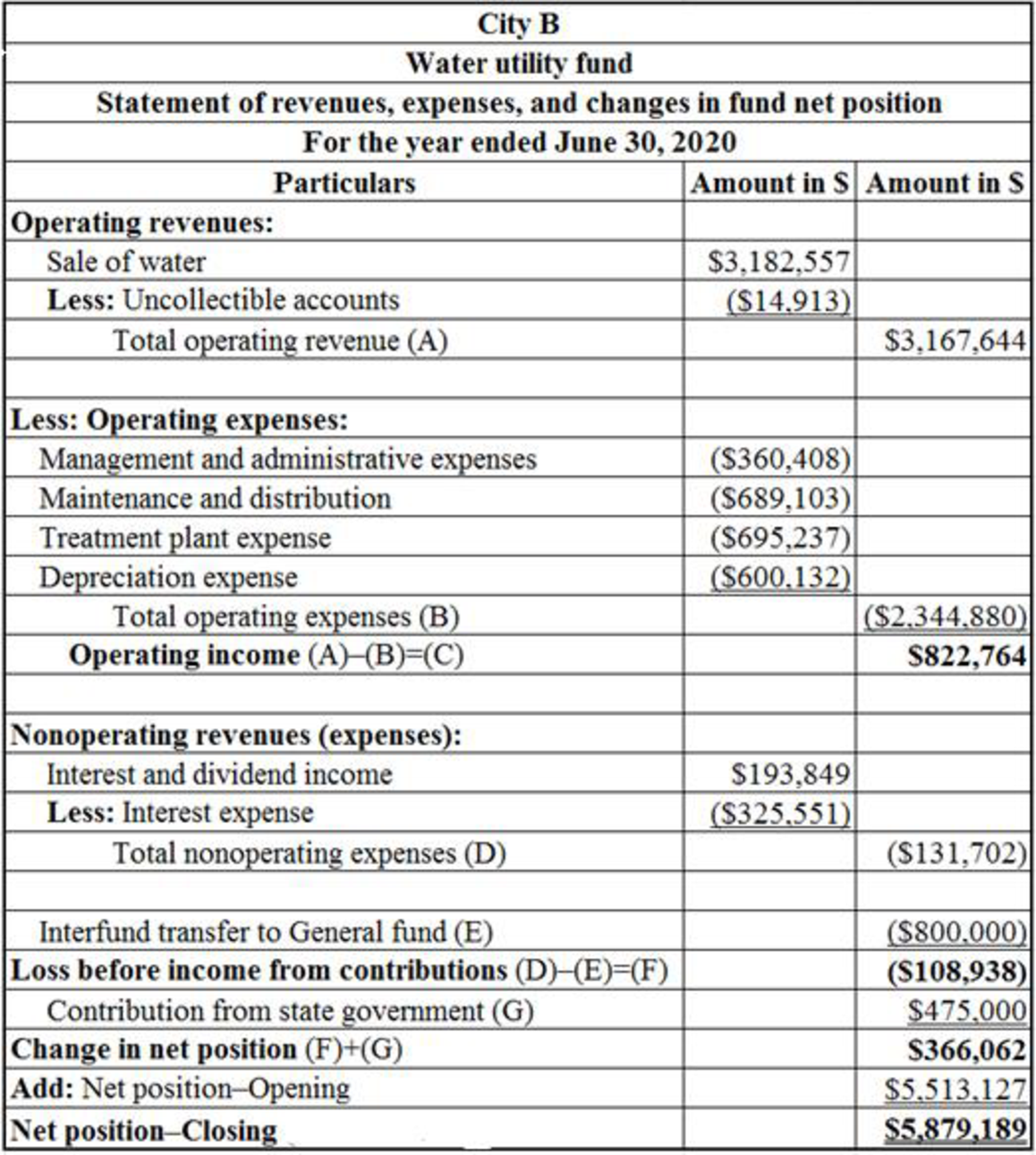

- b. Prepare a statement of revenues, expenses, and changes in fund net position for the Water Utility Fund for the year ended June 30, 2020.

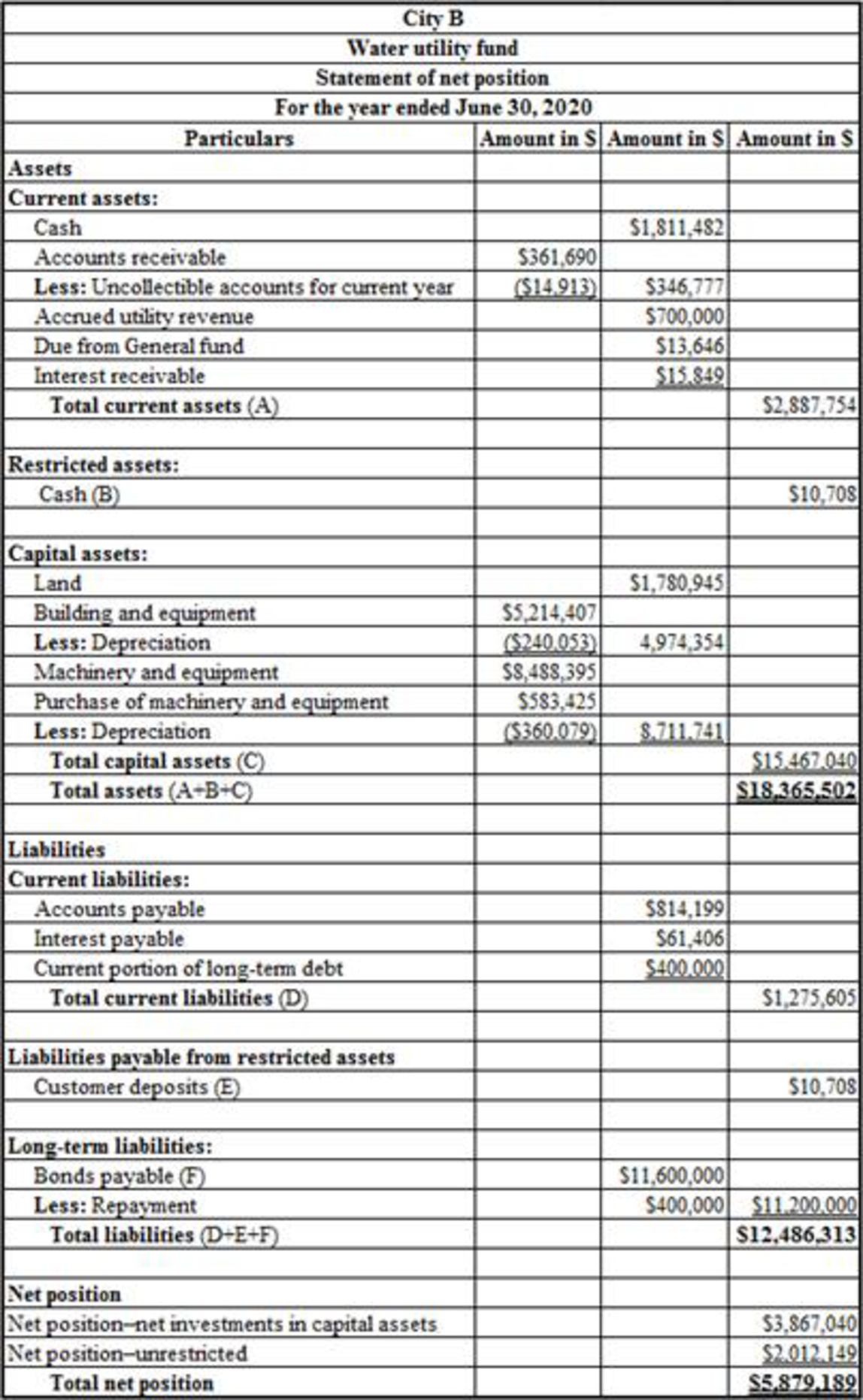

- c. Prepare a statement of net position for the Water Utility Fund as of June 30, 2020.

- d. Prepare a statement of

cash flows for the Water Utility Fund as of June 30, 2020.

a.

Prepare journal entries to record the transactions of Water Utility Fund.

Explanation of Solution

Enterprise funds: The enterprise funds record the activities that provide goods or service to the public. The enterprise funds are treated similar to that of business organizations.

Journal: Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare journal entry to reverse the “accrued utility revenue account”:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Sales of water | 500,000 | |||

| Accrued utility revenues | 500,000 | |||

| (To record the reverse of accrued utility revenue account) |

Table (1)

Prepare journal entry to record the accrual of revenue from the sale of water:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Accounts Receivable | 2,788,691 | |||

| Due from General fund | 193,866 | |||

| Sales of water | 2,982,557 | |||

| (To record the accrual of revenue from the sale of water) |

Table (2)

Prepare journal entry to record the interest income received and accrued:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash | 260,000 | |||

| Interest Income | 178,000 | |||

| Interest Receivable | 82,000 | |||

| (To record the interest income received and accrued) |

Table (3)

Prepare journal entry to record the accrual of expenses:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Management and administrative expense | 360,408 | |||

| Maintenance and Distribution | 689,103 | |||

| Treatment Plant Expense | 695,237 | |||

| Accounts Payable | 1,744,748 | |||

| (To record the accrual of expenses) |

Table (4)

Prepare journal entry to record the cash receipt for customer deposits:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash (restricted) | 2,427 | |||

| Customer deposits | 2,427 | |||

| (To record the cash receipts for customer deposits) |

Table (5)

Prepare journal entry to record the cash collected on customer account and general fund:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash | 2,943,401 | |||

| Accounts Receivable | 2,733,870 | |||

| Due from General Fund | 209,531 | |||

| (To record the cash collected on customer account and general fund) |

Table (6)

Prepare journal entry to record the payment of expenses and return of customer deposit:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Accounts Payable | 1,462,596 | |||

| Interest expense | 264,145 | |||

| Interest Payable | 131,772 | |||

| Current portion of long-term debt | 400,000 | |||

| Machinery and equipment | 583,425 | |||

| Customer deposits | 912 | |||

| Cash ($2,943,401-$209,531) | 2,841,938 | |||

| Cash (restricted) | 912 | |||

| (To record the payment of expenses and return of customer deposits) |

Table (7)

Prepare journal entry to record the receipt of state grant:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash | 475,000 | |||

| Contribution(capital grant) | 475,000 | |||

| (To record the receipt of grant from the state) |

Table (8)

Prepare journal entry to write off the uncollectible accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Allowance for uncollectible account | 10,013 | |||

| Accounts receivable | 10,013 | |||

| (To record the write off the uncollectible account) |

Table (9)

Prepare the journal entry to record the inter-fund fund transfer:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Interfund transfer- General fund | 800,000 | |||

| Cash | 800,000 | |||

| (To record the receipt of funds from general fund) |

Table (10)

Prepare journal entry to record the depreciation expense on building:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense - Building | 240,053 | |||

| Allowance for depreciation - Building | 240,053 | |||

| (To record the depreciation expense on building) |

Table (11)

Prepare journal entry to record the depreciation expense on machinery and equipment:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Machinery and equipment | 360,079 | |||

| Allowance for depreciation - Machinery and equipment | 360,079 | |||

| (To record the depreciation expense on machinery and equipment) |

Table (12)

Prepare journal entry to create provision for uncollectible accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Provision for uncollectible account | 14,913 | |||

| Allowance for uncollectible account | 14,913 | |||

| (To record the increase in uncollectible account) |

Table (13)

Prepare journal entry to record the accrual of utility revenues:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Accrued Utility Revenue | 700,000 | |||

| Sales of Water | 700,000 | |||

| (To record the increase in uncollectible account) |

Table (14)

Prepare journal entry to record the accrual of interest income:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Interest Receivable | 15,849 | |||

| Interest Income | 15,849 | |||

| (To record the accrual of interest income) |

Table (15)

Prepare journal entry to record the accrual of interest expense:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Interest Expense | 61,406 | |||

| Interest Payable | 61,406 | |||

| (To record the accrual of interest expense) |

Table (16)

Prepare journal entry to adjust the revenue bond payable and record the current portion of long-term debt:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Revenue bonds payable | 400,000 | |||

| Current portion of long-term debt | 400,000 | |||

| (To record the current portion of long-term debt) |

Table (17)

Prepare journal entry to close all the nominal accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Sales of water | 3,182,557 | |||

| Interest income | 193,849 | |||

| Contribution (capital grant) | 475,000 | |||

| Management and administrative expense | 360,408 | |||

| Maintenance and distribution | 689,103 | |||

| Treatment plant expense | 695,237 | |||

| Interfund transfer- general fund | 800,000 | |||

| Interest Expense | 325,551 | |||

| Depreciation expense-building | 240,053 | |||

| Depreciation expense- machinery and equipment | 360,079 | |||

| Uncollectible account | 14,913 | |||

| Net position-unrestricted (balancing figure) | 366,062 | |||

| (To record closing of nominal accounts) |

Table (18)

Prepare journal entry to allocate the increase in “net investment in capital assets” to the “unrestricted net position”:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Net position -Unrestricted | 383,293 | |||

| Net position-net investment in capital assets | 383,293 | |||

| (To record the increase in “net investment in capital assets” to the “unrestricted net position) |

Table (19)

Working note: Determine the amount of increase in the “net investments in capital assets”.

Step 1: Calculate the ending balance of “net investments in capital assets”.

Step 2: Calculate the amount of increase in the “net investments in capital assets”.

b.

Prepare a “statement of revenues, expenses, and changes in fund net position” for Central Station Fund.

Explanation of Solution

Statement of revenues, expenses and changes in net position: Statement of activities is the operating statement that reports revenues, expenses, and changes in net position during the year.

Prepare a “statement of revenues, expenses, and changes in fund net position” for Water utility fund.

Table (20)

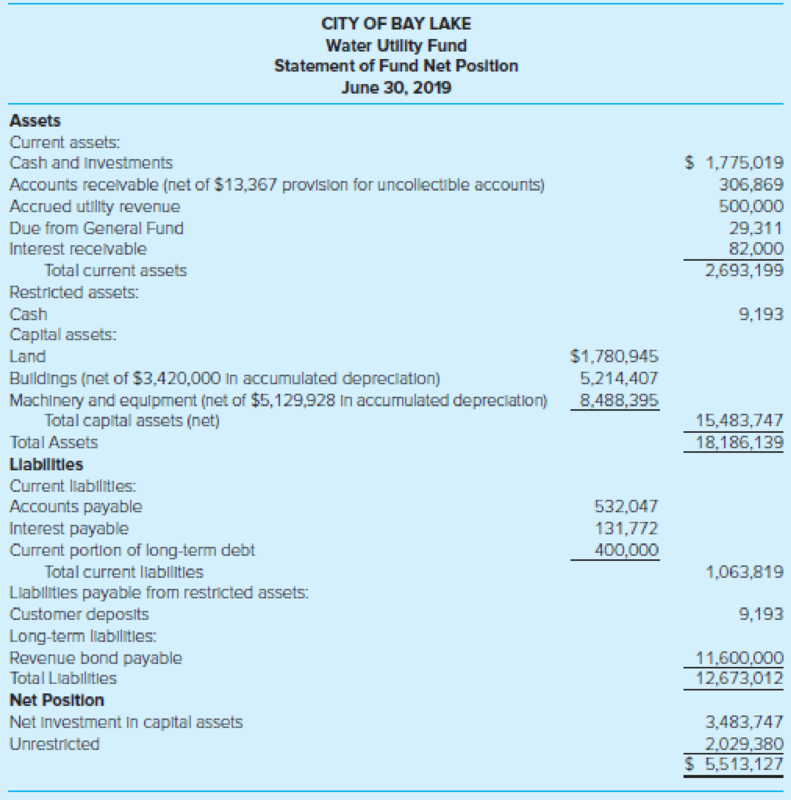

Working note: Determine the amount of net position-opening.

Before the fiscal year adjustment, the amount of unrestricted net position is $2,029,380 and the net position of “net investment is capital assets” calculated above is $3,483,747. Hence, the total net position-Opening is $5,513,127

(c)

Prepare a “statement of net position” for Water Utility Fund.

Explanation of Solution

Statement of net position: Statement of financial position is a balance sheet that reports the assets, deferred outflow of resources, liabilities, deferred inflow of resources and the residual amount or net position of the government at the end of the fiscal year.

Prepare a “statement of net position” for Water Utility Fund.

Table (21)

Working notes:

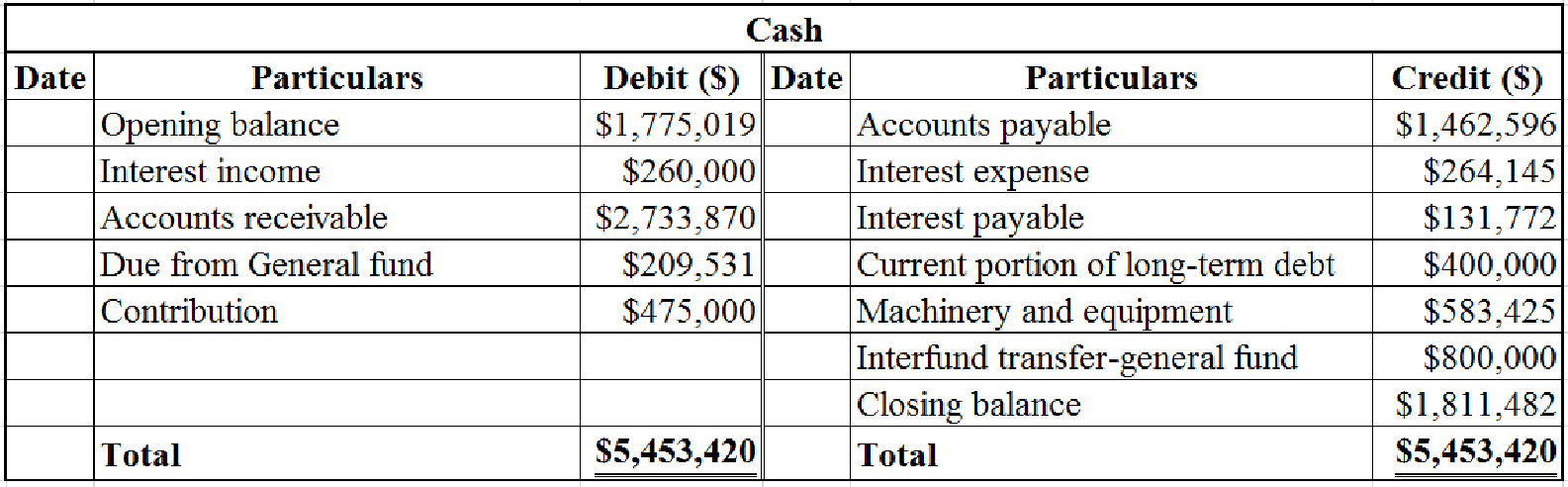

- Determine the closing balance of cash account.

Table (22)

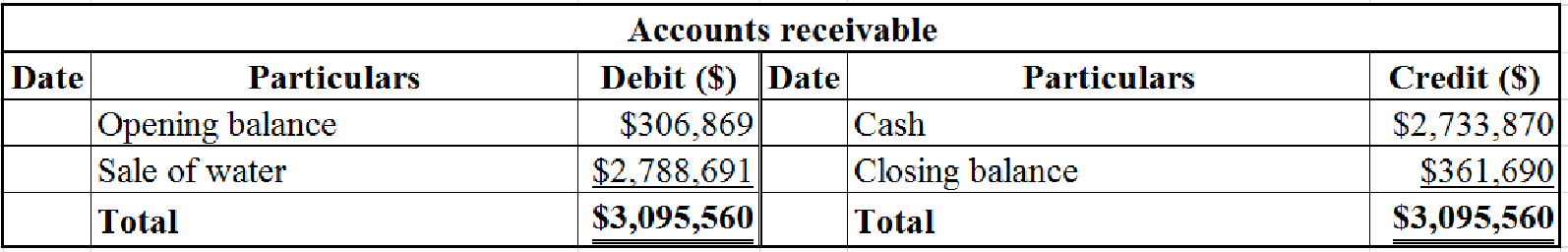

- Determine the closing balance of accounts receivable.

Table (23)

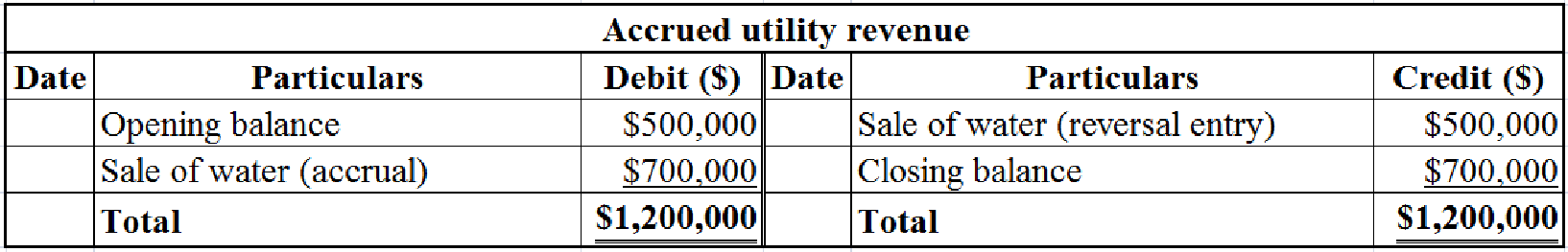

- Determine the closing balance of accrued utility revenue.

Table (24)

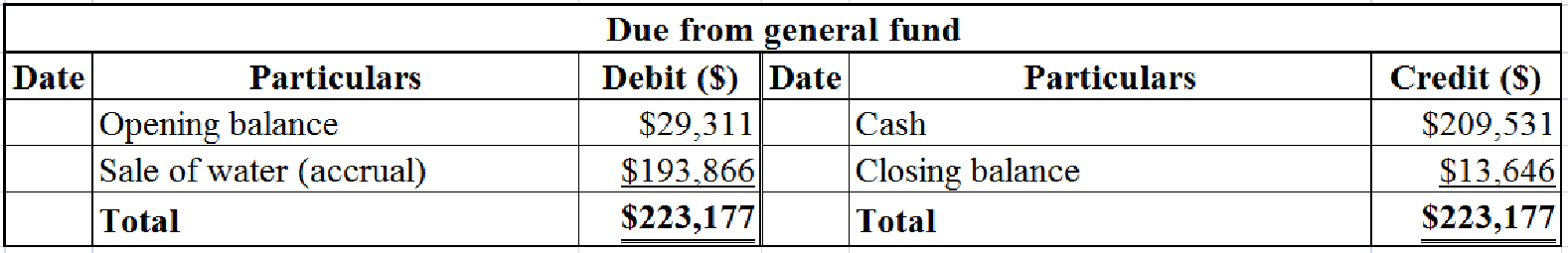

- Determine the closing balance of “due from general fund”.

Table (25)

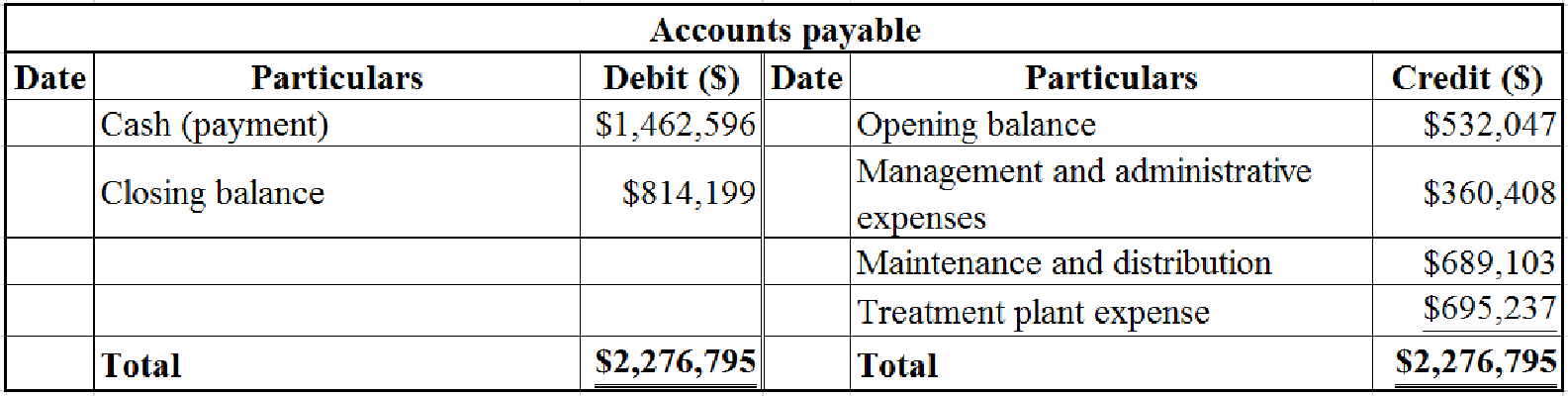

- Determine the closing balance of accounts payable.

Table (26)

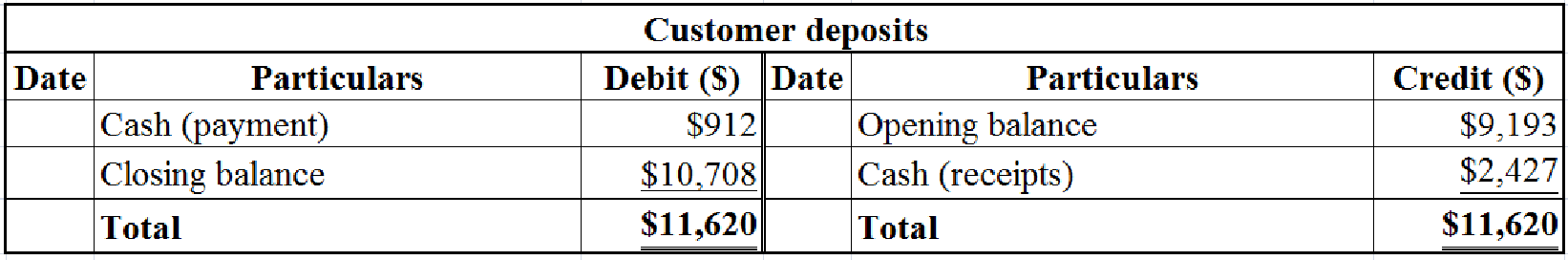

- Determine the closing balance of customer deposits.

Table (27)

- Determine the net position of unrestricted assets as on June 30, 2020.

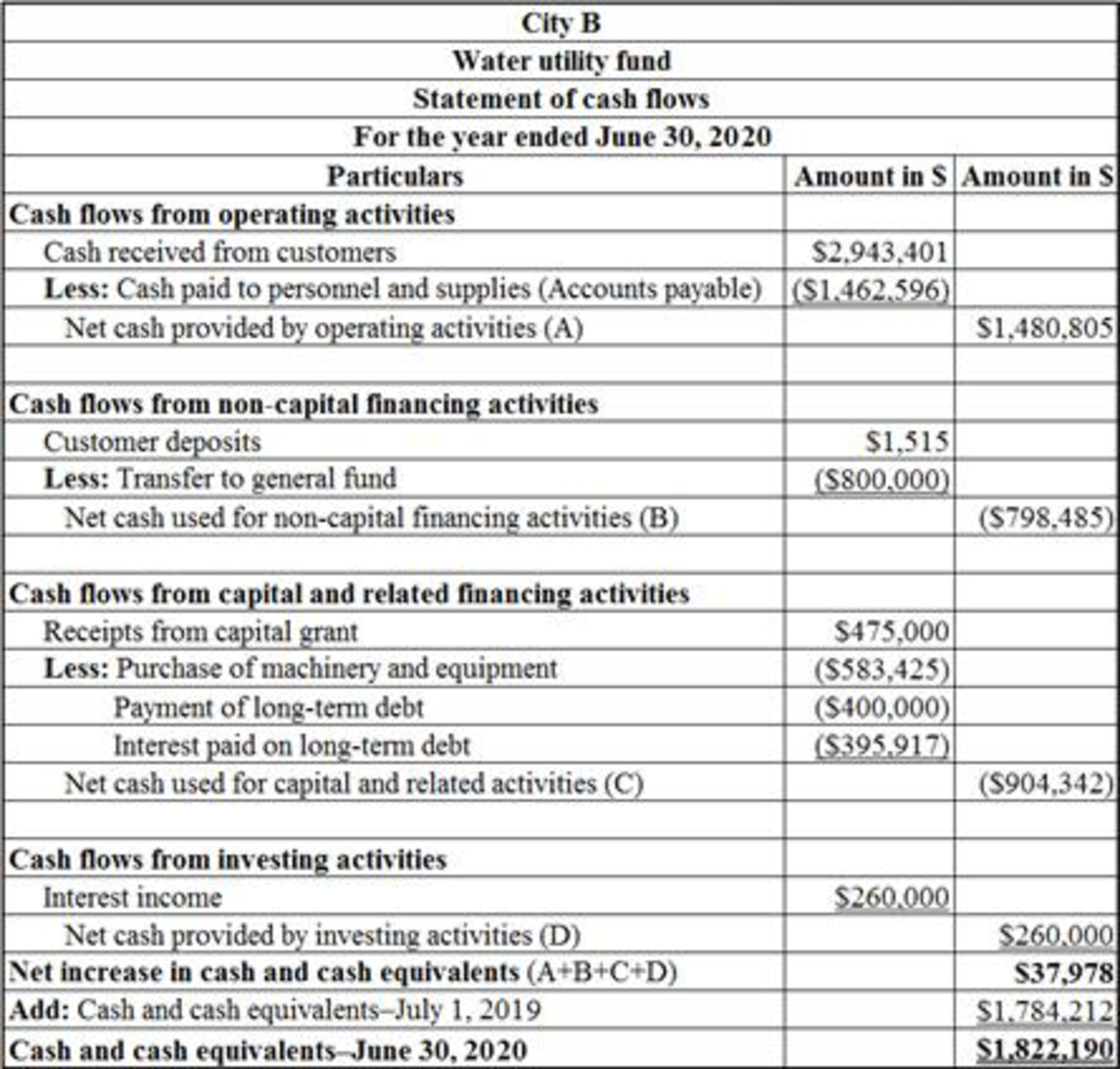

(d)

Prepare “a statement of cash flows” for water Utility Fund.

Explanation of Solution

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Prepare “a statement of cash flows” for water Utility Fund.

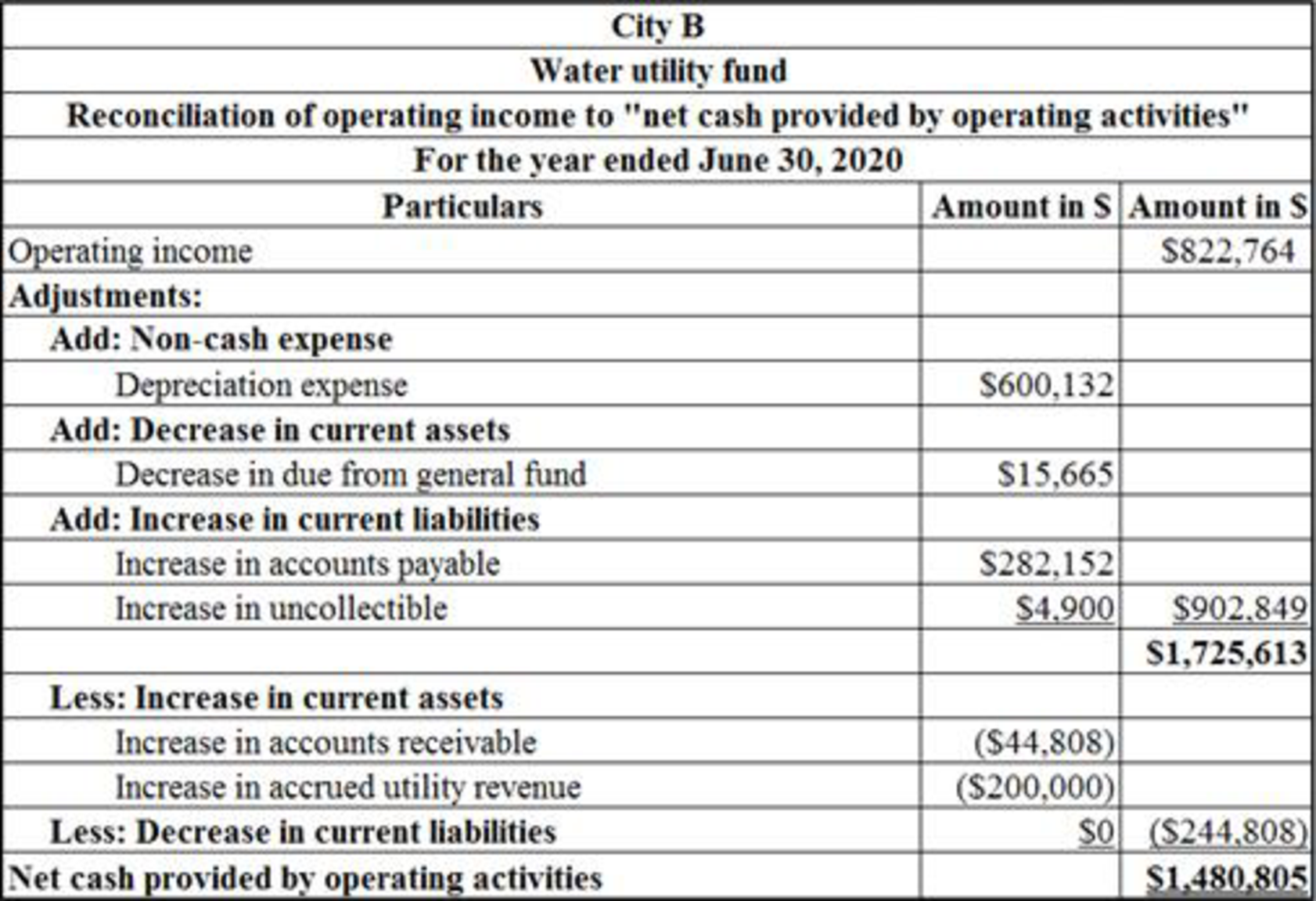

Step 1: Prepare the reconciliation statement to reconcile the operating loss with the “net cash used for operating activities”.

Table (28)

Working notes:

- Determine the increase in accounts payable.

The opening balance of accounts payable is $532,047 and the closing balance of accounts payable is $814,199. Hence, the accounts payable is increased by $282,152

- Determine the increase in “due from general fund”.

The opening balance of “due from general fund” is $29,311 and the closing balance of “due from general fund” is $13,646. Hence, the “due from general fund” is decreased by $15,665

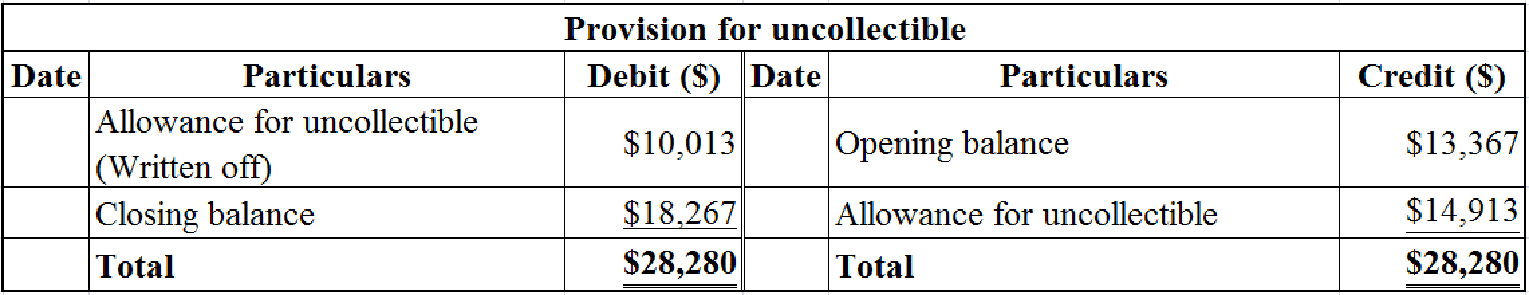

- Determine the balance in provision for uncollectible account.

Table (29)

- Determine the increase in uncollectible.

The opening balance of uncollectible is $13,367 and the closing balance of uncollectible is $18,267. Hence, the uncollectible is increased by $4,900

- Determine the increase in accounts receivable.

The opening balance of accounts receivable is $306,869. The closing balance of accounts receivable is $361,690. The written off portion of accounts receivable is $10,013. So, the net closing balance of accounts receivable is $351,677

- Determine the increase in accrued utility revenue.

The opening balance of accrued utility revenue is $500,000 and the closing balance of accrued utility revenue is $700,000. Hence, the accrued utility revenue is increased by $200,000

Step 2: Prepare “a statement of cash flows”.

Table (30)

Want to see more full solutions like this?

Chapter 7 Solutions

ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

- Acorn Construction (calendar-year-end C corporation) has had rapid expansion during the last half of the current year due to the housing market's recovery. The company has record income and would like to maximize its cost recovery deduction for the current year. (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Note: Round your answer to the nearest whole dollar amount. Acorn provided you with the following information: Asset Placed in Service Basis New equipment and tools August 20 $ 3,800,000 Used light-duty trucks October 17 2,000,000 Used machinery November 6 1,525,000 Total $ 7,325,000 The used assets had been contributed to the business by its owner in a tax-deferred transaction two years ago. a. What is Acorn's maximum cost recovery deduction in the current year?arrow_forwardGeneral accountingarrow_forwardQuick answer of this accounting questionsarrow_forward

- I want to correct answer general accounting questionarrow_forwardDon't use ai given answer accounting questionsarrow_forwardMultiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education