ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

18th Edition

ISBN: 9781307515596

Author: RECK

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 12C

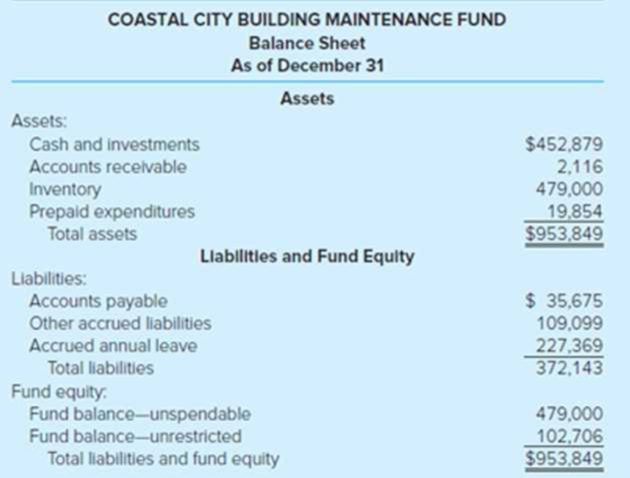

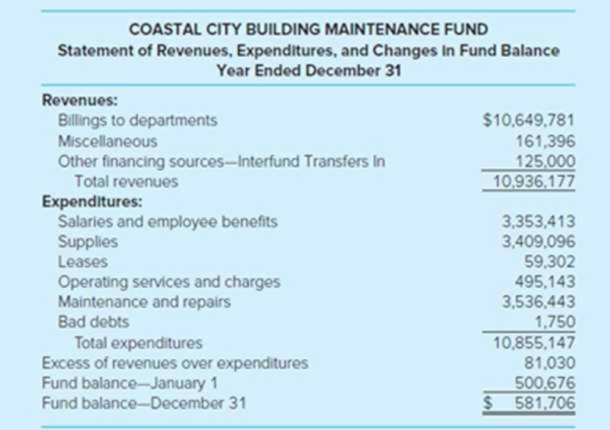

Internal Service Fund Reporting. (LO7-2) Financial statements for the Building Maintenance Fund, an internal service fund of Coastal City, are reproduced here. No further information about the nature or purposes of this fund is given in the annual report.

Required

- a. Assuming that the Building Maintenance Fund is an internal service fund, discuss whether the financial information is presented in accordance with GASB standards.

- b. If you were the manager of a city department that uses the services of the Building Maintenance Fund, what would you want to know in addition to the information disclosed in the financial statements?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Help me to solve this questions

correct answer please

Give this question financial accounting

Chapter 7 Solutions

ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

Ch. 7 - Prob. 1QCh. 7 - Explain the reporting requirements for internal...Ch. 7 - A member of the city commission insists that the...Ch. 7 - Prob. 4QCh. 7 - What is the purpose of the Restricted Assets...Ch. 7 - Prob. 6QCh. 7 - Prob. 7QCh. 7 - When do GASB standards require interfund...Ch. 7 - Prob. 9QCh. 7 - What is meant by segment information for...

Ch. 7 - Prob. 11QCh. 7 - Internal Service Fund Reporting. (LO7-2) Financial...Ch. 7 - Proprietary Fund Operating Statement. (LO7-1)...Ch. 7 - Enterprise Fund Golf Course Management. (LO7-1)...Ch. 7 - Prob. 17.1EPCh. 7 - Which of the following would most likely be...Ch. 7 - Under GASB standards, the City of Parkview is...Ch. 7 - Prob. 17.4EPCh. 7 - Which of the following events would generally be...Ch. 7 - Proprietary funds a. Are permitted to integrate...Ch. 7 - Prob. 17.7EPCh. 7 - Prob. 17.8EPCh. 7 - Prob. 17.9EPCh. 7 - Prob. 17.10EPCh. 7 - The City of Tutland issued 10 million, 6 percent,...Ch. 7 - The City of Tutland issued 10 million, 6 percent,...Ch. 7 - Prob. 18EPCh. 7 - Prob. 19EPCh. 7 - Central Garage Internal Service Fund. (LO7-2) The...Ch. 7 - Internal Service Fund Statement of Cash Flows....Ch. 7 - Tribute Aquatic Center Enterprise Fund. (LO7-5)...Ch. 7 - Net Position Classifications. (LO7-5) During the...Ch. 7 - Central Station Enterprise Fund. (LO7-5) The Town...Ch. 7 - Enterprise Fund Journal Entries and Financial...Ch. 7 - Net Position Classifications. (LO7-5) The Village...Ch. 7 - Enterprise Fund Statement of Cash Flows. (LO7-5)...Ch. 7 - AppendixSolid Waste Enterprise Fund. (LO7-6) Brown...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1.3 1.2.5 za When using a computerised accounting system, the paper work will be reduced in the organisation. Calculate the omitting figures: Enter only the answer next to the question number (1.3.1-1.3.5) in the NOTE. Round off to TWO decimals. VAT report of Comfy shoes as at 30 April 2021 OUTPUT TAX INPUT TAX NETT TAX Tax Gross Tax(15%) Gross (15%) Standard 75 614,04 1.3.1 Capital 1.3.2 9 893,36 94 924,94 Tax (15%) 1.3.3 Gross 484 782,70 75 849,08 -9 893,36 -75 849,08 Bad Debts TOTAL 1.3.4 4 400,00 1 922,27 14 737,42 -1 348,36 1.3.5 (5 x 2) (10arrow_forwardNonearrow_forwardWhat was her capital gains yield? General accountingarrow_forward

- L.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7. In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question:arrow_forwardWhat was her capital gains yield?arrow_forwardneed help this questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License