(Multiple Choice Problems and Computations) Identify the best answer for each of the following:

Questions 1 through 3 are based on the following scenario:

Matthew County issued a 6-month, 6%, $1,000,000 bond anticipation note on March 31, 20X5, to provide temporary financing for a major general government capital project. The issuance of long-term bonds had not yet received the legally required voter approval when the financial statements were issued, but most agree the voters will approve the referendum. However, in the event that the voters reject the long-term bond issue, the county has other sources it can use to finance the project.

- 1. Assuming the county has incurred $800,000 of construction costs on the project by the end of its fiscal year (June 30, 20X5), the fund balance of the Capital Projects Fund used to account for this project would be

- a. $185,000.

- b. $200,000.

- c. ($800,000).

- d. ($815,000).

- 2. Assume voter approval has in fact occurred as of the end of the fiscal year and all other legal requirements related to the bond issuance have been met. The county issued the bonds after the

balance sheet date (June 30, 20X5), but before the financial statements were issued and soon enough to use the bond proceeds to repay the bond anticipation notes. As of June 30, 20X5, the county should report fund balance in this Capital Projects Fund of - a. $185,000.

- b. $200,000.

- c. $800,000 deficit.

- d. $815,000 deficit.

- 3. Assume the BANs in question 2 were repaid when due from the proceeds of the bonds. The expenditures reported in the Capital Projects Fund for the repayment of the bond anticipation note principal and interest in the fiscal year ended June 30, 20X6, would be

- a. $0.

- b. $30,000.

- c. $1,000,000.

- d. $1,030,000.

Questions 4 and 5 are based on the following scenario:

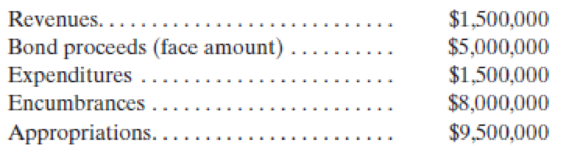

Robeson County has a Capital Projects Fund for its courthouse renovations. The appropriation authority for the fund continues until the end of the project. The voters approved a bond issue for the specific purpose of financing courthouse renovations, and the county commissioners committed a revenue source specifically for that purpose. The commission’s policy is that expenditures are presumed to be made first from bond proceeds, then from the committed revenue source. The fund has the following balances as of September 30, 20X8, its first fiscal year end:

- 4. Fund Balance should be reported as follows at September 30, 20X8:

- a. Restricted, $5,000,000.

- b. Assigned (by voters) $5,000,000.

- c. Restricted, $3,500,000 and Committed $1,500,000.

- d. Committed, $1,500,000 and Assigned, $3,500,000.

- 5. Assume that $1,500,000 of unassigned General Fund resources were transferred to the Capital Projects Fund from the General Fund to provide financing instead of the commission committing revenues specifically to the project. How should Fund Balance as of September 30, 20X8, be reported?

- a. Restricted, $5,000,000.

- b. Assigned (by voters) $5,000,000.

- c. Restricted, $3,500,000 and Assigned, $1,500,000.

- d. Restricted, $3,500,000 and Unassigned, $1,500,000.

Questions 6 through 9 are based on the following information:

The City of Cole is installing a lighting system in the Harvey Subdivision, which is considered to be a major general government capital project for the city. The system is being financed by levying $500,000 of special assessments on benefited property owners and transferring $750,000 (in the next year) from the General Fund. $100,000 of these assessments were due and collected during the current year. Also, as of the end of the fiscal year, the city had incurred expenditures of $750,000 on the project.

- 6. What amount of special assessment revenues should be reported in the Capital Projects Fund as of the end of the current year?

- a. $0—Special assessments should be accounted for in a Special Revenue Fund.

- b. $100,000.

- c. $500,000.

- d. $0—Special assessments should be accounted for as other financing sources, not revenues.

- 7. The effect of the preceding transactions on the net change in fund balance of the Capital Projects Fund for the fiscal year would be

- a. a decrease of $750,000.

- b. a decrease of $250,000.

- c. a decrease of $650,000.

- d. an increase of $500,000.

- 8. Assume that instead of levying the special assessments to finance a portion of the project, the city issued $500,000 of five-year, 6% notes payable six months before the end of the fiscal year. The net effect of the note issuance, as well as the incurred expenditures, on the net change in fund balance of the Capital Projects Fund for the fiscal year would be

- a. a decrease of $750,000 because the notes payable would be reported as a direct fund liability in the Capital Projects Fund.

- b. an increase of $500,000. The incurred expenditures would actually be reported as an increase to assets as the system will be a capitalized asset when it is completed.

- c. a decrease of $265,000. Expenditures as of the end of the fiscal year would include six months of accrued interest on the debt.

- d. a decrease of $250,000.

- 9. Assume that instead of levying the special assessments to finance a portion of the project, the city levies the special assessments to pay for the notes payable issued in Item 8. Of the $500,000 of special assessments levied, $100,000 is due and collected during the first year. What amount of special assessment revenues should be recognized in the Capital Projects Fund as of the end of the first fiscal year?

- a. $0. The special assessments should be reported in a Debt Service Fund.

- b. $0. Special assessments should be reported as other financing sources, not as revenues.

- c. $100,000.

- d. $500,000.

- 10. Luke County issued $20,000,000 par of capital improvement bonds for a general government project. The bonds were issued at a discount of 2% of par. The bond indenture requires that $500,000 of the proceeds be set aside for future debt service. These transactions should be reflected in the county’s Capital Projects Fund as

- a. other financing sources—bonds, $20,000,000.

- b. other financing sources—bonds, $19,600,000.

- c. other financing sources—bonds, $20,000,000; other financing uses—bond discount, $400,000; other financing uses—transfers out, $500,000.

- d. other financing sources—bonds, $19,600,000; debt service expenditures—$500,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Governmental and Nonprofit Accounting (11th Edition)

- Please do not give solution in image format ?.arrow_forwardSalvador County issued $25 million of 5 percent demand bonds for construction of a county maintenance building. The county has no take-out agreement related to the bonds. It estimates that 20 percent of the bonds would be demanded (called) by the buyers if interest rates increased by at least one percentage point. At year-end, rates on comparable debt were 7 percent. How should these demand bonds be reported in the governmental fund financial statements at year-end? A.) $25 million in the current liabilities section B.) $5 million in the governmental activities column AND $20 million would be reported in the schedule of changes in long-term obligations C.) $25 million in the long-term liabilities section of the governmental activities column D.) None of abovearrow_forwardSuppose the City of St. George, Utah, decides to assist residents by installing sidewalks in their neighborhood. Construction will be financed by cash provided from a ten-year, 3 percent, serial bond issue for which the government has no liability. Bonds mature at a rate of $500,000 per year. Area residents are assessed over a ten-year period to cover bond principal and interest payments. Events are as follows: 1. Serial bonds are issued, totaling $5,000,000. 2. Assessments are levied on area residents to cover the first year's principal and interest payments. 3. Assessments are collected and the first year's bond principal and interest are paid. Required Record the above events in a custodial fund. If a journal entry isn't required for an event, select No entry as your journal descriptions. Ref. Description 1 No entry No entry Debit Credit 0 0 0 0 To record issuance of serial bonds. 2 Additions Assessments receivable To record special assessment levy. 3 Cash Assessments receivable…arrow_forward

- The county of Santa Clara is building a new park. The main financing source will be $1,000,000 bond issue. In addition, the general fund will transfer $100,000 transfer to fund the capital project. Please record the journal entries for the Capital Project Fund & the Government-Wide financial statements. 1. The county has signed a contract with Spectacular Construction to construct the park $1,000,000 2.The $1,000,000 bonds were issued at par 3. Spectacular Construction billed the county of Santa Clara $1,000,000 upon completion of the project 4. The park is completedarrow_forward3. On the last day of the calendar year, the City of Soccerton borrowed $400,000 from the local bank as a short-term loan in anticipation of property tax collections in the month of January. The note is non-interest bearing, due in 30 days, and is discounted as a rate of 12% per year. Record this transaction from two perspectives: 1) from the governmental activities' perspective on the government-wide statements, and 2) from the General Fund perspective. (1) From the governmental activities' perspective: Date Account Name 12/31 (2) From the General Fund perspective Date Account Name 12/31 Debit Credit Debit Creditarrow_forwardThe voters of Salinas City authorized the construction of a new north-south expressway for a total cost of no more that $90 million. The voters also approved the issuance of $60 million of 5 percent general obligation bonds. The balance of the necessary funds will come from the following sources: $20 million from a federal grant and $10 million from a state grant. The city controls expenditures in capital project funds through project management. The city does not formally incorporate budgetary entries in the capital projects fund but it does use encumbrance accounting for control purposes. Assume that the city maintains its books and records in a manner that facilitates the preparation of the fund financial statements. Prepare journal entries in the capital projects fund, for the following transactions. The city (a) Issues $60 million of 5 percent general obligation bonds at 101. (b) Transfers the premium to the appropriate fund. (c) Incurs bid-related expenditures of $1,000. (d)…arrow_forward

- 7. In Wilayat ‘L’, the Parks and Recreation Department constructed a library in one of the county’s high growth areas. The construction was funded by a number of sources. Below is selected information related to the funding and closing of the Library Capital Project Fund. All activity related to the library construction occurred within the 2016 fiscal year. i. The county issued OMR 12,000,000, 8 percent bonds, with interest payable semiannually on June 30 and December 31. The bonds sold for 101 on July 30, 2015. Proceeds from the bonds were to be used for construction of the library, with all interest and premiums received to be used to service the debt issue. ii. A OMR 1,300,000 federal grant was received to help finance construction of the library. iii. The Library Special Revenue Fund transferred OMR 500,000 for use in construction of the library. iv. A construction contract was awarded in the amount of OMR 13,600,000. v. The library was completed on June 1, 2016, three…arrow_forwardDetermine the correct debit account from among the choices below: a. Expenditures b. Extraordinary Items c. Encumbrances d. Answer not included in the above selections The Debt Service Fund recognizes a principal payment that is currently due on a Bond debt. Answer 1 A contract is signed with ABC Construction for a project related to the Capital Projects Fund in the amount of $8,400,000. Answer 2 The city invests 30% of the bond proceeds in short term investments. Answer 3 A city’s water supply is contaminated by terrorists. Costs of clean-up, disposal, and importation of a fresh water supply total $50,000,000. Answer 4 The General Fund incurs and pays salaries totaling $400,000. Answer 5arrow_forwardonly need answers. nothing else. plz make it right and simple!arrow_forward

- Construction and debt transactions can affect more than one fund. During 2021 Luling Township engaged in the following transactions related to modernizing the bridge over the Luling River. The township accounts for long-term construction projects in a capital projects fund.• On July 1 it issued 10-year, 4 percent bonds with a face value of $1 million. The bonds were sold for $1,016,510, an amount that provides an annual yield of 3.8 percent (semiannual rate of 1.9 percent). The city incurred $10,000 in issue costs.• On August 1, it was awarded a state reimbursement grant of $800,000. During the year it incurred allowable costs of $600,000. Of these it paid $500,000 in cash to various contractors. It received $450,000 from the state, expecting to receive, early in 2022, the $150,000 difference between allowable costs incurred and cash received. Moreover, it expects to receive the balance of the grant later in 2022. • It invested the bond proceeds in short-term federal securities. During…arrow_forwardThe City of Minden entered into the following transactions during the year 2026. 1. 2. 3. 4. 5. 6. 7. 8. 9. A bond issue was authorized by vote to provide funds for the construction of a new municipal building, which it was estimated would cost $1,080,000. The bonds are to be paid in 10 equal installments from a Debt Service Fund, and payments are due March 1 of each year. Any premium on the bond issue, as well as any balance of the Capital Projects Fund, is to be transferred directly to the Debt Service Fund. An advance of $74,000 was received from the General Fund to underwrite a deposit on the land contract of $111,000. The deposit was made. Bonds of $992,000 were sold for cash at 102. It was decided not to sell all the bonds because the cost of the land was less than expected. Contracts amounting to $884,000 were let to Sunny and Company, the low bidder, for construction of the municipal building. The temporary advance from the General Fund was repaid and the balance on the land…arrow_forwardI need the journal entry for these questions As of January 1, 2020, the City of Monroe had $12,000,000 in general obligation bonds outstanding. Eliminate the expenditures for bond principal. Adjust for the interest accrued in the prior year government-wide statements, but recorded as an expenditure in the 2020 fund basis statements, ($12,000,000 × 0.03 × 6/12) = $180,000.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education