Governmental and Nonprofit Accounting (11th Edition)

11th Edition

ISBN: 9780133799569

Author: Robert J. Freeman, Craig D. Shoulders, Dwayne N. McSwain, Robert B. Scott

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 1.4E

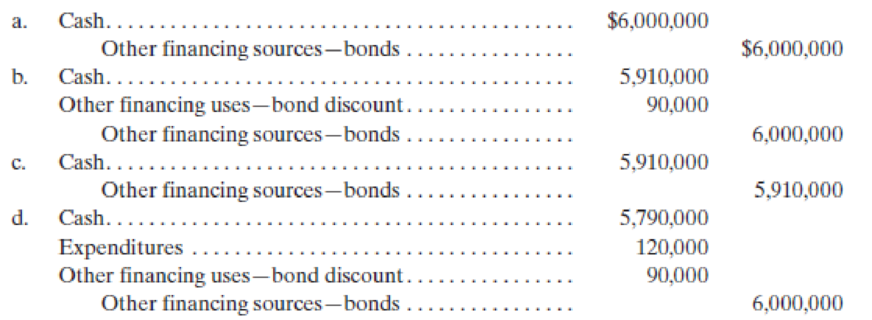

Wakefield Heights sold $6,000,000 of general obligation serial bonds at a 1.5% discount to finance the construction of a new recreation center. Bond issuance costs were 2% of the face amount of the bonds. The entry to record the sale of the bonds in a Capital Projects Fund would be

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the debt to equity ratio on these financial accounting question?

Provide answer to this accounting problem

Accounts receivable:130000, Accounts payable:90000

Chapter 7 Solutions

Governmental and Nonprofit Accounting (11th Edition)

Ch. 7 - When is a Capital Projects Fund used by a...Ch. 7 - Prob. 2QCh. 7 - What is the life cycle of a Capital Projects Fund?Ch. 7 - Why is each significant capital project usually...Ch. 7 - In what situations could several capital projects...Ch. 7 - Prob. 6QCh. 7 - Prob. 7QCh. 7 - Prob. 8QCh. 7 - Prob. 9QCh. 7 - Prob. 10Q

Ch. 7 - Prob. 11QCh. 7 - Prob. 12QCh. 7 - Which of the following general government capital...Ch. 7 - Budgets for Capital Projects Funds are a. often...Ch. 7 - Which of the following are sometimes reported as...Ch. 7 - Wakefield Heights sold 6,000,000 of general...Ch. 7 - Which of the following statements regarding the...Ch. 7 - Common expenditures in a Capital Projects Fund...Ch. 7 - Prob. 1.7ECh. 7 - In practice, which of the following is false...Ch. 7 - The funding sources for a Capital Projects Fund...Ch. 7 - Prob. 2.2ECh. 7 - When grant resources are received before...Ch. 7 - Bonds are sold to finance the construction of a...Ch. 7 - After restricted and committed levels of fund...Ch. 7 - Which of the following would not be reported on...Ch. 7 - The City of Hope received an unrestricted grant in...Ch. 7 - Expenditures are made in a Capital Projects Fund...Ch. 7 - A GAAP-based Statement of Revenues, Expenditures,...Ch. 7 - Prob. 2.10ECh. 7 - (General Ledger Entries) The following...Ch. 7 - (Long-Term Debt Issuances) Swenson Township issued...Ch. 7 - (Short Discussion and Analysis) Briefly discuss...Ch. 7 - (Statement of Revenues, Expenditures, and Changes...Ch. 7 - (Multiple Choice Problems and Computations)...Ch. 7 - Prob. 2PCh. 7 - (Statement of Revenues, Expenditures, and Changes...Ch. 7 - Prob. 6PCh. 7 - (CPF Journal EntriesBlue Earth County, Montana)...

Additional Business Textbook Solutions

Find more solutions based on key concepts

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

A typical discounted price of a AAA battery is 0.75. It is designed to provide 1.5 volts and 1.0 amps for about...

Engineering Economy (17th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- General Accountingarrow_forwardAmount of equity for quantum industries?arrow_forwardR-Mart has a beginning receivables balance on February 1 of $1050. Sales for February through May are $625, $698, $975, and $1,990, respectively. The accounts receivable period is 30 days. What is the amount of the April collections? Assume a year has 360 days. NO AI ANSWERarrow_forward

- What is the cash balance at the end of September on these general accounting question?arrow_forwardR-Mart has a beginning receivables balance on February 1 of $1050. Sales for February through May are $625, $698, $975, and $1,990, respectively. The accounts receivable period is 30 days. What is the amount of the April collections? Assume a year has 360 days.arrow_forwardTutor, solve this Accounting problemarrow_forward

- The monthly cost (in dollars) of a data plan for Mercury Communications is a linear function of the total data usage (in gigabytes). The monthly cost for 25 gigabytes of data is $45.50 and the monthly cost for 40 gigabytes is $58.00. What is the monthly cost for 28 gigabytes of data?solve this?arrow_forwardGeneral Accounting Question please answer this questionarrow_forwardWhat is the firm's equity on these financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

What is modified duration? | Dejargoned; Author: Mint;https://www.youtube.com/watch?v=5yLIybzb_OQ;License: Standard YouTube License, CC-BY