Contemporary Engineering Economics (6th Edition)

6th Edition

ISBN: 9780134105598

Author: Chan S. Park

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 15P

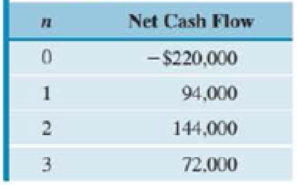

Consider an investment project with the cash flows given in Table P7.15.

- (a) Find the

IRR for this investment. - (b) Plot the present worth of the cash flow as a function of i.

- (c) On the basis of the IRR criterion, should the project be accepted at MARR = 15%?

TABLE P7.15

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please show how the graph is affected by these changes, utilizing all of the functions provided in the key next to the graph, with an updated graph.

#5. What is cardinality (aleph- naught, also called as aleph null or aleph 0) ?

not use ai please

Chapter 7 Solutions

Contemporary Engineering Economics (6th Edition)

Ch. 7 - Prob. 1PCh. 7 - Prob. 2PCh. 7 - Prob. 3PCh. 7 - Prob. 4PCh. 7 - Prob. 5PCh. 7 - Prob. 6PCh. 7 - Prob. 7PCh. 7 - Prob. 8PCh. 7 - Prob. 9PCh. 7 - Prob. 10P

Ch. 7 - Prob. 11PCh. 7 - Prob. 12PCh. 7 - Prob. 13PCh. 7 - Prob. 14PCh. 7 - Consider an investment project with the cash flows...Ch. 7 - Consider the investment projects given in Table...Ch. 7 - Prob. 17PCh. 7 - Prob. 18PCh. 7 - Consider the investment projects given in Table...Ch. 7 - Consider the investment projects given in Table...Ch. 7 - Prob. 21PCh. 7 - Prob. 22PCh. 7 - Consider the investment projects given in Table...Ch. 7 - Prob. 24PCh. 7 - Prob. 25PCh. 7 - Prob. 26PCh. 7 - Prob. 27PCh. 7 - Prob. 28PCh. 7 - Prob. 29PCh. 7 - Prob. 30PCh. 7 - Prob. 31PCh. 7 - Prob. 32PCh. 7 - Prob. 33PCh. 7 - Prob. 34PCh. 7 - Prob. 35PCh. 7 - Prob. 36PCh. 7 - Prob. 37PCh. 7 - Prob. 38PCh. 7 - Prob. 39PCh. 7 - Prob. 40PCh. 7 - Prob. 41PCh. 7 - Prob. 42PCh. 7 - Consider the two mutually exclusive investment...Ch. 7 - You are considering two types of automobiles....Ch. 7 - Prob. 45PCh. 7 - Prob. 46PCh. 7 - Fulton National Hospital is reviewing ways of...Ch. 7 - Prob. 48PCh. 7 - Consider the investment projects given in Table...Ch. 7 - Prob. 50PCh. 7 - Prob. 51PCh. 7 - Prob. 52PCh. 7 - Prob. 53PCh. 7 - Prob. 54PCh. 7 - Prob. 55PCh. 7 - Prob. 56PCh. 7 - Prob. 57PCh. 7 - Prob. 1STCh. 7 - Prob. 2STCh. 7 - Prob. 3STCh. 7 - Prob. 4STCh. 7 - Prob. 5ST

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- (d) Calculate the total change in qı. Total change: 007 (sp) S to vlijnsi (e) B₁ is our original budget constraint and B2 is our new budget constraint after the price of good 1 (p1) increased. Decompose the change in qı (that occurred from the increase in p₁) into the income and substitution effects. It is okay to estimate as needed via visual inspection. Add any necessary information to the graph to support your 03 answer. Substitution Effect: Income Effect:arrow_forwardeverything is in image (8 and 10) there are two images each separate questionsarrow_forwardeverything is in the picture (13) the first blank has the options (an equilibrium or a surplus) the second blank has the options (a surplus or a shortage)arrow_forward

- everything is in photo (19)arrow_forwardIn announcing tariffs on imported steel and aluminum last week, the President said he was imposing a tax on foreign manufacturers who seek to export to the U.S. Is that a fair description of what he did and who will pay? Explain your answer.arrow_forwardAnticipating a severe winter storm, stores stock up on snow shovels and consumers buy snow shovels to be able to clear access to their property. What happens to the price and quantity of snow shovels in the days leading up to the stormarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License