ACCT GOV.+NFP ENTITIES LOOSELEAF W/CONN.

18th Edition

ISBN: 9781260949766

Author: RECK

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 13C

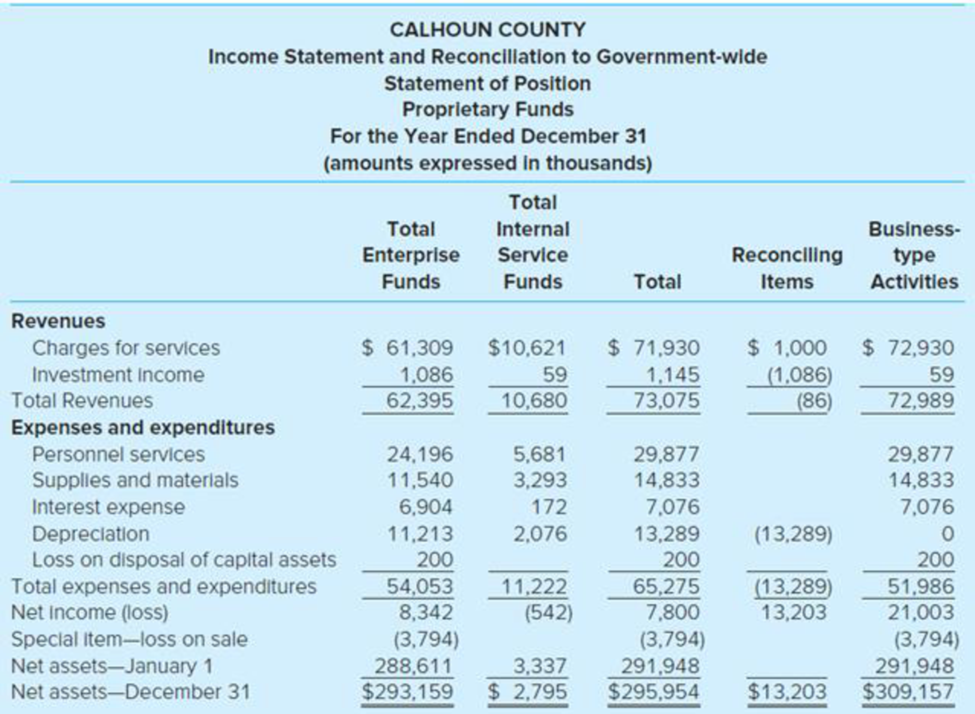

Proprietary Fund Operating Statement. (LO7-1) Calhoun County has prepared the following operating statement for its proprietary funds. The county has three enterprise funds and two internal service funds.

Required

The statement as presented is not in accordance with GASB standards. Identify the errors and explain how the errors should be corrected in order to conform with GASB standards. Along with the information in Chapter 7, Illustration A2–8 will be helpful in identifying and correcting the errors.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the predetermined overhead rate?

can you please solve this

How much was jackon's net sales

Chapter 7 Solutions

ACCT GOV.+NFP ENTITIES LOOSELEAF W/CONN.

Ch. 7 - Prob. 1QCh. 7 - Explain the reporting requirements for internal...Ch. 7 - A member of the city commission insists that the...Ch. 7 - Prob. 4QCh. 7 - What is the purpose of the Restricted Assets...Ch. 7 - Prob. 6QCh. 7 - Prob. 7QCh. 7 - When do GASB standards require interfund...Ch. 7 - Prob. 9QCh. 7 - What is meant by segment information for...

Ch. 7 - Prob. 11QCh. 7 - Internal Service Fund Reporting. (LO7-2) Financial...Ch. 7 - Proprietary Fund Operating Statement. (LO7-1)...Ch. 7 - Enterprise Fund Golf Course Management. (LO7-1)...Ch. 7 - Prob. 17.1EPCh. 7 - Which of the following would most likely be...Ch. 7 - Under GASB standards, the City of Parkview is...Ch. 7 - Prob. 17.4EPCh. 7 - Which of the following events would generally be...Ch. 7 - Proprietary funds a. Are permitted to integrate...Ch. 7 - Prob. 17.7EPCh. 7 - Prob. 17.8EPCh. 7 - Prob. 17.9EPCh. 7 - Prob. 17.10EPCh. 7 - The City of Tutland issued 10 million, 6 percent,...Ch. 7 - The City of Tutland issued 10 million, 6 percent,...Ch. 7 - Prob. 18EPCh. 7 - Prob. 19EPCh. 7 - Central Garage Internal Service Fund. (LO7-2) The...Ch. 7 - Internal Service Fund Statement of Cash Flows....Ch. 7 - Tribute Aquatic Center Enterprise Fund. (LO7-5)...Ch. 7 - Net Position Classifications. (LO7-5) During the...Ch. 7 - Central Station Enterprise Fund. (LO7-5) The Town...Ch. 7 - Enterprise Fund Journal Entries and Financial...Ch. 7 - Net Position Classifications. (LO7-5) The Village...Ch. 7 - Enterprise Fund Statement of Cash Flows. (LO7-5)...Ch. 7 - AppendixSolid Waste Enterprise Fund. (LO7-6) Brown...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Titan Corporation issued $750,000 of 8-year bonds at a 6% annual interest rate, payable semiannually. • What is the total interest expense over the life of the bonds? • What is the semiannual interest payment?arrow_forwardHello tutor please provide this question solution general accountingarrow_forwardFinancial accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License