Concept explainers

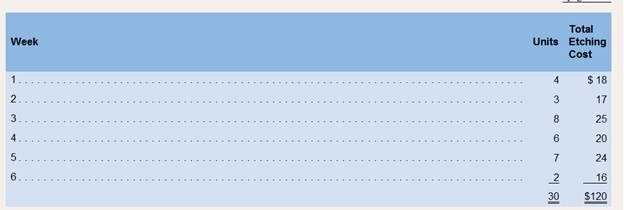

George Caloz&Freres, located in Grenchen, Switzerland, makes luxury custom watches in small lots. One of the company’s products, a platinmn diving watch. Goes through an etching process. The company has recorded etching costs as follows over the last six weeks:

For planning purposes, management would like to know the variable etching cost per unit and the total fixed etching cost per week.

Required:

1. Prepare a scattergraph plot. (PIot etching costs on the vertical axis and units on the horizontal axis)

2. Using the least-squares regression method estimate the variable etching cost per unit and the total fixed etching cost per week, Express these estimates in the form Y= a + bX.

3. If the company processes five units next week, what would be the expected total etching cost? (Round your answer to the nearest cent.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

INTRO MGRL ACCT LL W CONNECT

- I want the correct answer with accounting questionarrow_forwardGeneral Accounting Question please answerarrow_forwardIncorrect Question 6 0 / 10 pts Audit Organization ABC is evaluating the different non-audit services it provides to its various clients. Indicate which of the following non-audit services would impair its independence. There are multiple answers. (Hint: There are five non-audit services that would impair the firm's independence). Hiring or terminating the audited entity's employees. Preparing financial statements in their entirety from a client-provided trial balance. Evaluation of an entity's system of internal control performed outside the audit. Approving entity transactions. Supervising ongoing monitoring procedures over an entity's system of internal control. Preparing certain line items or sections of the financial statements based on information in the trial balance. Preparing account reconciliations that identify reconciling items for the audited entity management's evaluation. Changing journal entries without management approval. Posting coded transactions to an audited…arrow_forward

- Please provide correct answer with explanation for this general accounting questionarrow_forwardCan you please solve this general accounting question?arrow_forwardThe Spice Saga has two production departments, Assembly and Finishing. Each department calculates its own predetermined overhead rate and applies manufacturing overhead throughout the year. The following information was used to calculate overhead application rates: Assembly Finishing TotalEstimated overhead $ 800,000 $ 420,000 $ 1,220,000Direct labor hours 50,000 30,000 80,000Machine hours 16,000 8,000 24,000Overhead information for Job #687 is as follows: Assembly Finishing TotalDirect labor hours 100 125 225Machine hours 30 18 48 a. Assume that The Spice Saga uses direct labor hours to apply overhead in both production departments How much overhead will be applied to Job #687? Note: Round your answer to 2 decimals.b. Assume that The Spice Saga uses machine hours to apply…arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning