Mixed Cost Analysis and the Relevant Range LOS-10

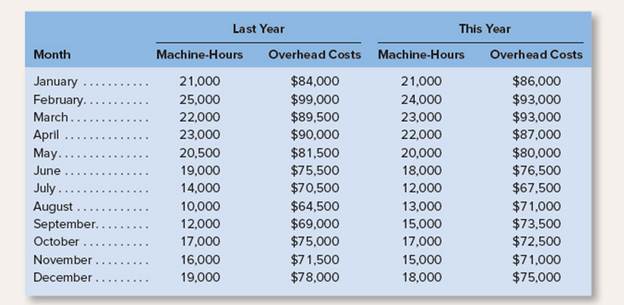

The Ramon Company is a manufacturer tint is interested in developing a cost formula to estimate the variable and fixed components of its monthly manufacturing

The company leases all of its manufacturing equipment. The lease arrangement calls for a flat monthly fee up to 19,500 machine-hours. If the machine-bows used exceeds 19,500, then the fee becomes strictly variable with respect to the total number of machine-bouts consumed during the month. Lease expense is a major element of overhead cost.

Required:

1. Using the high-low method, estimate a

2. Prepare a scattergraph using all of the data for the two-ear period. Fit a straight line or lines to the plotted points using a ruler. Describe the cost behaviour pattern resealed by your scattergraph plot.

3. Assume a least-squares regression analysis using all of the given data points estimated the total fixed cost to be $40,102 and the variable cost to be $2. 13 per machine-hour. Do you have any conceits about the accuracy of the high-Low estimates that you have computed or the least-squares regression estimates that have been provided?

4. Assume that the company consumes 22,500 machine-hours during a month. Using the high-low method, estimate the total overhead costthat would be incurred at this level of activity. Be sure to consider only the data points contained in the relevant range of activity when performing your computations.

5. Comment on the accuracy of your high-low estimates assuming a least-squares regression analysis using only the data points in therelevant range of activity estimated the total fixed cost tobe $10,090 and the variable cost to be $3.53 per machine-hour.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

INTRO MGRL ACCT LL W CONNECT

- Ajani Company has variable costs equal to 35% of sales. The company is considering a proposal that will increase sales by $25,000 and total fixed costs by $16,250. By what amount will net income increase? Step by Step Answerarrow_forwardTaxable income? Provide answer pleasearrow_forwardGeneral accounting questionarrow_forward

- Gordon Company was recently formed with a $7,000 investment in the company by shareholders. The company then borrowed $4,000 from a bank, purchased $3,000 of supplies on account, and also purchased $7,000 of equipment by paying $4,000 in cash and signing a note for the balance. Based on these transactions, the company's total assets are:arrow_forwardRadiant Motors has sales of $5,250, total assets of $3,900, and a profit margin of 6 percent. The firm has a total debt ratio of 48 percent. What is the return on equity?helparrow_forwardCompute the Cost of Goods Sold considering the following information from Kelly's Kandles. Sales Selling Expenses $133,200 13,500 General and Administrative Expenses 16,100 Net income before tax Net income 49,700 40,100arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning