MORTON SALT

Introduction

Morton Salt is a subsidiary of Morton International, a manufacturer of specialty chemicals, air bags, and salt products. The Morton salt-processing facility in Silver Springs, New York, between Buffalo and Rochester, is one of six similar Morton salt-processing facilities in the United States. The Silver Springs plant employs about 200 people, ranging from unskilled to skilled. It produces salt products for water conditioning, grocery, industrial, and agricultural markets. The grocery business consists of 26-oz. round cans of iodized salt. Although the grocery business represents a relatively small portion of the total output (approximately 15 percent), it is the most profitable.

Salt production

The basic raw material, salt, is obtained by injecting water into salt caverns that are located some 2,400 feet below the surface. There, the salt deposits dissolve in the water. The resulting brine is pumped to the surface where it is converted into salt crystals. The brine is boiled, and much of the liquid evaporates, leaving salt crystals and some residual moisture, which is removed in a drying process. This process is run continuously for about six weeks at a time. Initially, salt is produced at the rate of 45 tons per hour. But the rate of output decreases due to scale buildup, so that by the sixth week, output is only 75 percent of the initial rate. At that point, the process is halted to perform maintenance on the equipment and remove the scale, after which salt production resumes.

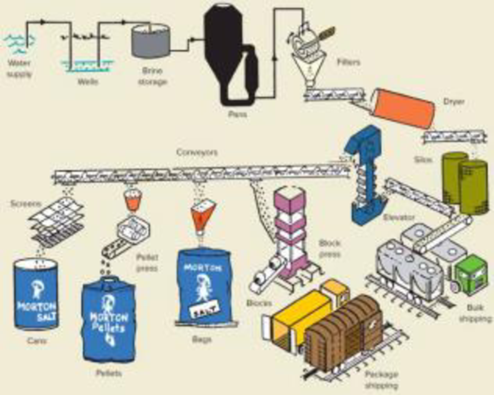

The salt is stored in silos until it is needed for production, or it is needed for production, or it is shipped in bulk to industrial customers. Conveyors move the salt to each of the four dedicated production areas, one of which is round can production (see diagram.). The discussion here focuses exclusively on round can production.

Round Can Production

Annual round can production averages roughly 3.8 million cans. Approximately 70 percent of the output is for the Morton label, and the rest is for private label. There are two parallel, high-speed production lines. The lines share common processes at the beginning of the lines, and then branch out into two identical lines. Each line is capable of producing 9,600 cans per hour (160 cans per minute). The equipment is not flexible, so the production rate is fixed. The operations are completely standardized; the only variable is the brand label that is applied. One line requires 12 production workers, while both lines together can be operated by 18 workers because of the common processes. Workers on the line perform low-skilled, repetitive tasks.

The plant produces both the salt and the cans the salt is packaged in. The cans are essentially a cylinder with a top and a bottom; they are made of cardboard, except for a plastic pour spout in the top. The cylinder portion is formed from two sheets of chip board that are glued together and then rolled into a continuous tube. The glue not only binds the material, it also provides a moisture barrier. The tube is cut in a two-step process. It is first cut into long sections, and those sections are then cut into can-size pieces. The top and bottom pieces for the cans are punched from a continuous strip of cardboard. The separate pieces move along conveyor belts to the lines where the components are assembled into cans and glued. The cans are then filled with salt and the pour spout is added. Finally, the cans are loaded onto pallets and placed into inventory, ready to be shipped to distributors.

Quality

Quality is checked at several points in the production process. Initially, the salt is checked for purity when it is obtained from the wells, Iodine and an anti-caking compound are added to the salt, and their levels are verified using chemical analysis. Crystal size is important. In order to achieve the desired size and to remove lumps, the salt is forced through a scraping screen, which can cause very fine pieces of metal to mix with the salt. However, these pieces are effectively removed by magnets that are placed at appropriate points in the process. If, for any reason, the salt is judged to be contaminated, it is diverted to a nonfood product.

Checking the quality of the cans is done primarily by visual inspection, including verifying the assembly operation is correct, checking filed cans for correct weight, inspecting cans to see that labels are labels are properly aligned, and checking to see that plastic pour spouts are correctly attached.

The equipment on the production line is sensitive to misshapen or damaged cans, and frequently jams, cussing production delays. This greatly reduces the chance of a defective can getting through the process, but it reduces productivity, and the salt in the defective cans must be scrapped. The cost of quality is fairly high, owing to the amount of product that is scrapped, the large number of inspectors, and the extensive laboratory testing that is needed.

Production Planning and Inventory

The plant can sell all of the salt it produces. The job of the production

Equipment Maintenance and Repair

The equipment is 1950s vintage, and it requires a fair amount of maintenance to keep it in good working order. Even so, breakdowns occur as parts wear out. The plant has its own tool shop where skilled workers repair parts or make new parts because replacement parts are no longer available for the old equipment.

5. Determine the approximate number of tons of salt produced annually. Hints: one ton = 2,000 pounds, and one pound = 16 ounces.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

OPERATIONS MANAGEMENT -CONNECT

- The Donald Fertilizer Company produces industrial chemical fertilizers. The projected manufacturing requirements (in gallons) for the next four quarters are 90,000, 90,000, 60,000, and 140,000 respectively. A level workforce is desired, relying only on anticipation inventory as a supply option. Stockouts and backorders are to be avoided, as are overtime and undertime. a. Determine the quarterly production rate required to meet total demand for the year, and minimize the anticipation inventory that would be left over at the end of the year. Beginning inventory is 0. The quarterly production rate is 95000 gallons. (Enter your response as an integer.) b. Specify the anticipation inventory that will be produced. (Enter your responses as an integers.) Quarter Anticipation inventory (gallons) 1 5000 2 10000 3 4 45000 c. Suppose that the requirements (in gallons) for the next four quarters are revised to 140,000, 60,000, 90,000, and 90,000 respectively. If total demand is the same, what level…arrow_forwardPlease help with the attached Capstone proposal Requirements:arrow_forwardLong term capacity plans and how to properly make decisions regarding long-term planning Long-term capacity plans cover periods longer periods of time. These plans are suitable for large businesses that want to scale their operations with a proven strategy for achieving production targets and meeting customer demands. Long-term capacity plans consider other factors apart from the productive requirements of the company. How important is it, in your mind, to properly make decisions regarding long-term capacity planning? How does this decision impact the present and future profitability of an organization? Be specific and give examples.arrow_forward

- In addition to the Amazon case study you provided, I'm curious if you've encountered other examples of companies successfully applying Little's Law to enhance their supply chain risk management practices. For instance, have you seen organizations use queuing theory to assess the potential ripple effects of disruptions, stress-test their contingency plans, or identify critical control points that require heightened monitoring and agility? Please provide a referencearrow_forwardSam's Pet Hotel operates 48 weeks per year, 6 days per week, and uses a continuous review inventory system. It purchases kitty litter for $13.00 per bag The following information is available about these bags: > Demand 85 bags/week >Order cost $60.00/order > Annual holding cost = 35 percent of cost > Desired cycle-service level 80 percent > Lead time = 4 weeks (24 working days) > Standard deviation of weekly demand = 15 bags > Current on-hand inventory is 320 bags, with no open orders or backorders. a. Suppose that the weekly demand forecast of 85 bags is incorrect and actual demand averages only 65 bags per week. How much higher will total costs be, owing to the distorted EOQ caused by this forecast error? The costs will be $higher owing to the error in EOQ. (Enter your response rounded to two decimal places.)arrow_forwardOsprey Sports stocks everything that a musky fisherman could want in the Great North Woods. A particular musky lure has been very popular with local fishermen as well as those who buy lures on the Internet from Osprey Sports. The cost to place orders with the supplier is $3030/order; the demand averages 55 lures per day, with a standard deviation of 11 lure; and the inventory holding cost is $1.001.00/lure/year. The lead time form the supplier is 1010 days, with a standard deviation of 33 days. It is important to maintain a 9898 percent cycle-service level to properly balance service with inventory holding costs. Osprey Sports is open 350 days a year to allow the owners the opportunity to fish for muskies during the prime season. The owners want to use a continuous review inventory system for this item. Refer to the standard normal table LOADING... for z-values. Part 2 a. What order quantity should be used? enter your response here lures. (Enter your response rounded to the…arrow_forward

- 9. Research Methodology Fully explain the Quantitative research methodology that and add in the following sub-sections: . Data Collection • Data Analysisarrow_forwardRuby-Star Incorporated is considering two different vendors for one of its top-selling products which has an average weekly demand of 40 units and is valued at $80 per unit. Inbound shipments from vendor 1 will average 340 units with an average lead time (including ordering delays and transit time) of 2 weeks. Inbound shipments from vendor 2 will average 550 units with an average lead time of 1 week. Ruby-Star operates 52 weeks per year; it carries a 2-week supply of inventory as safety stock and no anticipation inventory. a. The average aggregate inventory value of the product if Ruby-Star used vendor 1 exclusively is $ (Enter your response as a whole number.)arrow_forwardThe Carbondale Hospital is considering the purchase of a new ambulance. The decision will rest partly on the anticipated mileage to be driven next year. The miles driven during the past 5 years are as follows: Year Mileage 1 3,000 2 3 4 4,000 3,450 3,850 5 3,800 a) Using a 2-year moving average, the forecast for year 6 = miles (round your response to the nearest whole number). b) If a 2-year moving average is used to make the forecast, the MAD based on this = miles (round your response to one decimal place). (Hint: You will have only 3 years of matched data.) c) The forecast for year 6 using a weighted 2-year moving average with weights of 0.40 and 0.60 (the weight of 0.60 is for the most recent period) = ☐ miles (round your response to the nearest whole number). miles (round your response to one decimal place). (Hint: You will have only 3 years of The MAD for the forecast developed using a weighted 2-year moving average with weights of 0.40 and 0.60 = matched data.) d) Using…arrow_forward

- Task time estimates for the modification of an assembly line at Jim Goodale's Carbondale, Illinois, factory are as follows: B D G Time Activity (in hours) Immediate Predecessor(s) A 5.0 B 7.5 C 5.0 A DEFC 8.0 B, C 4.5 Figure 2 A B, C 7.7 D G 5.0 E, F This exercise contains only part a. a) The correct precedence diagram for the project is shown in 目 F B Figure 3 A E B E ☑ D Farrow_forwardDave Fletcher was able to determine the activity times for constructing his laser scanning machine. Fletcher would like to determine ES, EF, LS, LF, and slack for each activity. The total project completion time and the critical path should also be determined. Here are the activity times: Activity Time (weeks) Immediate Predecessor(s) Activity Time (weeks) Immediate Predecessor(s) A 6 E 3 B B 8 F 6 B C 3 A G 11 C, E D 1 A H 7 D, F Dave's earliest start (ES) and earliest finish (EF) are: Activity ES .EF A 0 6 B 0 8 C 3 9 D 6 E F 8 G 22 H 21 Dave's latest start (LS) and latest finish (LF) are: Activity LS LF H 15 G 11 F 9arrow_forwardThere are multiple ways a company can enter a foreign market. Explore two possibilities such as exporting, foreign direct investment, and collaborations (joint ventures, alliances, licensing, franchising), and evaluate the pros and cons of each method. Which types of products and services would be appropriate for each market entry method?arrow_forward

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,