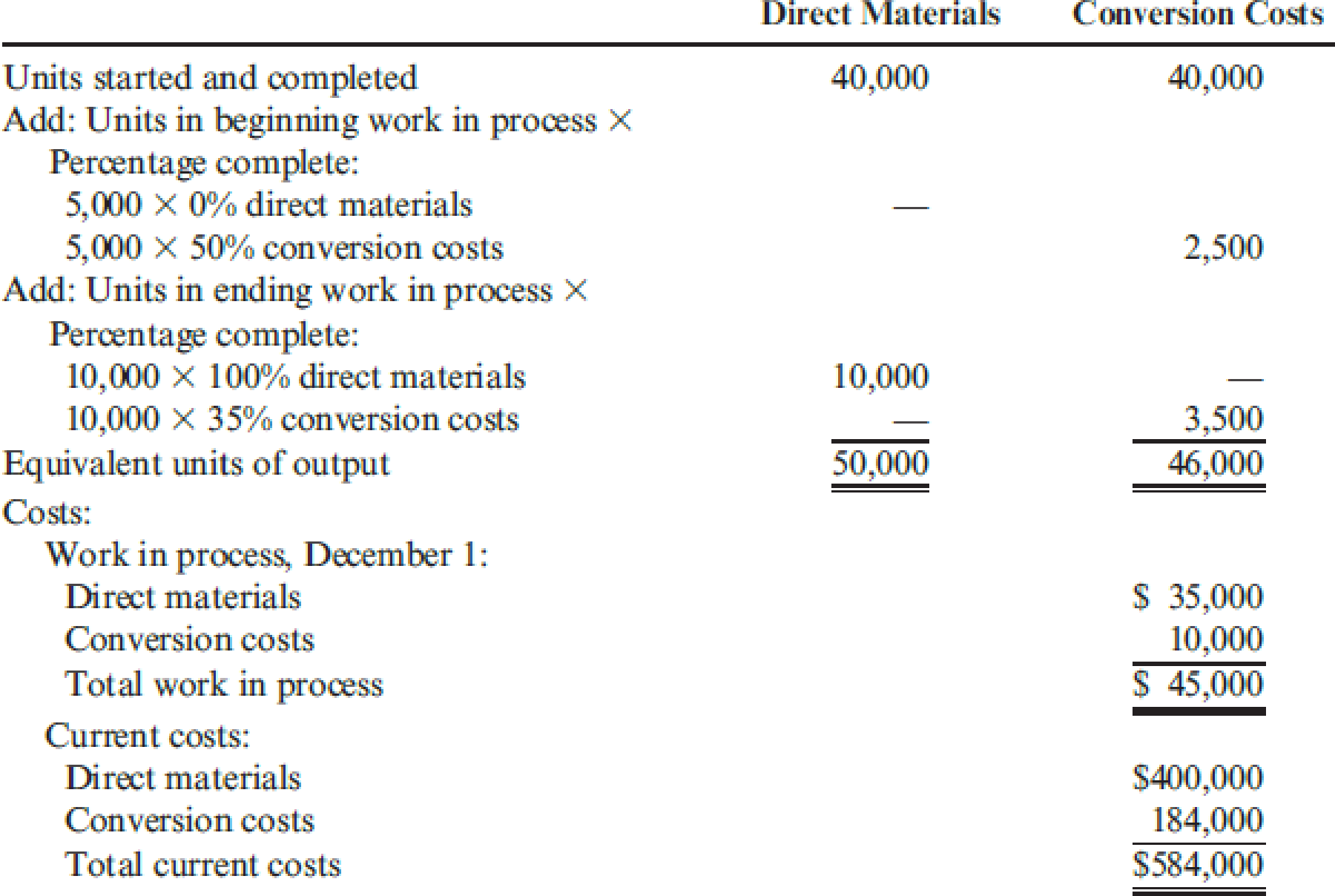

Gunnison Company had the following equivalent units schedule and cost information for its Sewing Department for the month of December:

Required:

- 1. Calculate the unit cost for December, using the FIFO method.

- 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for.

- 3. What if you were asked for the unit cost from the month of November? Calculate November’s unit cost and explain why this might be of interest to management.

1.

Ascertain the unit cost for December using First-in-first-out (FIFO) method for company G.

Explanation of Solution

Cost per unit: Total unit cost is the cost incurred by the company to produce one unit of product. The unit cost is calculated by dividing the units produced with the total cost.

Compute unit cost using FIFO method:

Thus, the cost per equivalent unit for company G is $12 per equivalent unit.

2.

Determine the cost of EWIP, compute the cost of goods transferred out, and reconcile the cost assigned with the costs to account for.

Explanation of Solution

Ascertain the cost of EWIP (Ending Work-In Process):

Calculate the cost of goods transferred out:

| Particulars | Amount ($) |

| From BWIP | $ 45,000 |

| To complete BWIP | |

| $ 10,000 | |

| Started and completed | |

| $ 480,000 | |

| Total cost of goods transferred out | $ 535,000 |

Table (1)

Determine the total cost assigned.

Reconcile the cost assigned with the costs to account for:

| Particulars | Amount ($) |

| Cost to account for: | |

| BWIP | $ 45,000 |

| Current (December) | $ 584,000 |

| Total | $ 629,000 |

Table (2)

3.

Determine the unit cost for November and determine in what manner it might be of interest to management.

Explanation of Solution

There are 5,000 equivalent units of materials (100% complete) and 2,500

Therefore, November unit cost will be,

The managers can obtain the trends in cost and thereby they can implement better control over costs by recognizing last month’s unit cost. If costs are diminishing, it may disclose that continuous development effort is succeeding. If increasing, it may show obstacles that can be corrected.

Want to see more full solutions like this?

Chapter 6 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- Provide answerarrow_forwardMCQarrow_forwardExercise 3-12A (Algo) Conducting sensitivity analysis using a spreadsheet LO 3-5 Use the below table to answer the following questions. Selling Price$27.00 Variable 2,100 3,100 Fixed Cost Cost Sales Volume 4,100 Profitability 5,100 6,100 $25,700 8 $14,200 $33,200 $52,200 $71,200 $90,200 25,700 9 12,100 30,100 48,100 66,100 84,100 25,700 10 10,000 27,000 44,000 61,000 78,000 35,700 8 4,200 23,200 42,200 61,200 80,200 35,700 9 2,100 20,100 38,100 56,100 74,100 35,700 10 17,000 34,000 51,000 68,000 45,700 8 (5,800) 13,200 32,200 51,200 70,200 45,700 9 (7,900) 10,100 28,100 46,100 64,100 45,700 10 (10,000) 7,000 24,000 41,000 58,000 Required a. Determine the sales volume, fixed cost, and variable cost per unit at the break-even point. b. Determine the expected profit if Rundle projects the following data for Delatine: sales, 4,100 bottles; fixed cost, $25,700; and variable cost per unit, $10. c. Rundle is considering new circumstances that would change the conditions described in…arrow_forward

- The following balance sheet for the Hubbard Corporation was prepared by the company: HUBBARD CORPORATION Balance Sheet At December 31, 2024 Assets Buildings Land Cash Accounts receivable (net) Inventory Machinery Patent (net) Investment in equity securities Total assets Accounts payable $ 763,000 289,000 73,000 146,000 266,000 293,000 113,000 86,000 Liabilities and Shareholders' Equity Accumulated depreciation Notes payable Appreciation of inventory Common stock (authorized and issued 113,000 shares of no par stock) $ 2,029,000 $ 228,000 268,000 526,000 93,000 452,000 Retained earnings 462,000 Total liabilities and shareholders' equity $ 2,029,000 Additional information: 1. The buildings, land, and machinery are all stated at cost except for a parcel of land that the company is holding for future sale. The land originally cost $63,000 but, due to a significant increase in market value, is listed at $146,000. The increase in the land account was credited to retained earnings. 2. The…arrow_forwardProvide correct answer this general accounting questionarrow_forwardPlease answer the financial accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub