Concept explainers

Using the same data found in Exercise 6.22, assume the company uses the FIFO method.

Required:

Prepare a schedule of equivalent units, and compute the unit cost for the month of December.

Fordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was $40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments.

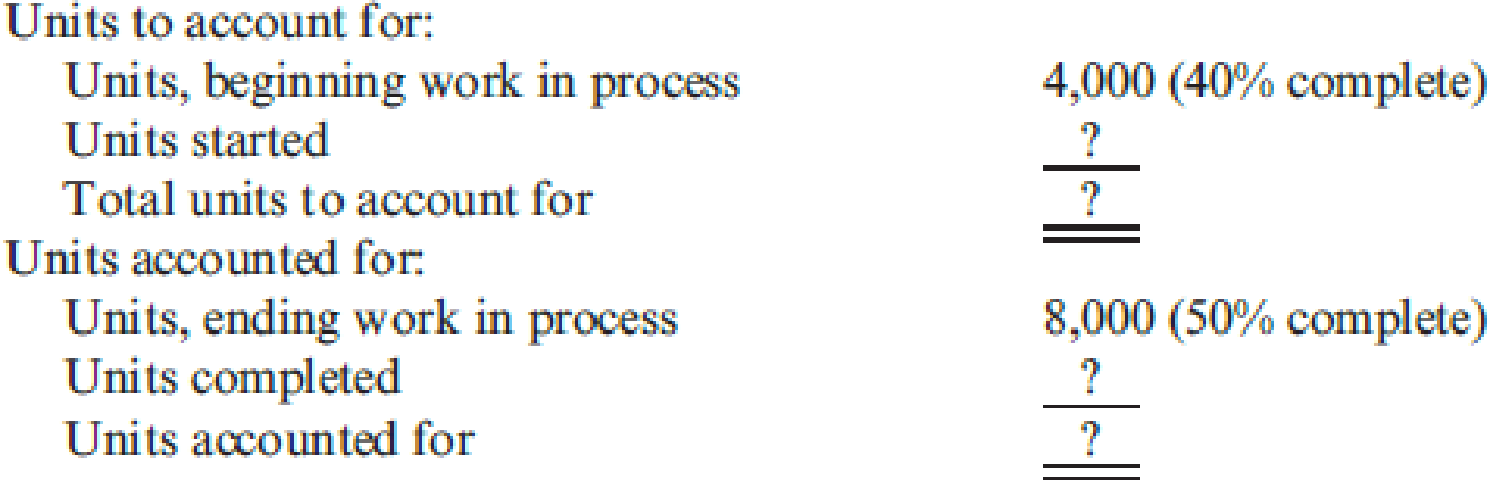

The second department (Polishing) had the following physical flow schedule for December:

Costs in beginning work in process for the Polishing Department were direct materials, $5,000; conversion costs, $6,000; and transferred in, $8,000. Costs added during the month: direct materials, $32,000; conversion costs, $50,000; and transferred in, $40,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- Don't use ai given answer accounting questionsarrow_forwardNeed help with this question solution general accountingarrow_forwardOn January 1, 2023, Pharoah Ltd. had 702,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Issued 160,000 shares Mar. 1 Issued a 10% stock dividend May 1 Acquired 181,000 common shares and retired them June 1 Issued a 3-for-1 stock split Oct. 1 Issued 78,000 shares ♡ The company's year end is December 31Determine the weighted average number of shares outstanding as at December 31, 2023. (Round answer to O decimal places, eg. 5,275.) Weighted average number of shares outstandingarrow_forward

- On January 1, 2023, Pharoah Ltd. had 702,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Issued 160,000 shares Mar. 1 Issued a 10% stock dividend May 1 Acquired 181,000 common shares and retired them June 1 Issued a 3-for-1 stock split Oct. 1 Issued 78,000 shares ♡ The company's year end is December 31 Assume that Pharoah earned net income of $3,441,340 during 2023. In addition, it had 90,000 of 10%, $100 par, non-convertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2023. Calculate earnings per share for 2023, using the weighted average number of shares determined above. (Round answer to 2 decimal places, e.g. 15.25.) Earnings per sharearrow_forwardI want to correct answer general accounting questionarrow_forwardHi expert please give me answer general accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning