Engineering Economy (16th Edition) - Standalone book

16th Edition

ISBN: 9780133439274

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 85FE

Problems 6-82 through 6-85. (6.4)

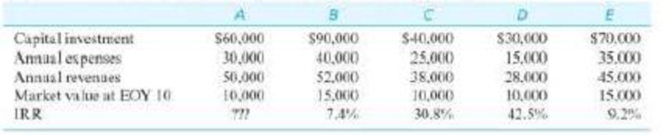

Table P6-82 Data for Problems 6-82 through 6-85

6-85. Using a MARR of 15%, the preferred Alternative is:

- a. Do Nothing

- b. Alternative A

- c. Alternative B

- d. Alternative C

- e. Alternative D

- f. Alternative E

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

In the following table, complete the third column by determining the quantity sold in each country at a price of $18 per toy train. Next, complete the

fourth column by calculating the total profit and the profit from each country under a single price.

Price

Single Price

Quantity Sold

Price Discrimination

Country

(Dollars per toy

train)

(Millions of toy

trains)

Profit

(Millions of

dollars)

Price

(Dollars per toy

train)

Quantity Sold

(Millions of toy

trains)

Profit

(Millions of

dollars)

France

18

Russia

18

Total

N/A

N/A

N/A

N/A

Suppose that as a profit-maximizing firm, Le Jouet decides to price discriminate by charging a different price in each market, while its marginal cost of

production remains $8 per toy.

Complete the last three columns in the previous table by determining the profit-maximizing price, the quantity sold at that price, the profit in each

country, and total profit if Le Jouet price discriminates.

Le Jouet charges a lower price in the market with a relatively

elastic…

Not use ai please

Not dhdjdjdjduudnxnxjfjfi fever

Chapter 6 Solutions

Engineering Economy (16th Edition) - Standalone book

Ch. 6 - Prob. 1PCh. 6 - The Consolidated Oil Company must install...Ch. 6 - Prob. 3PCh. 6 - Three mutually exclusive design alternatives are...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Fiesta Foundry is considering a new furnace that...Ch. 6 - Prob. 8PCh. 6 - Prob. 9PCh. 6 - Consider the following cash flows for two mutually...

Ch. 6 - Prob. 11PCh. 6 - Prob. 12PCh. 6 - The alternatives for an engineering project to...Ch. 6 - Prob. 14PCh. 6 - Prob. 15PCh. 6 - Prob. 16PCh. 6 - Refer to the situation in Problem 6-16. Most...Ch. 6 - Prob. 18PCh. 6 - Prob. 19PCh. 6 - Prob. 20PCh. 6 - Prob. 21PCh. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - Prob. 24PCh. 6 - Prob. 25PCh. 6 - In the Rawhide Company (a leather products...Ch. 6 - Refer to Problem 6-2. Solve this problem using the...Ch. 6 - Prob. 28PCh. 6 - Prob. 29PCh. 6 - Prob. 30PCh. 6 - Prob. 31PCh. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Potable water is in short supply in many...Ch. 6 - Prob. 35PCh. 6 - Prob. 36PCh. 6 - In the design of a special-use structure, two...Ch. 6 - Prob. 38PCh. 6 - a. Compare the probable part cost from Machine A...Ch. 6 - Prob. 40PCh. 6 - Two mutually exclusive alternatives are being...Ch. 6 - Prob. 42PCh. 6 - IBM is considering an environmentally conscious...Ch. 6 - Three mutually exclusive earth-moving pieces of...Ch. 6 - A piece of production equipment is to be replaced...Ch. 6 - Prob. 46PCh. 6 - Prob. 47PCh. 6 - Prob. 48PCh. 6 - Prob. 49PCh. 6 - Prob. 50PCh. 6 - Prob. 51PCh. 6 - Prob. 52PCh. 6 - Prob. 53PCh. 6 - Prob. 54PCh. 6 - Prob. 55PCh. 6 - Prob. 56PCh. 6 - Prob. 57PCh. 6 - Prob. 58PCh. 6 - Prob. 59PCh. 6 - Prob. 60PCh. 6 - Prob. 61PCh. 6 - Prob. 62PCh. 6 - Prob. 63PCh. 6 - Prob. 64PCh. 6 - Prob. 65PCh. 6 - Prob. 66PCh. 6 - Three models of baseball bats will be manufactured...Ch. 6 - Refer to Example 6-3. Re-evaluate the recommended...Ch. 6 - Prob. 69SECh. 6 - Prob. 70SECh. 6 - Prob. 71SECh. 6 - Prob. 72CSCh. 6 - Prob. 73CSCh. 6 - Prob. 74CSCh. 6 - Prob. 75FECh. 6 - Prob. 76FECh. 6 - Prob. 77FECh. 6 - Complete the following analysis of cost...Ch. 6 - Prob. 79FECh. 6 - For the following table, assume a MARR of 10% per...Ch. 6 - Prob. 81FECh. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Prob. 83FECh. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Consider the mutually exclusive alternatives given...Ch. 6 - Prob. 87FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Discuss the different types of resources (natural, human, capital) and how they are allocated in an economy. Identify which resources are scarce and which are abundant, and explain the implications of this scarcity or abundance.arrow_forwardNot use ai pleasearrow_forwardNot use ai please letarrow_forward

- Location should be in GWAGWALADA Abuja Nigeria Use the Internet to do itarrow_forwardUsing data from 1988 for houses sold in Andover, Massachusetts, from Kiel and McClain (1995), the following equation relates housing price (price) to the distance from a recently built garbage incinerator (dist): = log(price) 9.40 + 0.312 log(dist) n = 135, R2 = 0.162. Interpretation of the slope coefficient? ► How would our interpretation of the slope coefficient change if distance were measured in metres instead of kilometres?arrow_forwardIf GDP goes up by 1% and the investment component of GDPgoes up by more than 1%, how is the investment share ofGDP changing in absolute terms?▶ In economics, what else is expressed as relative percentagechanges?arrow_forward

- CEO Salary and Firm SalesWe can estimate a constant elasticity model relating CEO salary to firm sales. The data set is the same one used in Example 2.3, except we now relate salary to sales. Let sales be annual firm sales, measured in millions of dollars. A constant elasticity model is[2.45]ßßlog (salary) = ß0 + ß0log (sales) + u,where ß1 is the elasticity of salary with respect to sales. This model falls under the simple regression model by defining the dependent variable to be y = log(salary) and the independent variable to be x = log1sales2. Estimating this equation by OLS gives[2.46]log (salary)^=4.822 + 0.257 (sales) n = 209, R2 = 0.211.The coefficient of log(sales) is the estimated elasticity of salary with respect to sales. It implies that a 1% increase in firm sales increases CEO salary by about 0.257%—the usual interpretation of an elasticity.arrow_forwardSolvearrow_forwardAsap please and give with explanation with each steparrow_forward

- not use ai pleaesarrow_forwardNot use ai pleasearrow_forwardB G C D E H M K Armchair For puzzles 96 and 97, use the first phylogenetic tree on the following page (Figure 2). 96) Who is the most recent common ancestor of species A and species G? 97) Who is the most recent common ancestor of species D, E, and F?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License